-

Mortgage application volume decreased 8.4% compared with one week earlier as lenders managed activity by raising rates even as 10-year Treasury yields fell below 1%, according to the Mortgage Bankers Association.

March 18 -

Mortgage applications to purchase new homes took a small step back in February from record levels during the previous month, but further positive momentum could be blunted by the coronavirus.

March 17 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Mortgage Bankers Association raised its refinance projections for 2020, a move precipitated by an application volume increase of 55.4% from one week earlier.

March 11 -

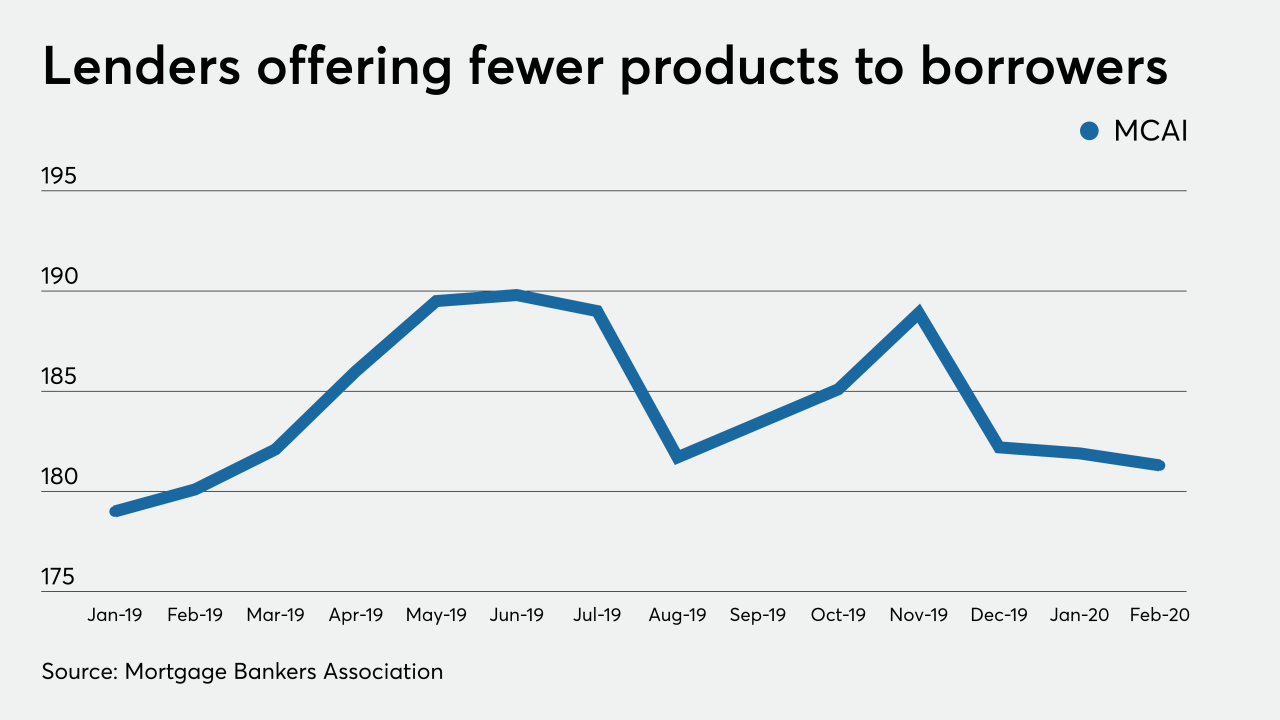

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Mortgage application volume increased 15.1% from one week earlier, and with interest rates still falling, even higher refinance demand is probable in the short term, according to the Mortgage Bankers Association.

March 4 -

Investors' purchases of 10-year Treasurys after the Fed's 50 basis point short-term rate cut drove the yield below 1% for a period of time.

March 3 -

Any impact from the coronavirus outbreak on commercial and multifamily loan delinquencies won't be known for some time, the Mortgage Bankers Association said.

March 3 -

Servicers' struggle to retain borrowers mounted in the fourth quarter when a type of loan that is tough to recapture rose to a more than 10-year high, according to Black Knight.

March 2 -

Fears stemming from the coronavirus have resulted in lower mortgage rates and more business for now, but if the situation deteriorates further, consumers could decide to put off buying a home.

March 2 -

Ginnie Mae in 2020 is going to seriously examine what it would take to respond to a longstanding, priority request of its issuers.

February 27 -

Distressed mortgage servicing costs are falling and that's primarily due to the market's stability, but it also reflects improved efficiencies that may help in a weaker economy.

February 26 -

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

February 26 -

The Department of Housing and Urban Development asked mortgage servicers and other stakeholders to respond quickly to a proposed set of foreclosure-sale policy improvements so it can finalize them soon.

February 25 -

Equifax has released a series of bundled services aimed at helping financial institutions use data and analytics to manage tasks associated with the process of servicing mortgage loans.

February 24 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

Newly constructed home purchase application volume continued its upward momentum during January, with unexpectedly low mortgage rates encouraging consumers to start shopping now, according to the Mortgage Bankers Association.

February 18 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12 -

Mortgage delinquencies dropped to a 40-year low in the fourth quarter as strong employment bolstered borrowers' ability to make timely payments, the Mortgage Bankers Association said.

February 11