-

The share of mortgage refinance applications dropped to its lowest level in nearly 10 years as interest rates continued to climb.

March 21 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

February's volume of mortgage loan applications for newly constructed homes rose both year-over-year and month-to-month, continuing the momentum from a surprisingly strong showing in January.

March 13 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

Loan program revisions made by one large conventional mortgage investor led to a decrease in total residential home finance credit availability in February.

March 8 -

Tight margins, regulatory clarity and a renewed appetite to expand have made mortgage brokers and the wholesale channel attractive again, at least to the small and medium mortgage lenders.

March 8 -

Mortgage application activity increased slightly from one week earlier even as the rate for the 30-year conforming loan rose to its highest level in four years.

March 7 -

Commercial and multifamily fourth-quarter mortgage delinquency rates improved for most investor types compared to one year prior as the U.S. economy continued its recovery.

March 6 -

Recent developments in the Federal Housing Administration's Home Equity Conversion Mortgage program are making it easier for lenders to originate reverse mortgages to borrowers who want to buy a new-construction home.

March 6 -

Higher levels of purchase activity even with rising interest rates drove the increase in mortgage applications compared with one week earlier.

February 28 -

With 30-year mortgage rates reaching a four-year high, loan application activity was lower this past week, according to the Mortgage Bankers Association.

February 21 -

Rising rates, largely tied to the stock market turmoil, took their toll on mortgage application volume during the past week.

February 14 -

There was an increase in total mortgage defaults during the fourth quarter but that rise has to be measured in context of what had been a favorable environment prior to the third-quarter storms.

February 8 -

Mortgage servicers should approach efforts to overhaul their compensated structure with caution, as changes to the status quo "could have ripple effects across the entire real estate finance industry," warned Mortgage Bankers Association Chairman David Motley.

February 7 -

From insights about borrower payment preferences to new automation assisting with natural disaster recovery efforts, here's a roundup of news coming out of the Mortgage Bankers Association Servicing Conference.

February 7 -

Even as rates hit their highest levels in nearly four years, mortgage application volume increased compared with one week earlier, according to the Mortgage Bankers Association.

February 7 -

Housing finance reformers are pushing full steam ahead to get a bill introduced before the political calendar makes passage nearly impossible.

February 2 -

From responding to natural disasters to emerging technology strategies, here's a look at six top trends on the agenda for the 2018 MBA Servicing Conference.

February 2 -

Rising rates suppressed total mortgage application activity, which decreased 2.6% from one week earlier, according to the Mortgage Bankers Association.

January 31 -

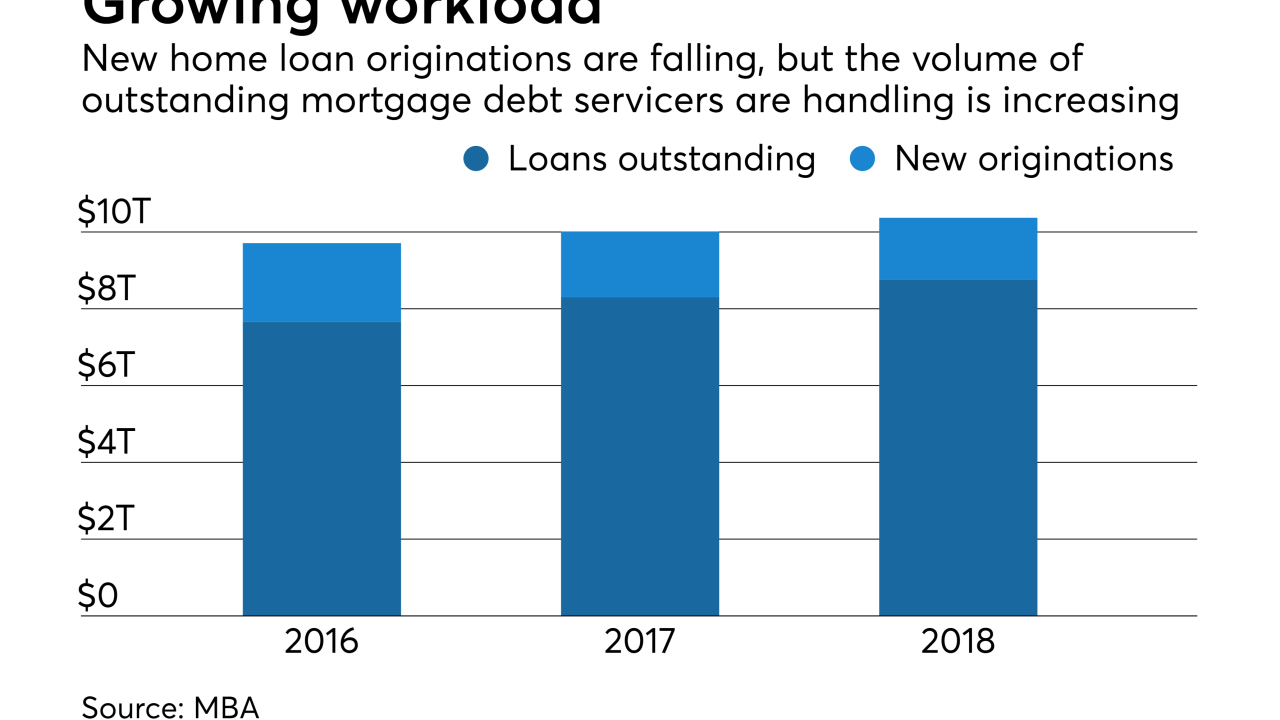

Rising mortgage rates have taken a toll on refinance lending and extended the lifecycle of existing loans. With new purchase originations also making portfolios larger, servicers must take steps to avoid capacity constraints.

January 31