-

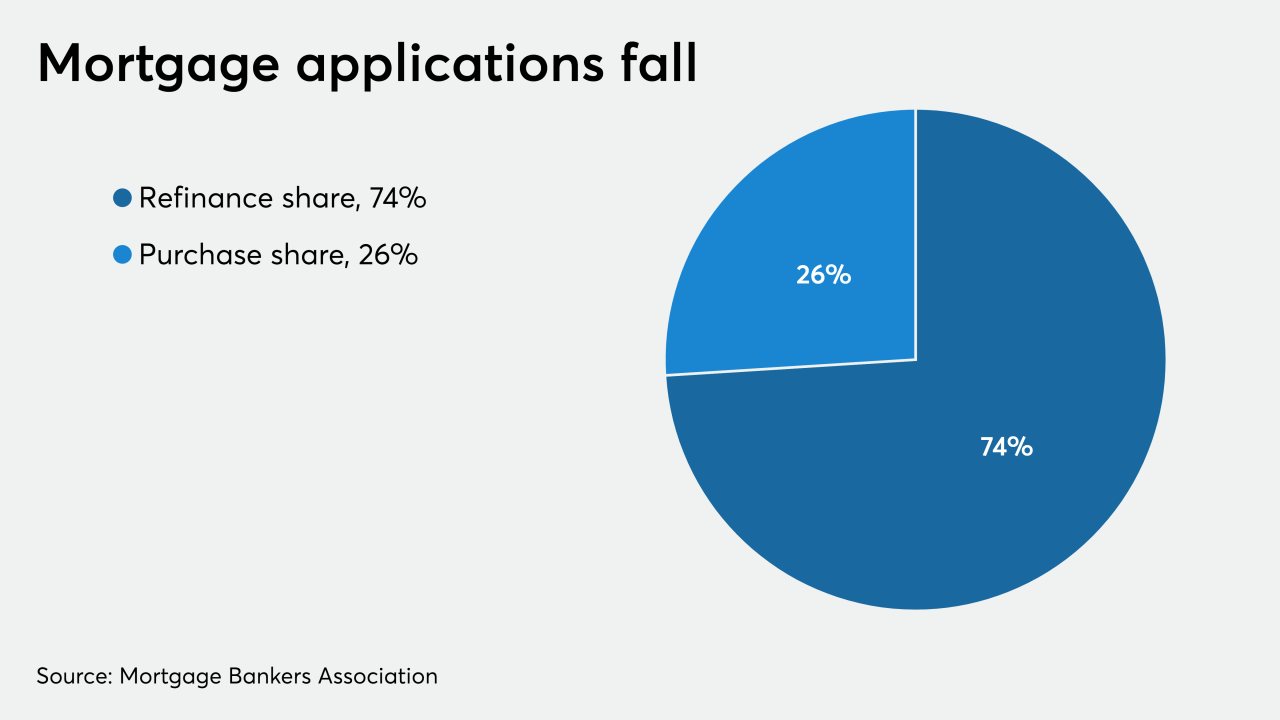

Mortgage applications decreased 17.9% from one week earlier, as coronavirus-related volatility affected consumer sentiment, according to the Mortgage Bankers Association.

April 8 -

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

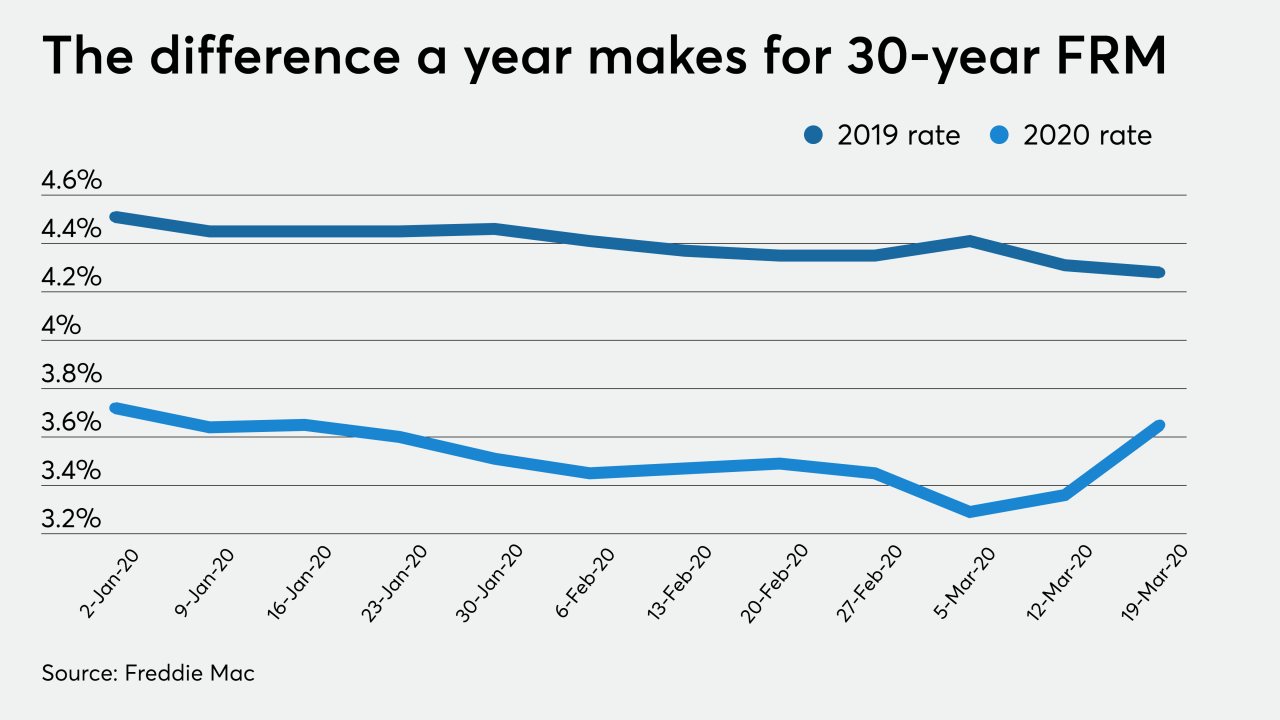

Mortgage application activity increased from the prior week, driven by strong refinance volume after a 35-basis-point drop in conforming loan interest rates, according to the Mortgage Bankers Association.

April 1 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

Detroit-based mortgage giant Quicken Loans could be facing a cash crunch in coming weeks and possibly need temporary emergency federal assistance if lots of borrowers stop making payments on their home mortgages during the coronavirus pandemic, according to a news report.

March 25 -

There was a nearly 30% week-to-week decline in loan applications as Americans reacted to the uncertainty, both economic and medical, from the spread of COVID-19, according to the Mortgage Bankers Association.

March 25 -

Independent mortgage bankers had their most profitable fourth quarter in seven years for originations, but the fallout from the coronavirus could upset the economics of the industry in the short term.

March 24 -

The Federal Reserve Board should create a dedicated facility for mortgage servicers to access in order to make required advances, industry participants and observers, including its largest trade group, said.

March 24 -

Mortgage application volume decreased 8.4% compared with one week earlier as lenders managed activity by raising rates even as 10-year Treasury yields fell below 1%, according to the Mortgage Bankers Association.

March 18 -

Mortgage applications to purchase new homes took a small step back in February from record levels during the previous month, but further positive momentum could be blunted by the coronavirus.

March 17 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

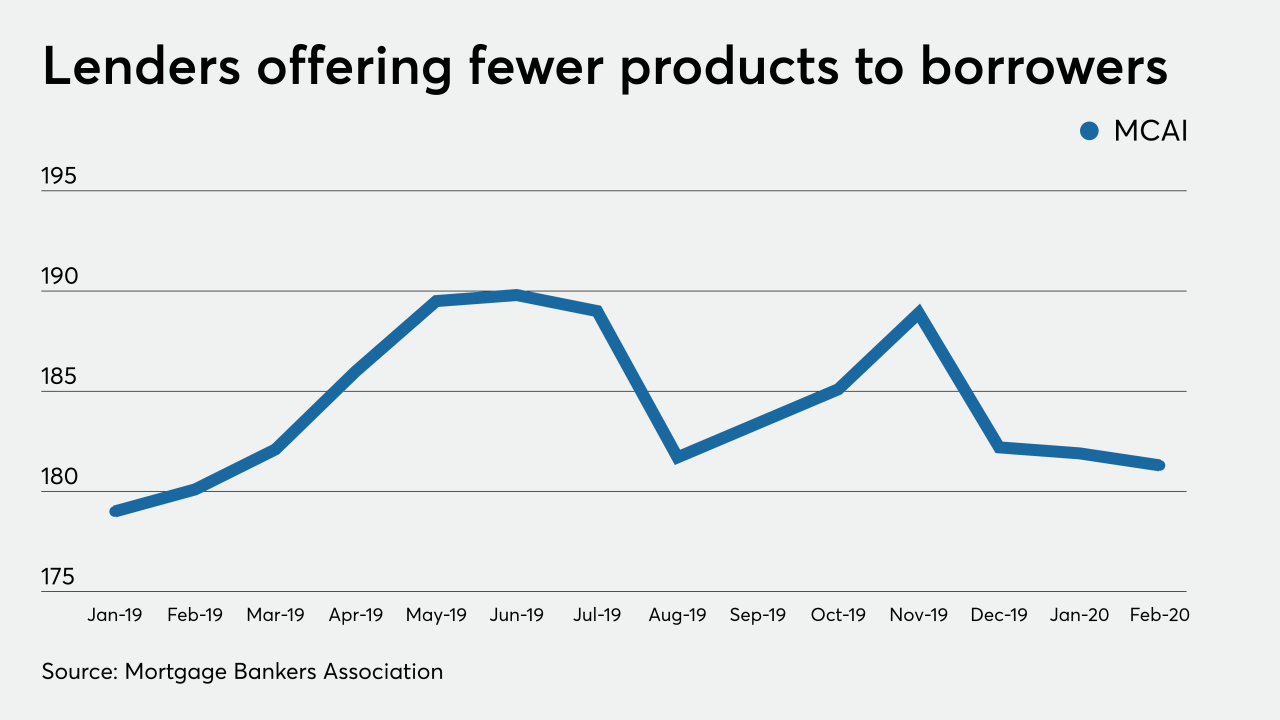

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Servicers' struggle to retain borrowers mounted in the fourth quarter when a type of loan that is tough to recapture rose to a more than 10-year high, according to Black Knight.

March 2