-

June employment by nondepository mortgage bankers and brokers was little changed from the previous month, but later numbers could prove stronger given some influential lenders' interest in staffing up.

August 2 -

Mortgage servicer customer satisfaction levels are among the lowest of any industry as more companies prioritize cost-cutting, regulation and default management over their borrowers, according to J.D. Power.

August 1 -

Quicken Loans Inc.'s biggest quarter to date means more jobs in Detroit.

July 18 -

Appraiser and homeowner estimates of house prices are aligning closer after the second straight month of a tightened gap in perceptions of value, according to Quicken Loans.

July 10 -

Mortgage lenders might be feeling a little less stressed over False Claims Act actions being brought against them following recent headlines but there is still some work to be done before they can chill out.

July 2 -

As Amazon looms over the mortgage industry, expert views differ on the retail monolith claiming its stake in the sector.

June 18 -

Quicken Loans claimed victory in its dispute with the Department of Housing and Urban Development over the False Claims Act, only paying the agency for losses incurred and interest.

June 14 -

OBX 2019-INV2 is a private-label RMBS pool of 1,087 of agency-eligible investor-property loans.

June 12 -

Appraisals are viewed as a choke point in the mortgage process. As the ranks of appraisers dwindle and technology advances, a new, AI-driven approach may not be far off.

June 10 -

Many banks have already scaled back home lending or even left the business. With profit margins shrinking, inventories of homes at crisis levels and competition from nonbanks intensifying, that’s unlikely to change.

May 29 -

Dan Gilbert, the billionaire founder of mortgage giant Quicken Loans Inc. and owner of the NBA's Cleveland Cavaliers, is "awake, responsive and resting comfortably," a day after suffering a stroke.

May 28 -

Dan Gilbert, the founder and chairman of Quicken Loans, was hospitalized on Sunday after suffering stroke-like symptoms, according to the Detroit News.

May 27 -

The gap in home price perception between appraisers and property owners widened in April, reaching its greatest spike in four years, according to Quicken Loans. At the same time, home values continued climbing.

May 15 -

JPMorgan Chase's Corporate Client Banking and Specialized Industries Mortgage group is now accepting electronic promissory notes as collateral to fund warehouse loans.

May 2 -

Quicken Loans parent company Rock Holdings is strengthening its investments in the Canadian market by acquiring a majority stake in Lendesk, a Vancouver-based mortgage fintech.

April 24 -

Home prices dipped from February — while annual growth remained suppressed — due to affordability and inventory issues, according to Quicken Loans.

April 9 -

A judge in Michigan has ordered the Justice Department and Quicken Loans attempt a settlement in a years-old lawsuit in which the federal government accused the mortgage lending company of fraud.

April 9 -

While home prices continued the gradual annual growth in February, its plateaued monthly progression could open a big spring for mortgage lending, according to Quicken Loans.

March 13 -

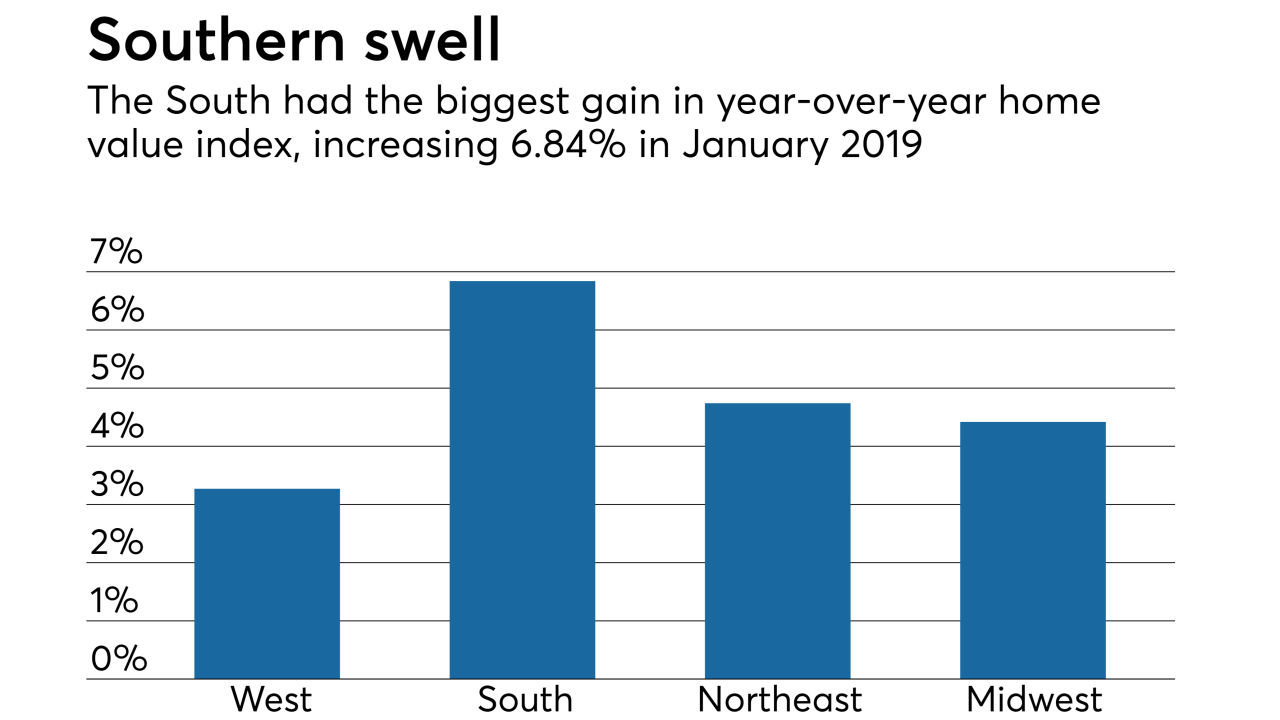

While home price appreciation showed steady growth in January, it's a lower rate than years past and consumer appraisal perception lags reality, according to Quicken Loans.

February 13 -

While home values rose over 5% in November, air is getting let out of the home price balloon, as the growth rate remains low compared to the past few years, according to Quicken Loans.

December 11