-

Some hopeful souls in Washington believe the commercial banking industry will return to originating and servicing higher-risk mortgages, but most banks are more likely to continue withdrawing from the sector.

January 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

Fintechs must be held to the same standards as regulated financial institutions, a letter from the National Association of Federally-Insured Credit Unions stated that used Zillow's entrance into the mortgage business as an example.

January 9 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

The White House said that Comptroller of the Currency Joseph Otting will serve as acting director of the Federal Housing Finance Agency beginning Jan. 6, after Director Mel Watt’s term ends.

December 21 -

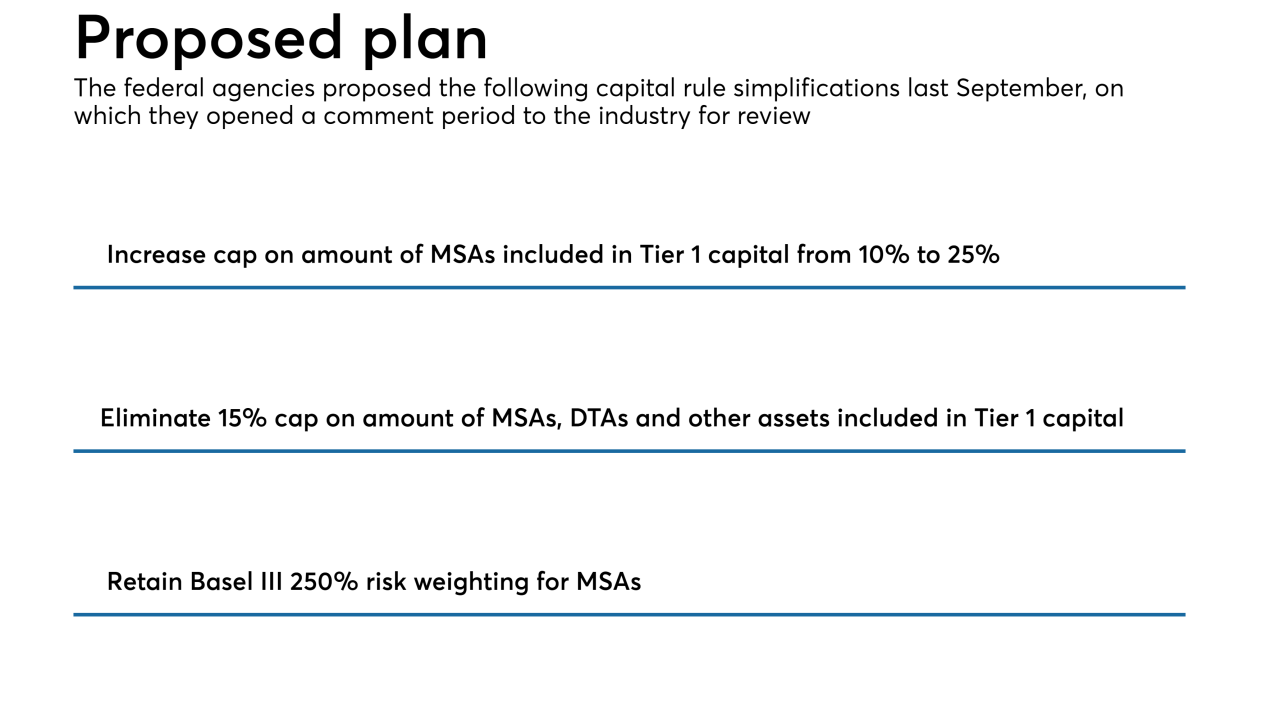

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The effort to raise the threshold for transactions excused from appraisal requirements responds to concerns that the current threshold is outpaced by real estate prices.

November 20 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

Federal regulators have issued answers to frequently asked questions on appraisal regulations.

October 16 -

The Office of the Comptroller of the Currency lowered the $14 billion-asset thrift in Cleveland to “needs to improve” from "satisfactory."

October 3 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

The changes mandated by the recent regulatory relief law would narrow the definition of "high-volatility commercial real estate" exposures that get a higher risk weight.

September 18 -

Regulators will continue to issue guidance to articulate general views on appropriate practices, but they will not issue enforcement actions based on violations.

September 11 -

Comptroller of the Currency Joseph Otting writes that the Community Reinvestment Act has not kept pace with changes in banking and needs to be updated.

September 5 Office of the Comptroller of the Currency

Office of the Comptroller of the Currency -

The Office of the Comptroller of the Currency’s questions for the public to comment on the decades-old law could illuminate a path forward as regulators struggle to agree on an updated policy.

August 30 -

Several states pledged to compensate for a slowdown in enforcement at the Consumer Financial Protection Bureau under Mick Mulvaney, but their efforts have been complicated by tight budgets and doubts over whether such initiatives are necessary.

August 20 -

The federal bank regulators are considering roughly a dozen new rulemakings in response to the bill rolling back certain sections of Dodd-Frank.

July 20