-

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

Purchase mortgage application activity is at its highest level since this summer on a seasonally adjusted basis, and should remain strong in December, according to the Mortgage Bankers Association.

December 4 -

Mortgage application activity rose 1.5% compared with one week earlier as interest rates remained below 4%, according to the Mortgage Bankers Association.

November 27 -

For the second consecutive week, mortgage application activity unusually moved in the same direction as interest rates, decreasing 2.2% from one week earlier, according to the Mortgage Bankers Association.

November 20 -

Loan applications to purchase newly constructed homes during October rose by nearly one-third year-over-year as sales reached their highest annual pace since the Mortgage Bankers Association started tracking this data.

November 19 -

Mortgage applications increased from one week earlier, although conforming loan interest rates moved back over 4%, according to the Mortgage Bankers Association.

November 13 -

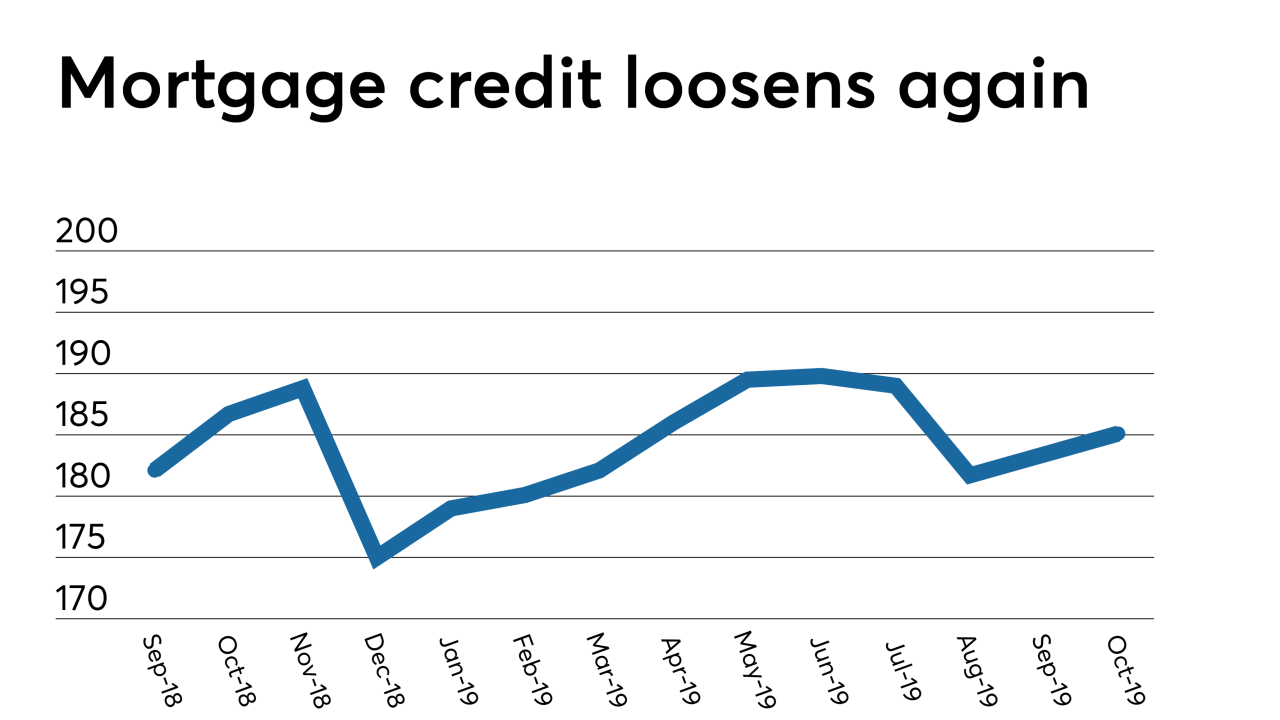

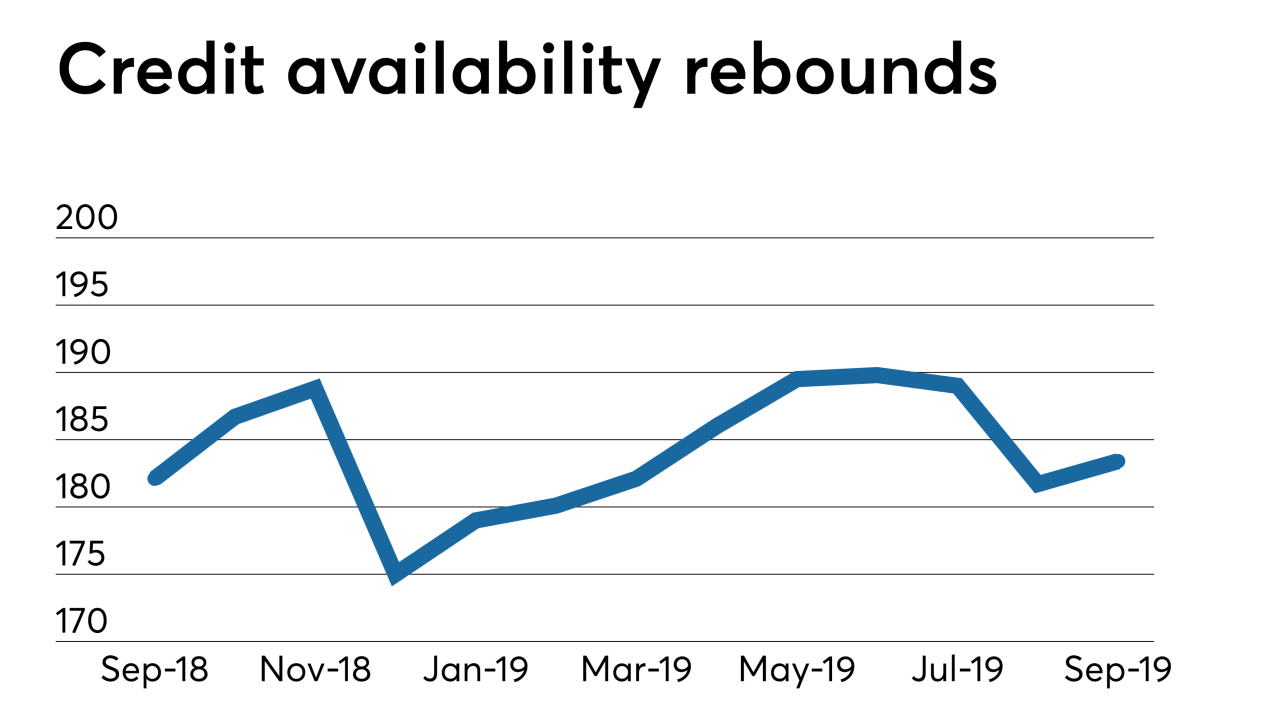

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

It was activity at the upper end of the housing market that helped to keep mortgage application volume level with the previous week, the Mortgage Bankers Association said.

November 6 -

From the Tennessee-Kentucky border through coastal North Carolina, here are the 15 metro areas where millennial VA purchase-loan activity increased the most over the past fiscal year.

November 5 -

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

Mortgage applications increased 0.5% from one week earlier, although interest rate instability affected consumers' ability to get the best price for their loan, according to the Mortgage Bankers Association.

October 16 -

The Department of Veterans Affairs distributed more than $400 million in refunded home loan fees after finding exempt borrowers were mistakenly charged due to clerical errors related to their disability status.

October 10 -

Mortgage applications jumped 5.2% from one week earlier as a drop in rates caused another surge in refinances, according to the Mortgage Bankers Association.

October 9 -

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

October 7 -

Millennials took advantage of mortgage rates falling to near three-year lows in August, increasing their refinance share to the highest percentage since December 2015, according to Ellie Mae.

October 2 -

Mortgage applications increased 8.1% from one week earlier as conventional mortgage rates fell under 4% again, according to the Mortgage Bankers Association.

October 2 -

The recent spike in mortgage interest rates reduced home purchase application activity last week, contributing to a 10.1% decline in total activity, according to the Mortgage Bankers Association.

September 25