-

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

May 23 -

Democrats and Republicans on the House Financial Services Committee called for steps to minimize the harm to community banks and credit unions bracing for the new accounting standard.

May 16 -

Tim Sloan couldn't hang on any longer. Here are insights about why he left now, what role policymakers played in the decision and will continue to have in the company's future, and who in the world would want to lead Wells Fargo.

March 28 -

The bank was fined $25 million for what the Office of the Comptroller of the Currency said was an inability to provide the discounts to all who were eligible.

March 19 -

Recent remarks from top officials at the FDIC and Fed suggest the agencies' recent impasse over reforming the Community Reinvestment Act may be ending.

March 18 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

Private flood insurance rules that go into effect this summer have a safe harbor for some policies, but determining whether others are compliant could be a time-consuming, imprecise and costly exercise.

February 27 Buckley Sandler LLP

Buckley Sandler LLP -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

Some hopeful souls in Washington believe the commercial banking industry will return to originating and servicing higher-risk mortgages, but most banks are more likely to continue withdrawing from the sector.

January 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

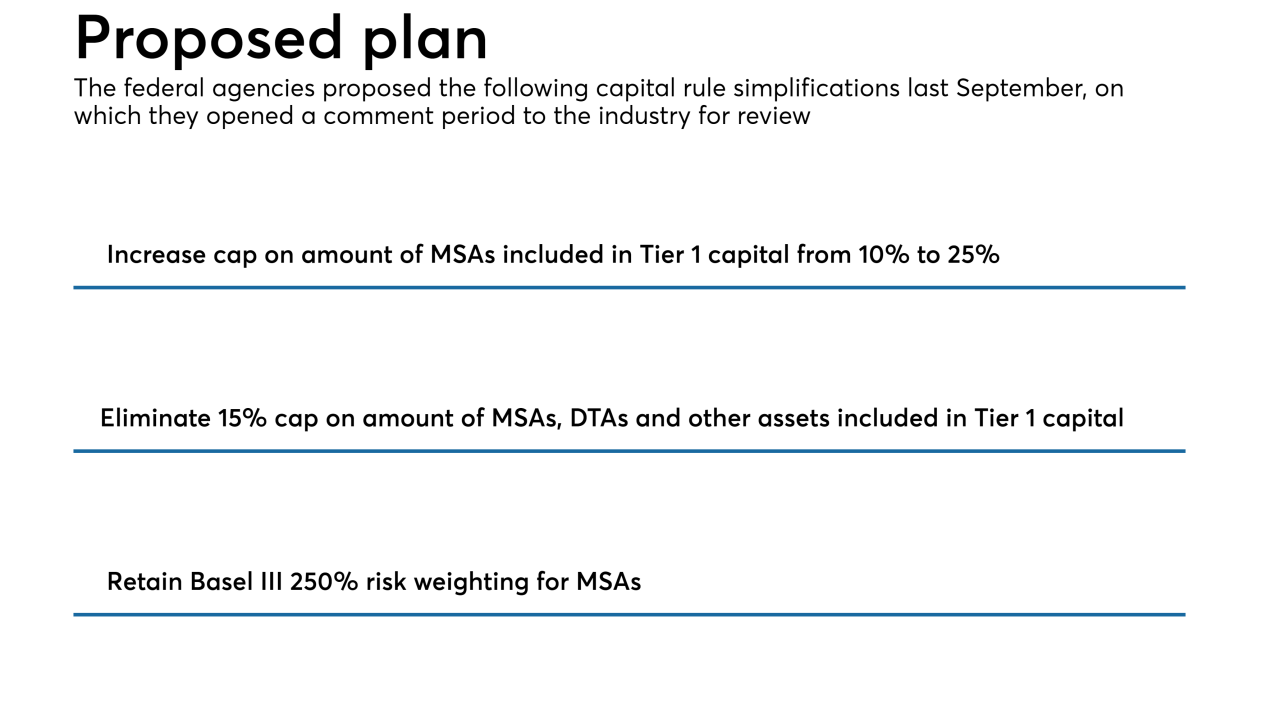

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6