-

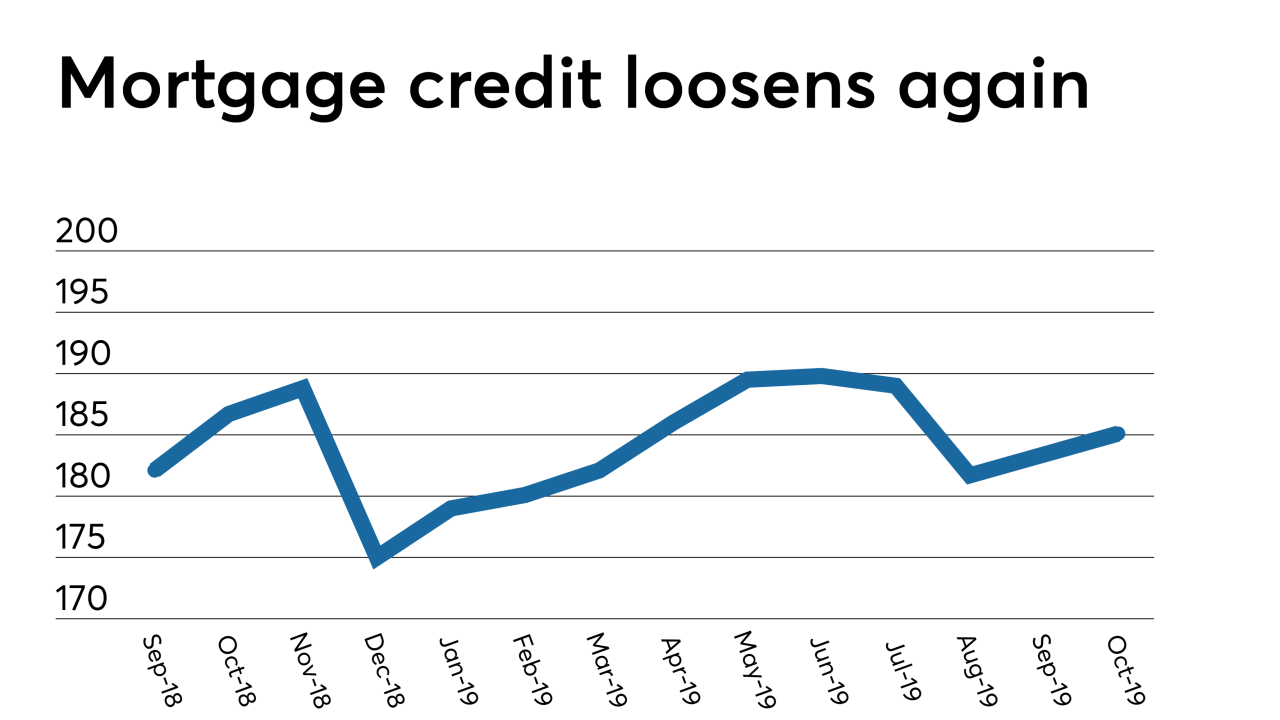

Mortgage lenders are increasingly introducing new loan programs outside of typical underwriting parameters in line with indicators suggesting that the availability of credit in the housing finance market is growing.

December 10 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

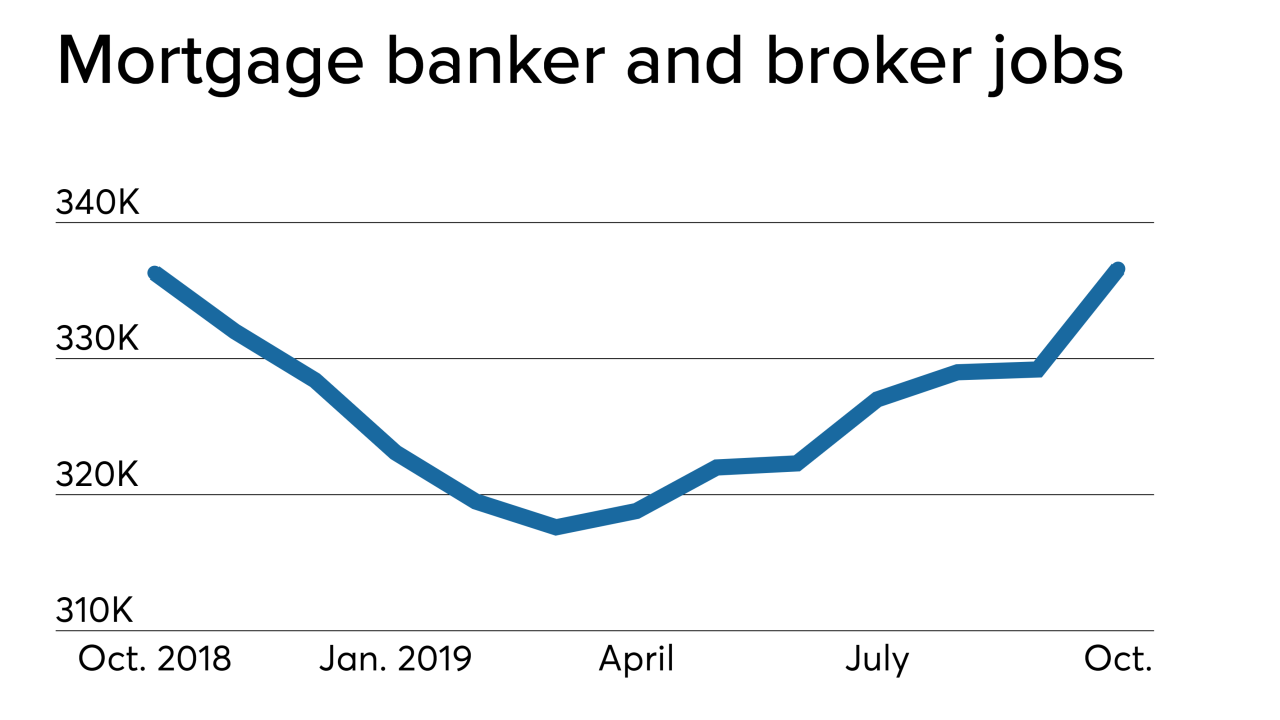

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

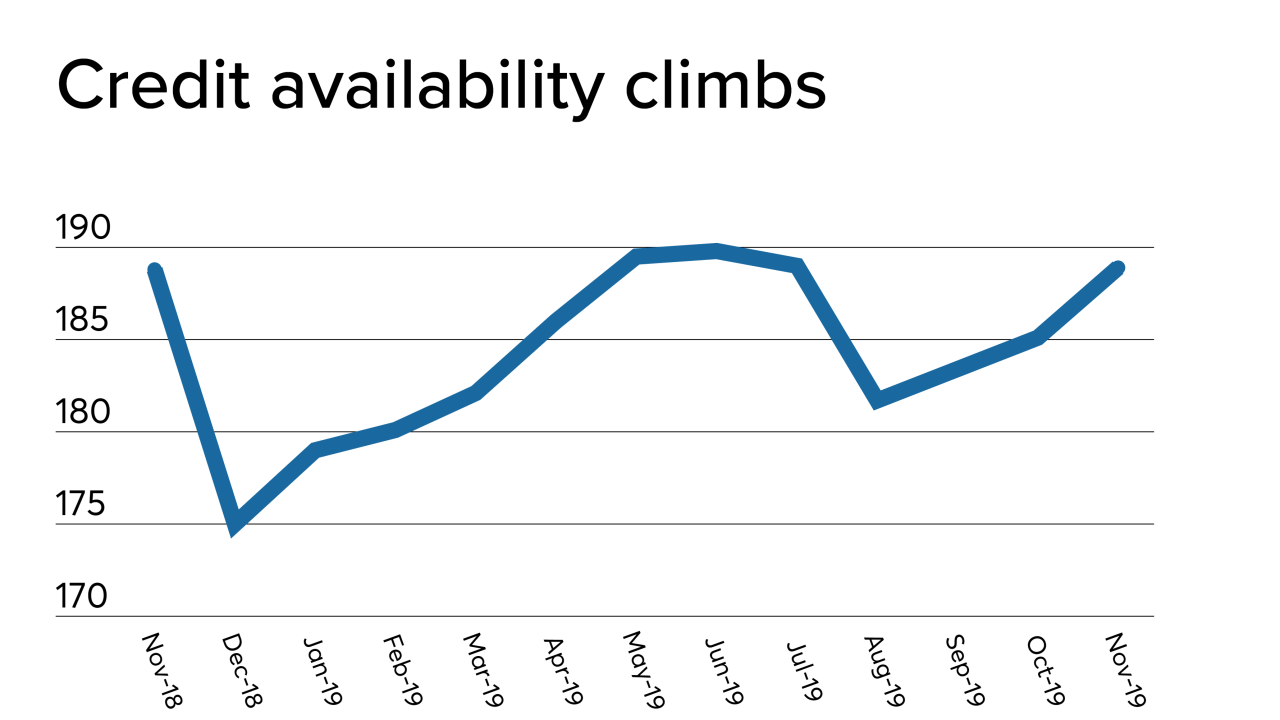

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

Purchase mortgage application activity is at its highest level since this summer on a seasonally adjusted basis, and should remain strong in December, according to the Mortgage Bankers Association.

December 4 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 -

Mortgage prepayment levels were at their highest in over six years during October, as existing homeowners took advantage of the lower rates to refinance, or to a lesser extent, purchase a new residence, Black Knight said.

November 25 -

Lender profitability rose to a high not seen since 2012 in the Mortgage Bankers Association's latest quarterly report despite some variability in revenue generated per loan.

November 21 -

Mortgage lenders are operating in a refinance-dominated market again for the first time in years, but it may offer diminishing returns.

November 20 -

For the second consecutive week, mortgage application activity unusually moved in the same direction as interest rates, decreasing 2.2% from one week earlier, according to the Mortgage Bankers Association.

November 20 -

Loan applications to purchase newly constructed homes during October rose by nearly one-third year-over-year as sales reached their highest annual pace since the Mortgage Bankers Association started tracking this data.

November 19 -

The third-quarter delinquency rate fell to its lowest point since 1995, according to the MBA. However, Attom Data Solutions' numbers show foreclosure filings experienced a near-term growth spurt in October.

November 14 -

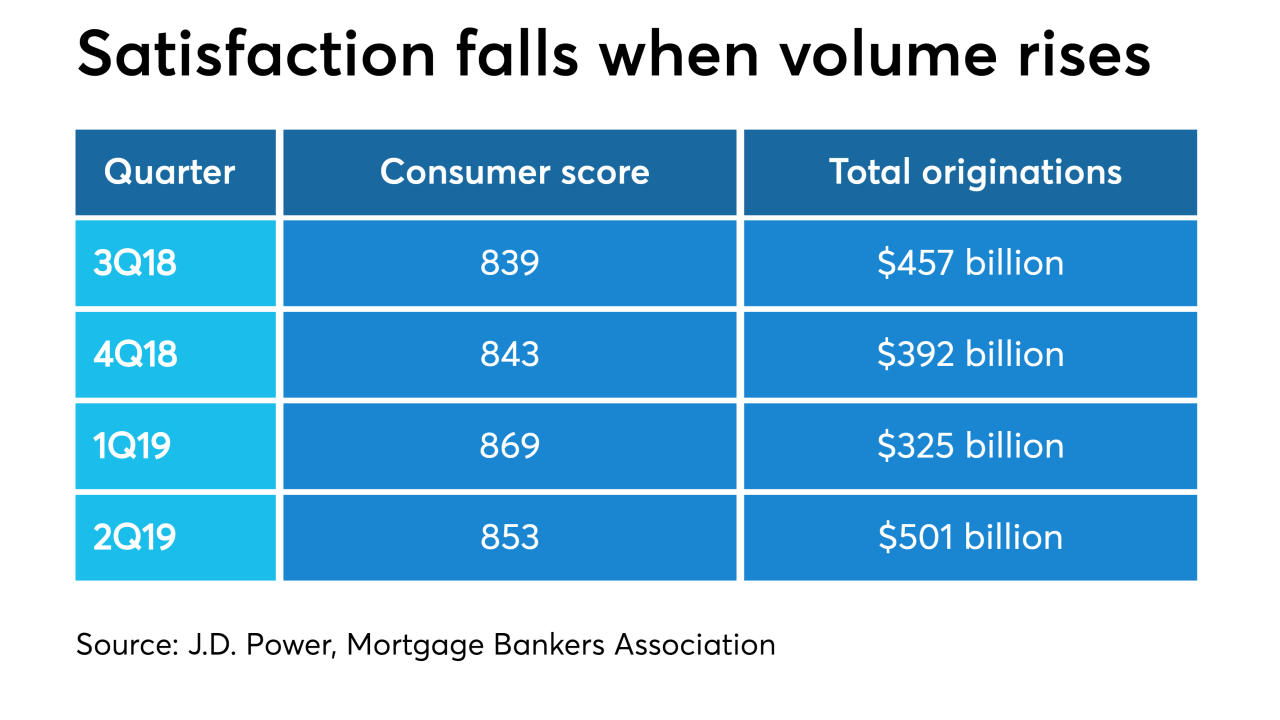

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

Mortgage applications increased from one week earlier, although conforming loan interest rates moved back over 4%, according to the Mortgage Bankers Association.

November 13 -

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

It was activity at the upper end of the housing market that helped to keep mortgage application volume level with the previous week, the Mortgage Bankers Association said.

November 6 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

Freddie Mac is now forecasting back-to-back years of $2 trillion in mortgage loan originations rather than a drop-off in 2020.

November 1 -

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

Home lenders will benefit from elevated refinance activity through the first half of next year, but volume may then fall off quickly, according the Mortgage Bankers Association's latest forecast.

October 30