-

Groups representing community banks and credit unions generally support the new percentage-based goals set by the Federal Housing Finance Agency.

June 10 -

Consumer sentiment for home buying fell to its lowest point since November 2011, according to Fannie Mae.

May 7 -

Draft legislation would amend the Bank Service Company Act to give the National Credit Union Administration third-party vendor oversight, a power it has been requesting for the better part of two decades.

October 18 -

Public orders are an effective way to discourage violations of consumer protection law, the bureau's director said at a credit union conference.

September 9 -

The agency's vote Thursday threatens to block many of the industry's communications with customers, though banks did win one concession.

June 6 -

The industry has long complained that gathering the data is confusing and costly but two plans issued by the CFPB could help lighten the burden for a significant portion of credit unions.

May 10 -

Revised legislation would exclude credit unions from Community Reinvestment Act requirements, but could make the National Credit Union Administration the de facto enforcer of how CUs meet the needs of underserved markets.

March 18 -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

Groups representing banks, credit unions, the housing industry and others argue in favor of a bill requiring the CFPB to issue timely guidance on its rules.

June 12 -

Credit union executives talked up a pending regulatory relief effort while endorsing a radical shift in direction by the Consumer Financial Protection Bureau during a meeting with President Trump and other top White House officials on Monday.

February 26 -

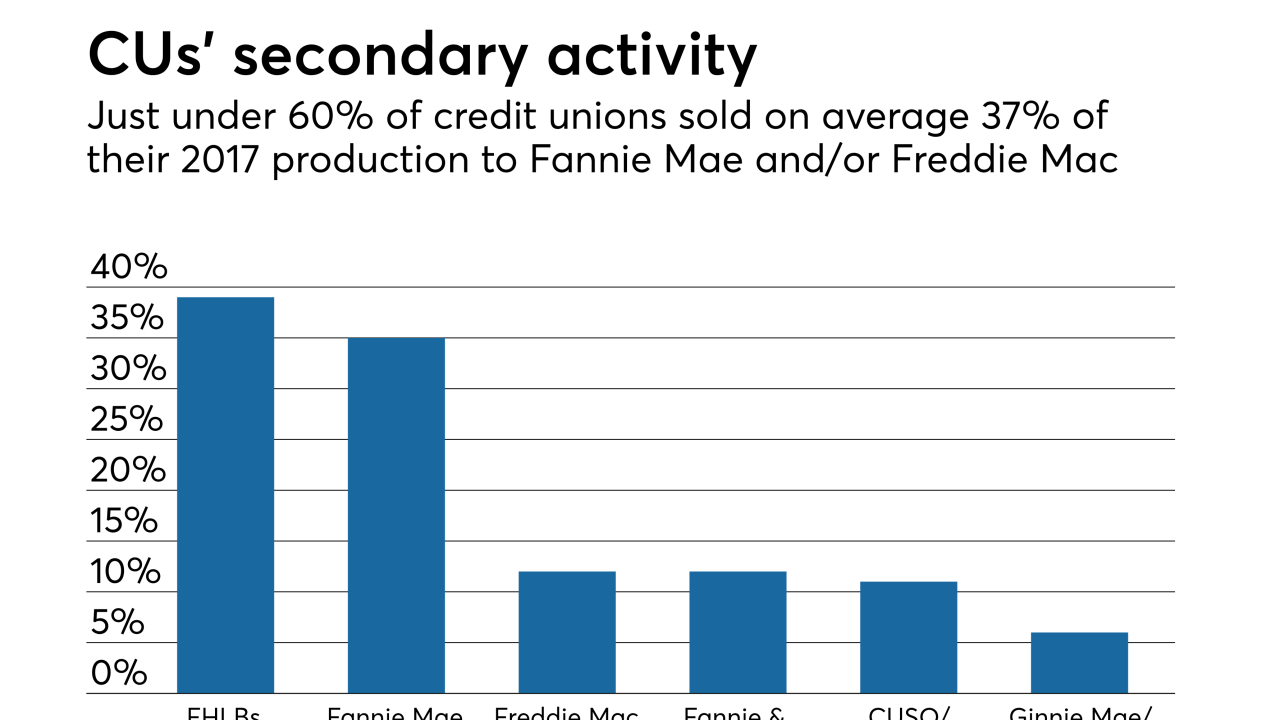

Credit unions favor housing finance reforms that would keep the government-sponsored enterprises or something similar in place, but add an explicit government guarantee to their mortgage-backed securities, according to a recent survey.

February 26 -

The regulator on Thursday announced a delay in the implementation of its prepaid rule, along with safe harbor for HMDA data reporting.

December 22 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

Lawmakers signaled Monday that Congress will likely have a swift and powerful response to revelations that the credit reporting company Equifax was hacked, exposing 143 million people to identity theft.

September 11 -

The National Association of Federally-Insured Credit Unions defended the credit union tax exemption and called for other financial reforms during a meeting Tuesday with Treasury Secretary Steven Mnuchin.

August 22 -

The Consumer Financial Protection Bureau's final rule to formalize guidance on a number of TILA-RESPA Integrated Disclosures compliance points omits an originally proposed fix for the so-called black hole that's created when a mortgage closing is delayed.

July 7 -

The accounting board has scheduled a meeting that bankers hope will produce eleventh-hour modifications to reserving requirements.

June 6