-

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

If California voters approve Proposition 10 in November, the ramifications will be felt on the state's affordable housing, according to the Mortgage Bankers Association.

October 2 -

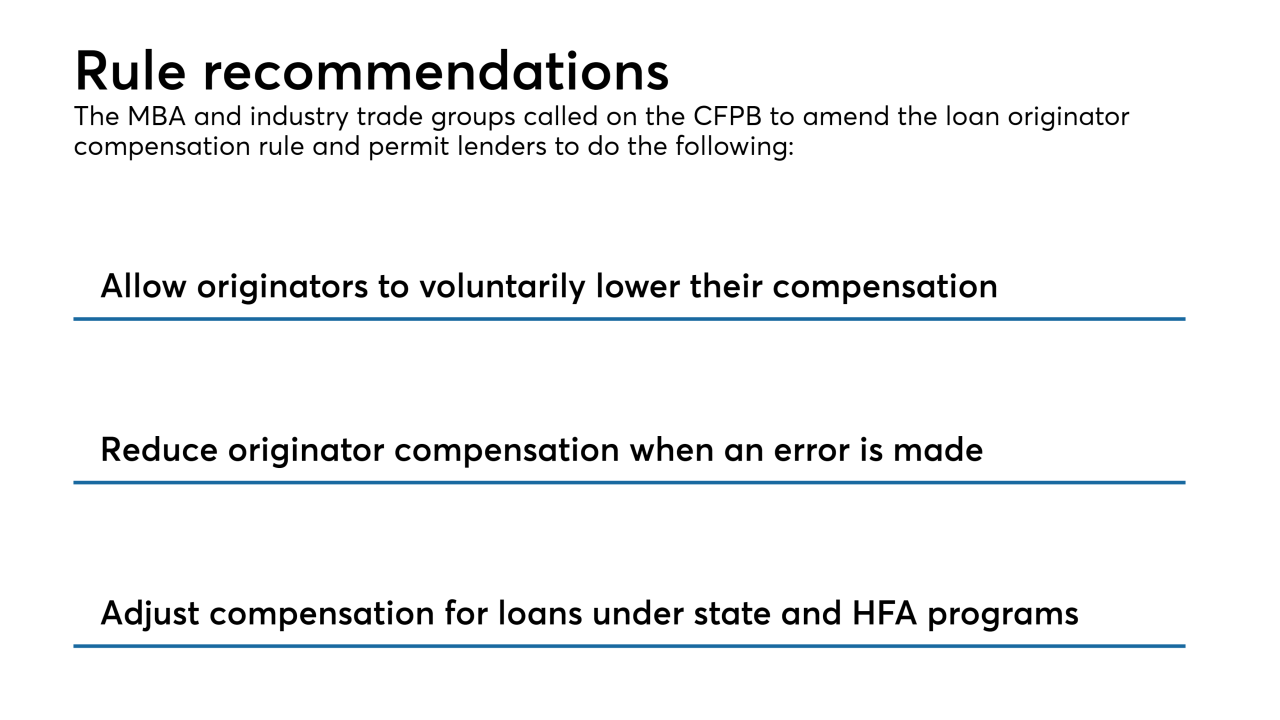

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

Commercial and multifamily mortgage debt outstanding grew by 1.6% during the second quarter, benefiting from improved property values and low interest rates, according to the Mortgage Bankers Association.

September 28 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Mortgage credit accessibility dropped for the first time in four months as jumbo loan products took a step back, according to the Mortgage Bankers Association.

September 11 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5 -

Delinquencies for loans securing commercial mortgage-backed securities continued to decline, although they are still well above rates for other types of investors, according to the Mortgage Bankers Association.

September 4 -

With spring homebuying in bloom, the second quarter brought profits to independent mortgage bankers after going negative for the second time ever, according to the Mortgage Bankers Association.

August 29 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

Mortgage applications increased 4.2% from one week earlier, rising for the first time in over a month, according to the Mortgage Bankers Association.

August 22 -

Mortgages originated to finance apartments and other income-producing properties managed to generate an overall year-to-year increase in the first half, even though there are declines in some parts of the market.

August 21 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15 -

The risk of mortgage defaults reached its highest point since the second quarter of 2015 as lenders loosen credit, according to VantageScore.

August 10 -

July's new-home sales were at their highest pace since April, leading to a 3.5% year-over-year increase in mortgage applications to purchase recently constructed homes, the Mortgage Bankers Association said.

August 10 -

Mortgage applications declined for the fourth consecutive week as interest rates remained at high levels.

August 8