-

The Consumer Financial Protection Bureau's practice of "regulation by enforcement" and use of nonbinding guidance materials makes its regulatory efforts "unfair and ineffective" to lenders and servicers, the Mortgage Bankers Association said.

July 5 -

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5 -

Commercial and multifamily mortgage debt outstanding grew $44.3 billion during the first three months of 2018, the largest first-quarter gain since before the Great Recession, according to the Mortgage Bankers Association.

July 2 -

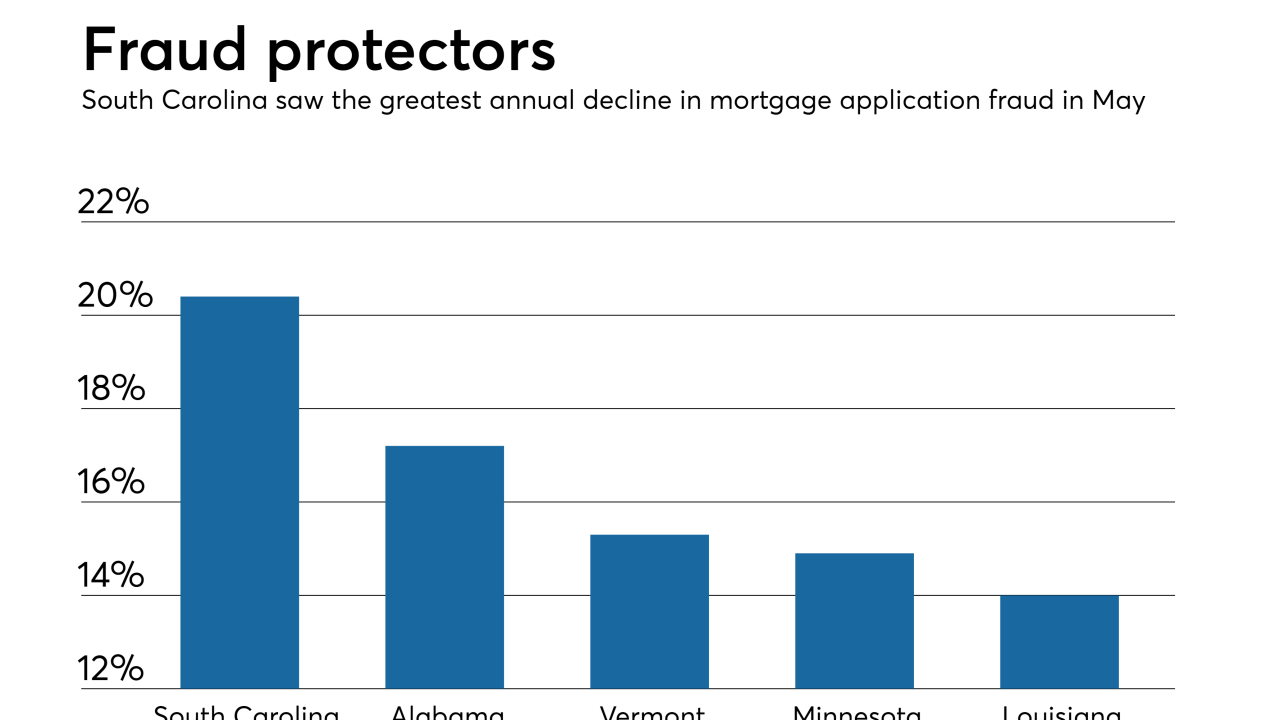

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Mortgage applications fell by nearly 5% last week as concerns over foreign trade and tariffs outweighed other positive economic news, according to the Mortgage Bankers Association.

June 27 -

Mortgage application activity increased 5.1%, rising for the second time in the past three weeks, according to the Mortgage Bankers Association.

June 20 -

Long-time mortgage industry veteran A.W. Pickel III is the new president of Waterstone Mortgage as Eric Egenhoefer has elected to concentrate on the chief executive position.

June 19 -

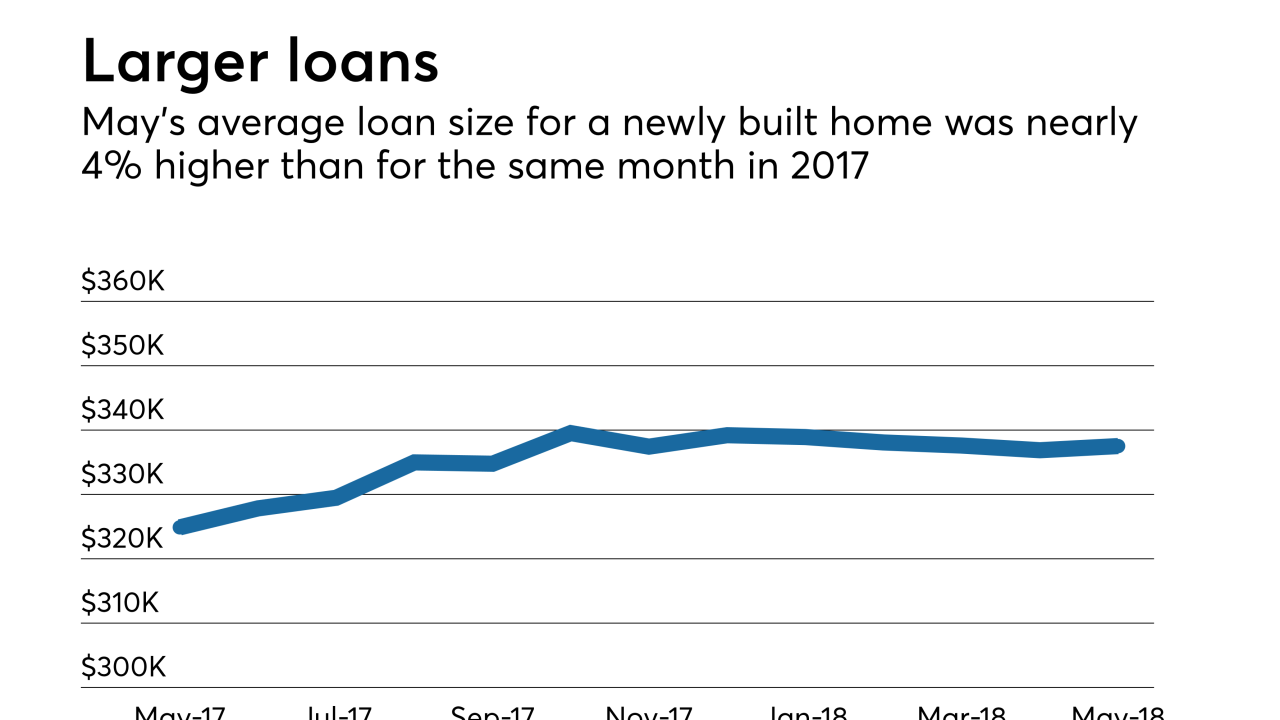

Mortgage applications for newly constructed homes declined in May as sales and supply are not keeping up with demand, the Mortgage Bankers Association said.

June 15 -

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year, according to Freddie Mac.

June 14 -

Mortgage applications fell 1.5% from the previous week, as rising interest rates ended a brief pickup in activity, the Mortgage Bankers Association reported.

June 13 -

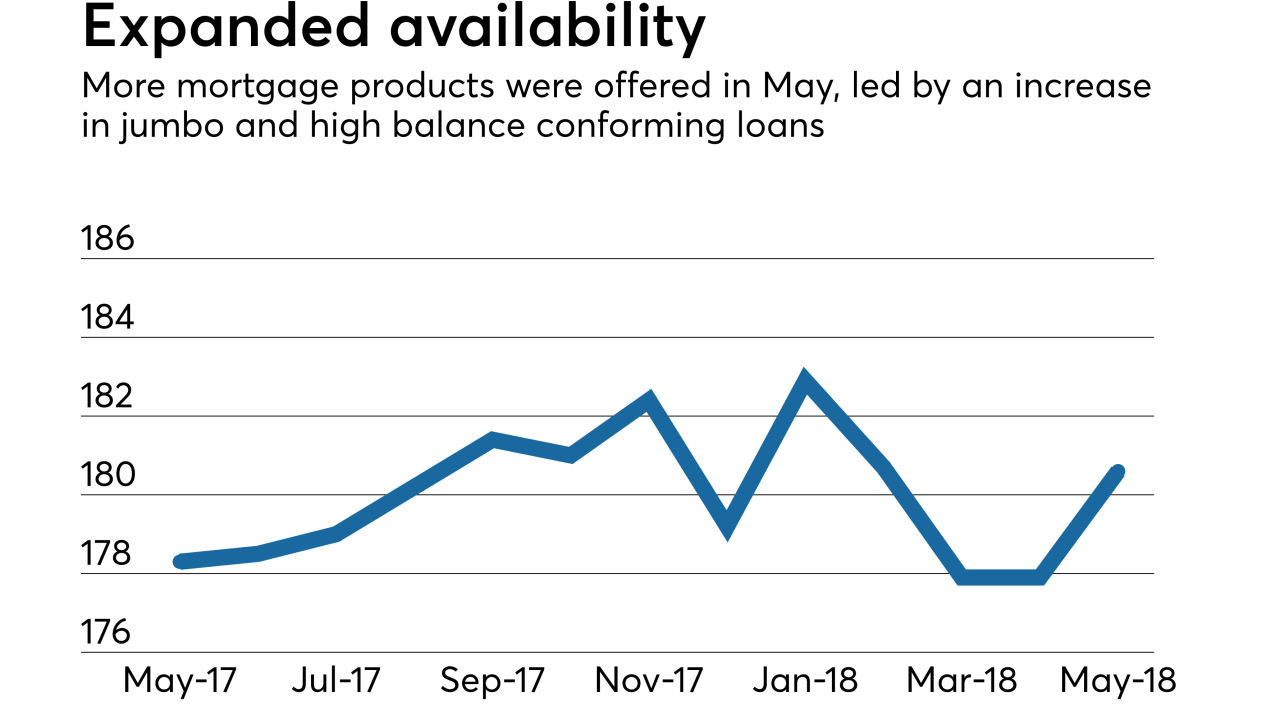

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

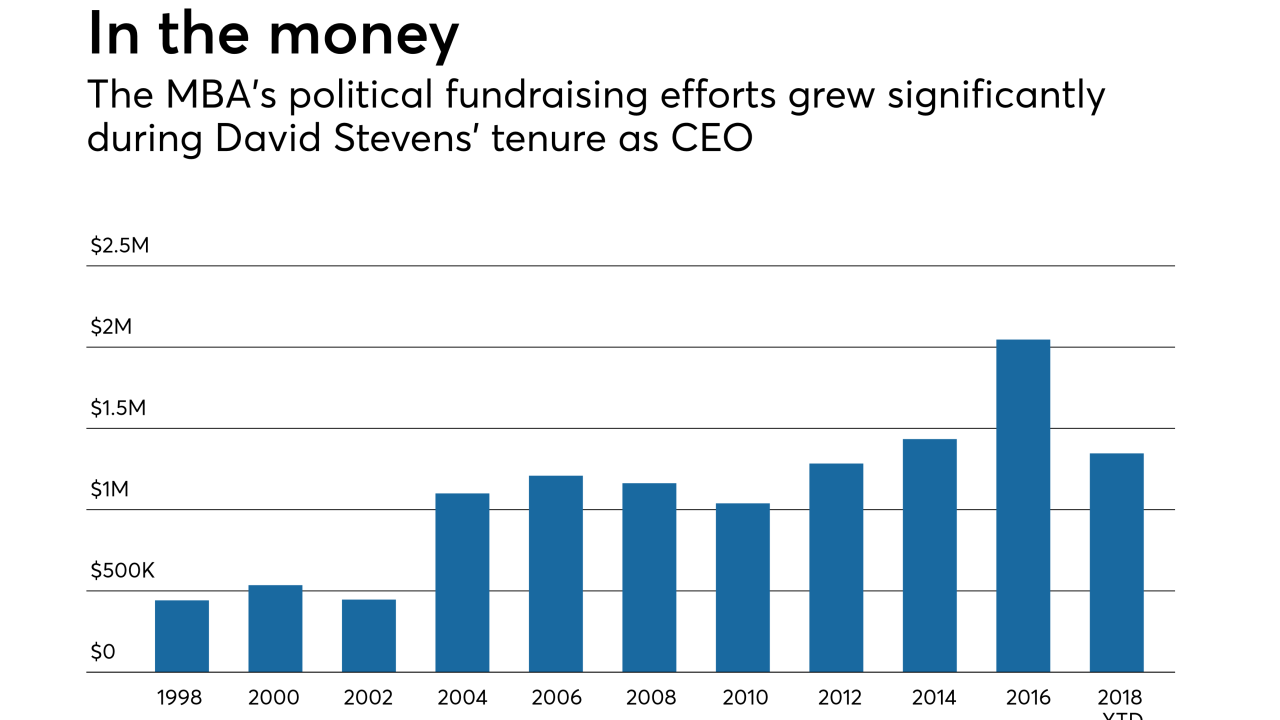

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

Robert Broeksmit, a career mortgage industry executive, will succeed David Stevens as the president and CEO of the Mortgage Bankers Association.

June 7 -

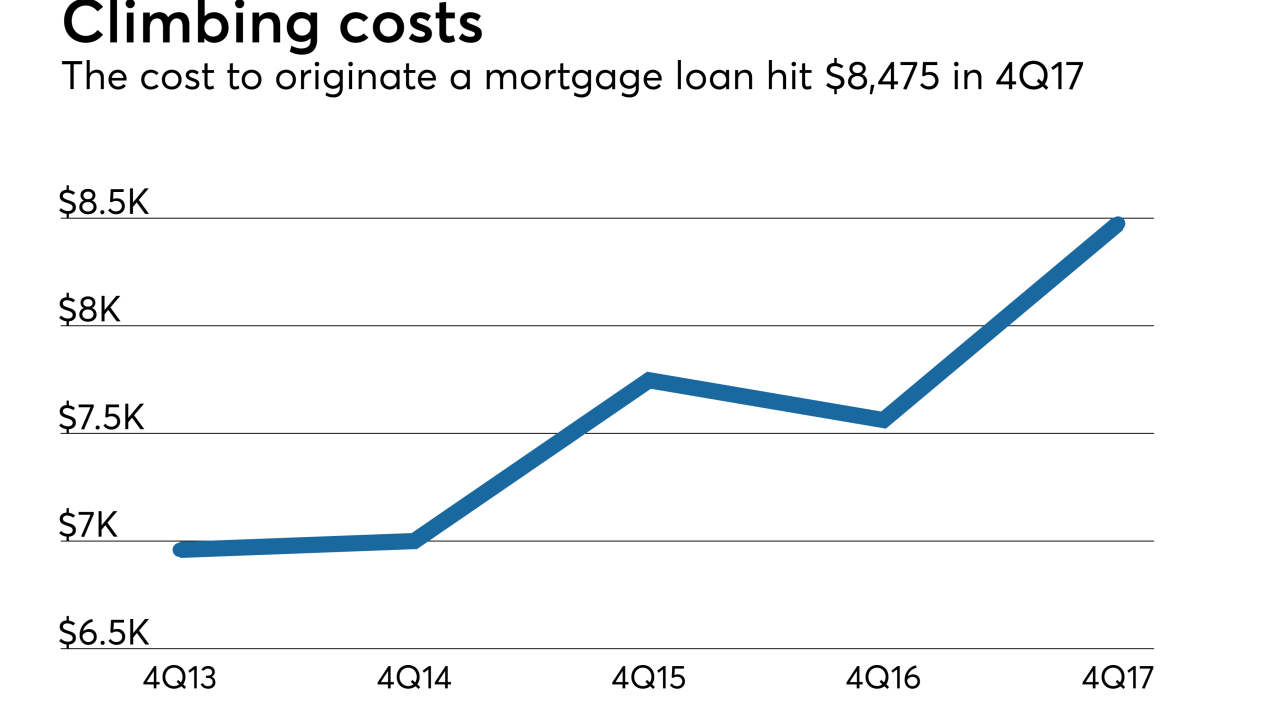

Declining mortgage origination volume and record-high costs drove production income for independent mortgage bankers into negative territory, according to the Mortgage Bankers Association.

June 6 -

After eight consecutive weeks of decreases, mortgage applications increased by 4.1% last week as key interest rates dropped sharply, according to the Mortgage Bankers Association.

June 6 -

Mortgage applications decreased 2.9%, falling for the eighth consecutive week even as interest rates came down from their recent highs, according to the Mortgage Bankers Association.

May 30 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

The cash-out mortgage refinance share was at its highest in nearly 10 years in the first quarter, due to rising interest rates and homes not being used as piggybanks.

May 24 -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

Digital mortgage efficiencies span from origination to the secondary market and beyond, but something as small as a low-quality image in the loan file can cause headaches with investors.

May 23