-

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

Loan applications for newly constructed properties accelerated going into this year's peak home buying season, contrasting with the weakness seen in the market a year ago, according to the Mortgage Bankers Association.

April 9 -

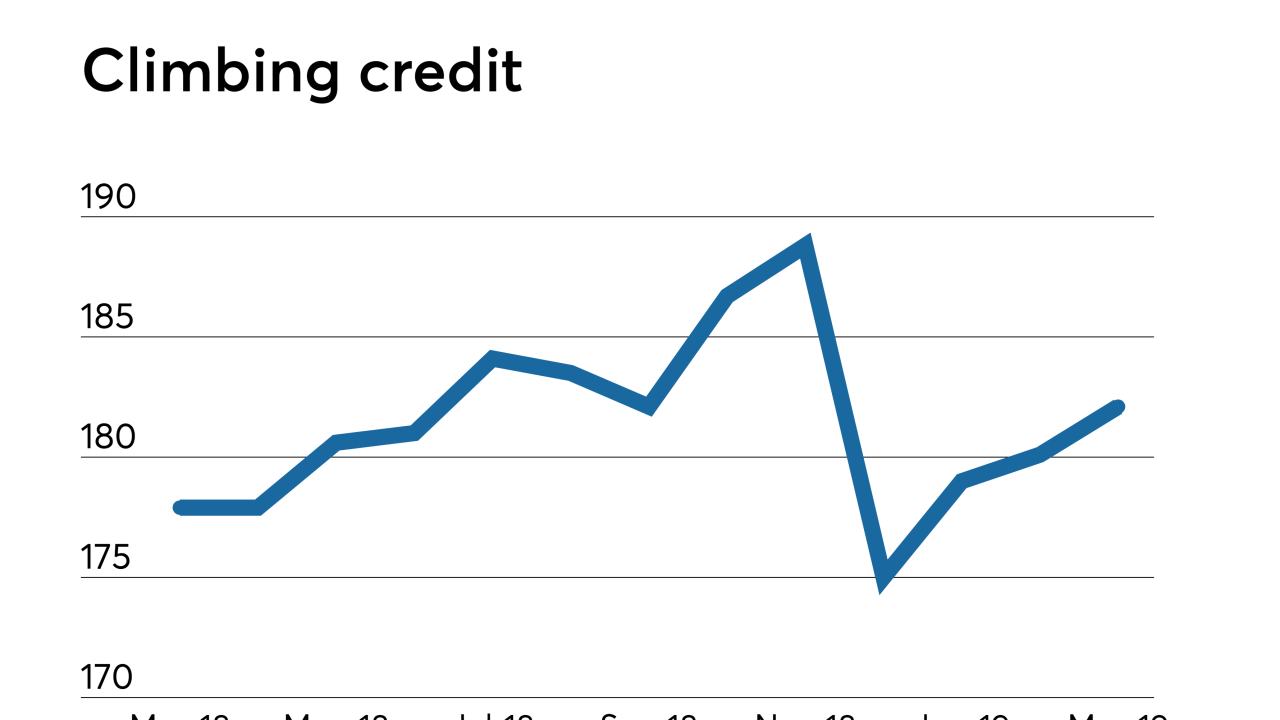

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Mortgage refinance applications reached their highest level in three years as interest rates plunged last week in the aftermath of the Federal Open Market Committee's March meeting.

April 3 -

The mortgage industry is stepping up its fight against a bill that would raise the Department of Veterans Affairs' mortgage fees to cover medical costs for Vietnam vets.

April 1 -

There was a huge rise in mortgage refinance application activity due to the large drop in interest rates following last week's Federal Open Market Committee meeting.

March 27 -

Mortgage applications increased last week but unlike the prior period, it was driven by refinance volume as interest rates fell to a one-year low, according to the Mortgage Bankers Association.

March 20 -

New-home mortgage applications are on the rise, incentivizing builders to add housing stock in a market drained of supply and signaling a healthy spring buying season ahead, according to the Mortgage Bankers Association.

March 15