-

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

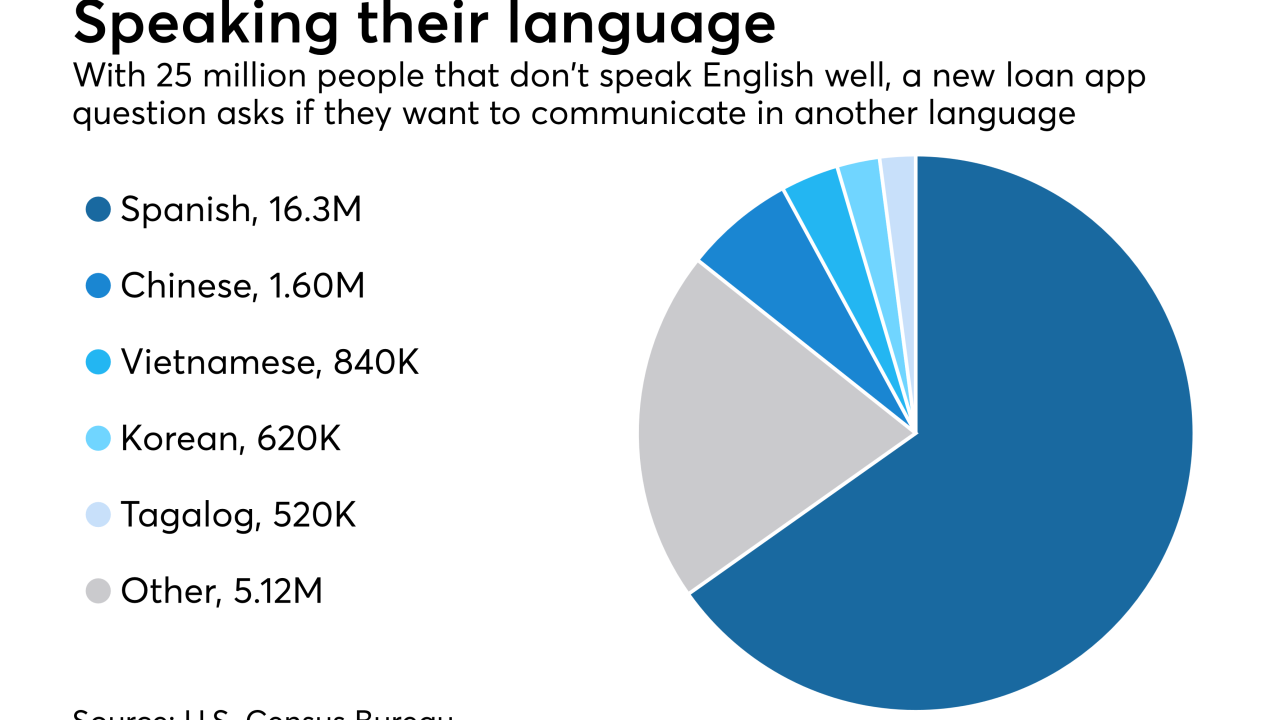

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

Hurricanes Harvey and Irma affected new-home sales in Texas and Florida, resulting in a 7.5% year-over-year decline in mortgage applications to purchase these properties in September.

October 16 -

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

Slightly looser underwriting outside the government sector is primarily responsible for the latest increase in credit availability.

October 10 -

A decline in refinancing applications offset the gain in purchase activity, leading to an overall drop in application activity of 0.4% from one week earlier.

October 4 -

Ginnie Mae will more closely examine liquidity at all issuers in response to complaints by the HUD inspector general that it would be vulnerable to defaults at nonbanks it does business with.

September 27 -

Mortgage application activity decreased 0.5% from one week earlier as a decline in refinance volume was only partially offset by an increase in purchases.

September 27 -

The Federal Housing Administration responded to lender concerns about timelines that delay property re-inspections after storms by issuing a waiver for properties affected by Hurricane Irma.

September 21