-

A Rochester, N.Y., developer who faces federal mortgage fraud charges connected to apartments in Buffalo and other cities has pushed back the sale of a significant part of his real estate portfolio until later this month.

October 7 -

Flagstar Bank expects to recover $1 million of its loan to defunct reverse mortgage lender Live Well Financial following the sale of the collateral that secured it.

September 19 -

A West Chicago, Ill., property developer is accused by federal authorities of operating a Ponzi scheme that defrauded more than 300 investors in 32 states of at least $41.6 million.

September 11 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

Robert Shapiro, the former chief executive officer of Woodbridge Group of Companies, pleaded guilty to running a $1.3 billion fraud that caused more than 7,000 investors to lose money, according to prosecutors.

August 9 -

A Nomura Holdings Inc. unit will repay customers about $25 million to settle U.S. regulators' allegations that it failed to supervise traders who made false statements in negotiating sales of mortgage securities.

July 15 -

Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

June 19 -

The bipartisan House effort to delay the Current Expected Credit Loss standard comes less than a month after Republican senators introduced a similar bill.

June 11 -

A trio of Los Angeles-area real estate developers were accused by the federal government of taking $1.3 billion of investor funds that was supposed to be used for hard money loans for their own use.

April 15 -

The House Financial Services Committee will hold eight hearings next month, looking at Wells Fargo's recent consumer protection scandals, a reauthorization of the flood insurance program and more.

February 25 -

A former Ocwen Financial executive is settling Securities and Exchange Commission charges that he engaged in insider trading related to his company's dealings with Altisource Portfolio Solutions following a CFPB enforcement action and its upcoming merger with PHH Corp.

September 28 -

Bank of America Corp.'s Merrill Lynch unit will pay $15.7 million to settle a U.S. regulator's allegations that it failed to properly supervise traders who persuaded clients to overpay for mortgage bonds by misleading them about how much the firm paid for the securities.

June 12 -

Ditech Holding Corp. has received a second notice from the New York Stock Exchange warning its common stock could be delisted for not being in compliance with the exchange's requirements.

May 29 -

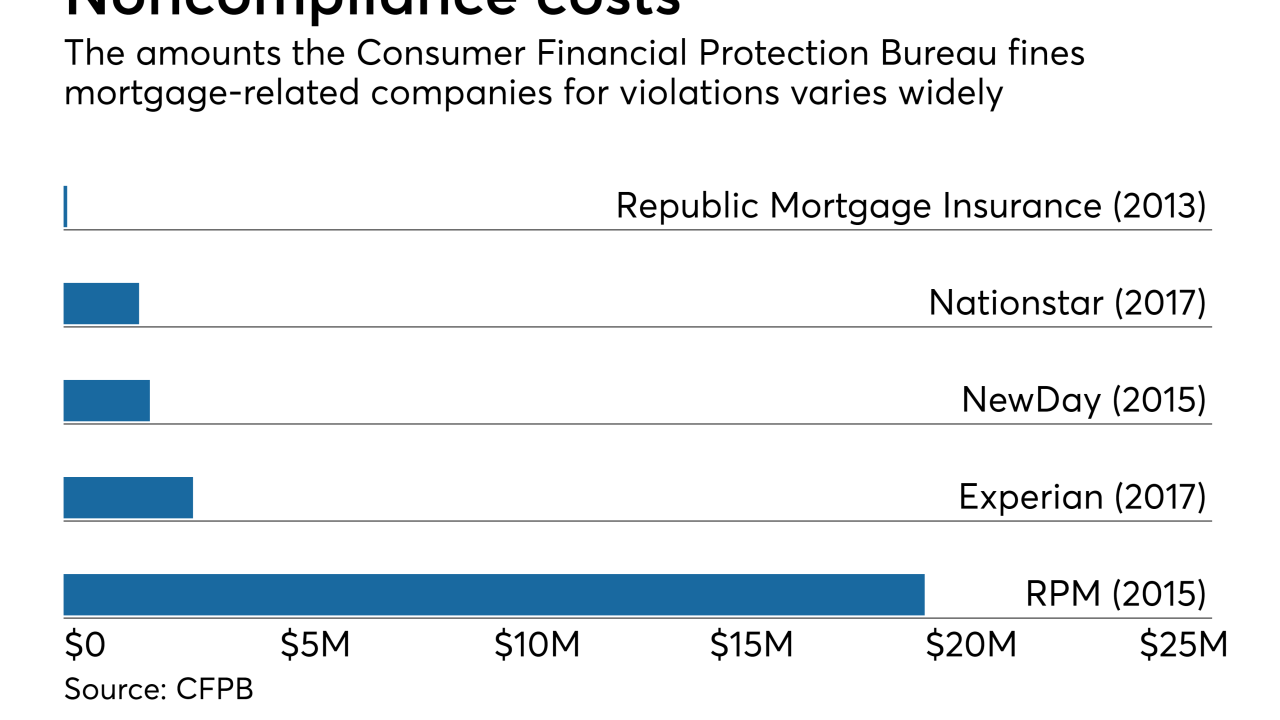

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

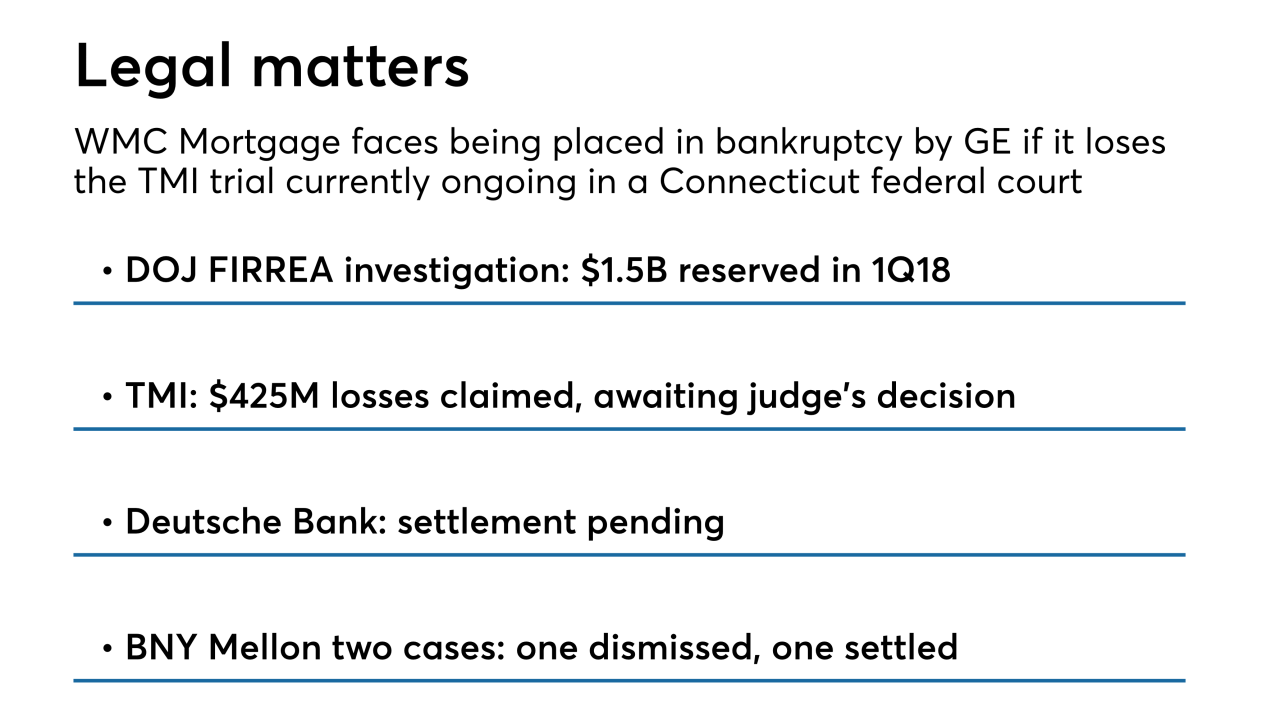

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

Heads of a large real estate investment company with offices in Alaska and California have agreed to pay $3 million in fines for what a federal agency says was a scheme to "bilk" hundreds of investors out of millions of dollars.

March 29 -

A $2.38 million loan Remax founder and former CEO David Liniger provided to the company's then-chief operating officer, Adam Contos, violated the company's code of ethics because its board of directors was never told about it, the company said as it announced it had completed an internal investigation.

February 23 -

The Supreme Court agreed Friday to hear a case challenging the appointment of administrative law judges, which could impact a ruling on the constitutionality of the CFPB.

January 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Ocwen Financial Corp. received more breathing room on the legal front as the Securities and Exchange Commission is not pursuing an enforcement action against the company regarding its debt collection practices.

October 4