-

Mortgage applications decreased by 3.4% this week, although refinance activity remained close to its 2019 high point, according to the Mortgage Bankers Association.

June 19 -

With refinance activity rising to its highest level in three years, mortgage application volume increased 26.8% from one week earlier, according to the Mortgage Bankers Association.

June 12 -

Refinance mortgage application activity surged as interest rates fell to their lowest level since the start of 2018, but potential homebuyers remained sidelined due to economic uncertainty, according to the Mortgage Bankers Association.

June 5 -

Consumer worries over the direction of the U.S. economy affected mortgage application activity this past week even as interest rates remained flat or declined, according to the Mortgage Bankers Association.

May 29 -

In a weak first quarter, housing activity held up better for first-time homebuyers than others, according to a new Genworth Mortgage Insurance report.

May 23 -

With mortgage rates falling to their lowest level in over a year, refinance volume drove this week's increase in application activity, according to the Mortgage Bankers Association.

May 22 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

The trade dispute with China is likely to affect consumers' willingness to buy a home and apply for a new mortgage loan, according to the Mortgage Bankers Association.

May 15 -

Even though mortgage delinquencies increased on a quarter-to-quarter basis, strong overall metrics mitigate any concerns regarding future loan performance, according to the Mortgage Bankers Association.

May 14 -

An increase in purchase activity drove the week-over-week rise in mortgage application volume as homebuyers entered the market while interest rates fell, according to the Mortgage Bankers Association.

May 8 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

Military service members are a crucial market segment for lenders because they are younger than other demographics and a steady group of borrowers unfazed by independent economic concerns.

April 30 NewDay USA

NewDay USA -

Customer-facing mortgage technology is not that big of a deal for Top Producers based in the South, even as a growing number of lenders are partnering with fintech firms to create a better user experience.

April 24 -

Purchase mortgage applications, which until now were unaffected by the recent rise in interest rates, fell by 4% on a seasonally adjusted basis from last week, according to the Mortgage Bankers Association.

April 24 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

Loan applications for newly constructed properties accelerated going into this year's peak home buying season, contrasting with the weakness seen in the market a year ago, according to the Mortgage Bankers Association.

April 9 -

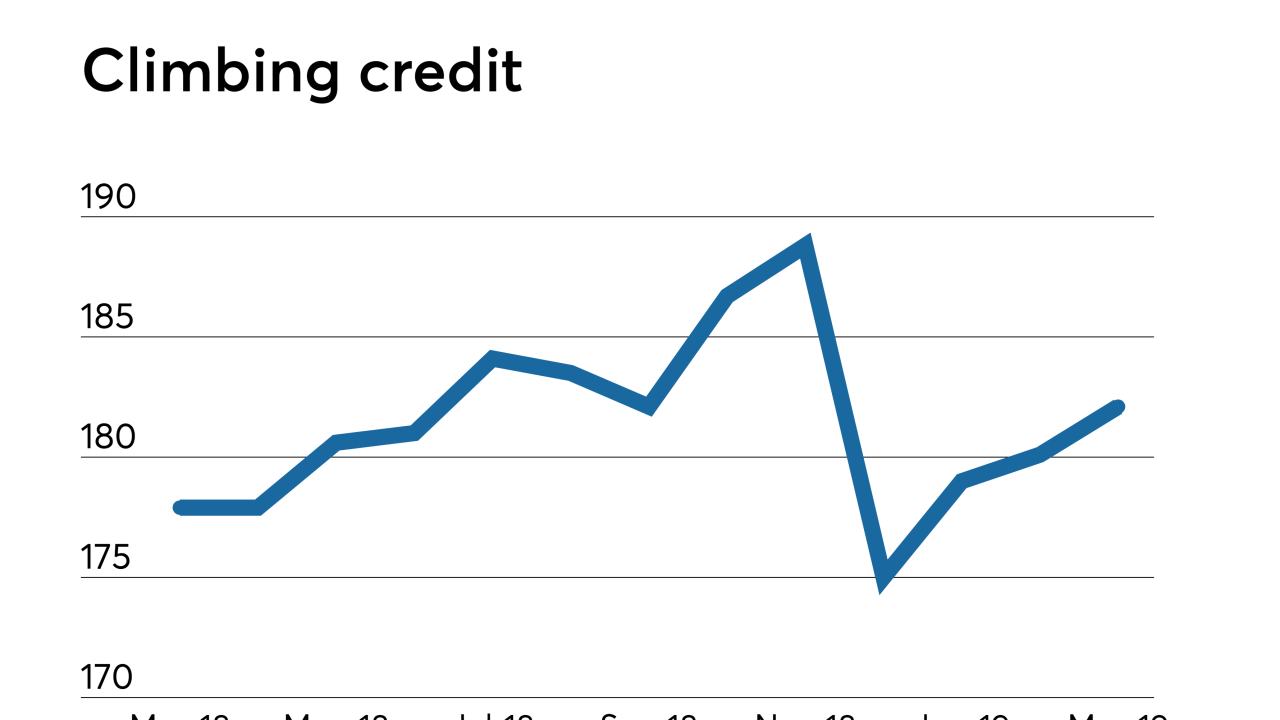

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3