-

A former Ocwen Financial executive is settling Securities and Exchange Commission charges that he engaged in insider trading related to his company's dealings with Altisource Portfolio Solutions following a CFPB enforcement action and its upcoming merger with PHH Corp.

September 28 -

Bank of America Corp.'s Merrill Lynch unit will pay $15.7 million to settle a U.S. regulator's allegations that it failed to properly supervise traders who persuaded clients to overpay for mortgage bonds by misleading them about how much the firm paid for the securities.

June 12 -

Ditech Holding Corp. has received a second notice from the New York Stock Exchange warning its common stock could be delisted for not being in compliance with the exchange's requirements.

May 29 -

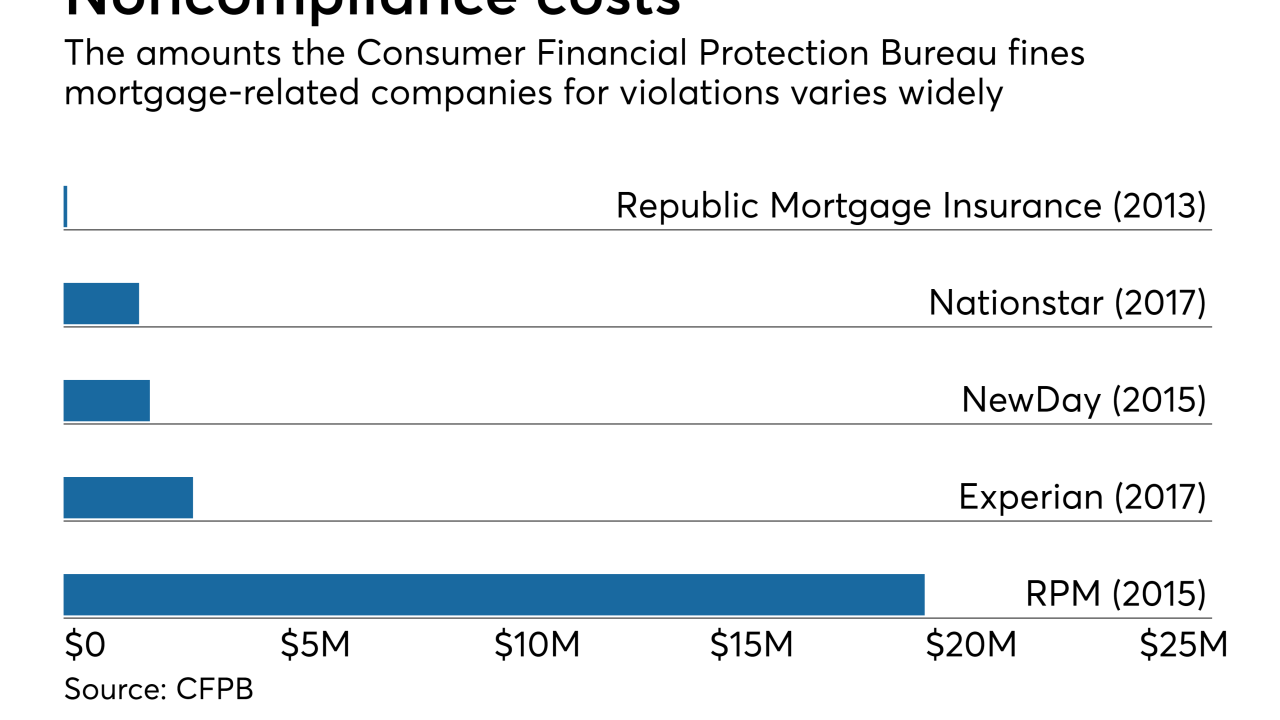

Nationstar Mortgage may face a Consumer Financial Protection Bureau enforcement action over alleged violations of the Real Estate Settlement Act and other regulations, the Mr. Cooper parent company said.

May 11 -

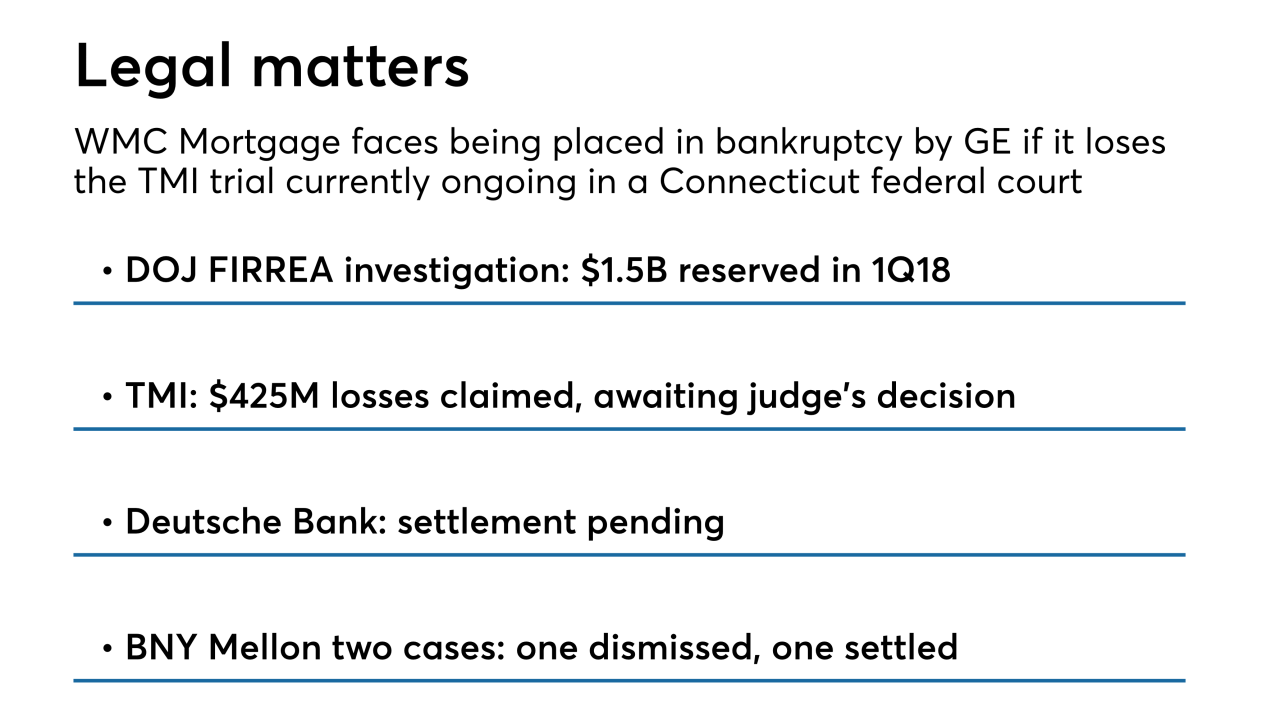

WMC Mortgage, a leading subprime originator during the boom era, could file for bankruptcy by parent company General Electric if it loses a legal proceeding regarding indemnifications on mortgage-backed securities.

May 3 -

Heads of a large real estate investment company with offices in Alaska and California have agreed to pay $3 million in fines for what a federal agency says was a scheme to "bilk" hundreds of investors out of millions of dollars.

March 29 -

A $2.38 million loan Remax founder and former CEO David Liniger provided to the company's then-chief operating officer, Adam Contos, violated the company's code of ethics because its board of directors was never told about it, the company said as it announced it had completed an internal investigation.

February 23 -

The Supreme Court agreed Friday to hear a case challenging the appointment of administrative law judges, which could impact a ruling on the constitutionality of the CFPB.

January 12 -

Fannie Mae and Freddie Mac will suspend the evictions of foreclosed single-family properties during the holiday season, according to the government-sponsored enterprises.

December 11 -

Ocwen Financial Corp. received more breathing room on the legal front as the Securities and Exchange Commission is not pursuing an enforcement action against the company regarding its debt collection practices.

October 4 -

After the FSOC voted to rescind its systemic designation for AIG, it's unclear whether the interagency council will continue to appeal a court ruling overturning MetLife's SIFI designation.

October 2 -

Sen. Elizabeth Warren, D-Mass., is broadening her probe into the data breach to look at whether the company should have disclosed the breach sooner and if it plans to claw back compensation.

September 22 -

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP -

Regulators reached a $183.5 million deal Thursday to get debt relief to 41,000 students of the bankrupt Corinthian Colleges.

August 17 -

A regulatory plan to create new restrictions on banks’ executive compensation practices appears dead — but changes since the financial crisis may have made the proposal largely obsolete anyway.

July 21 -

Ocwen Financial Corp. agreed to settle a shareholder lawsuit for a cash payment of $49 million, plus 2.5 million shares of the company's stock.

July 20 -

A former Nomura Holdings trader was found guilty of conspiring to lie to clients about mortgage-bond prices, while another was cleared of all charges in a verdict that highlights the challenge of policing fraud in the market.

June 15 -

The Securities and Exchange Commission isn't planning to bring an enforcement action tied to Deutsche Bank's losing nearly $550 million on mortgage-bond trades.

May 5 -

More than 100 days into Trump’s presidency, financial regulators still lack key appointments. Here's why that matters.

May 2 -

Jesse Litvak was sentenced to two years in prison and fined $2 million after he was convicted a second time for lying about mortgage-backed securities prices.

April 26