-

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

Mortgage applications decreased 4.3% from one week earlier although concerns over the global economy resulted in falling interest rates, according to the Mortgage Bankers Association.

May 1 -

Military service members are a crucial market segment for lenders because they are younger than other demographics and a steady group of borrowers unfazed by independent economic concerns.

April 30 NewDay USA

NewDay USA -

Customer-facing mortgage technology is not that big of a deal for Top Producers based in the South, even as a growing number of lenders are partnering with fintech firms to create a better user experience.

April 24 -

Purchase mortgage applications, which until now were unaffected by the recent rise in interest rates, fell by 4% on a seasonally adjusted basis from last week, according to the Mortgage Bankers Association.

April 24 -

Higher interest rates cut refinance mortgage application volume and reduced overall activity even as the purchase index reached a nine-year high, according to the Mortgage Bankers Association.

April 17 -

Mortgage application volume fell 5.6% from one week earlier as rising interest rates put an end to the recent surge in refinancings, according to the Mortgage Bankers Association.

April 10 -

Loan applications for newly constructed properties accelerated going into this year's peak home buying season, contrasting with the weakness seen in the market a year ago, according to the Mortgage Bankers Association.

April 9 -

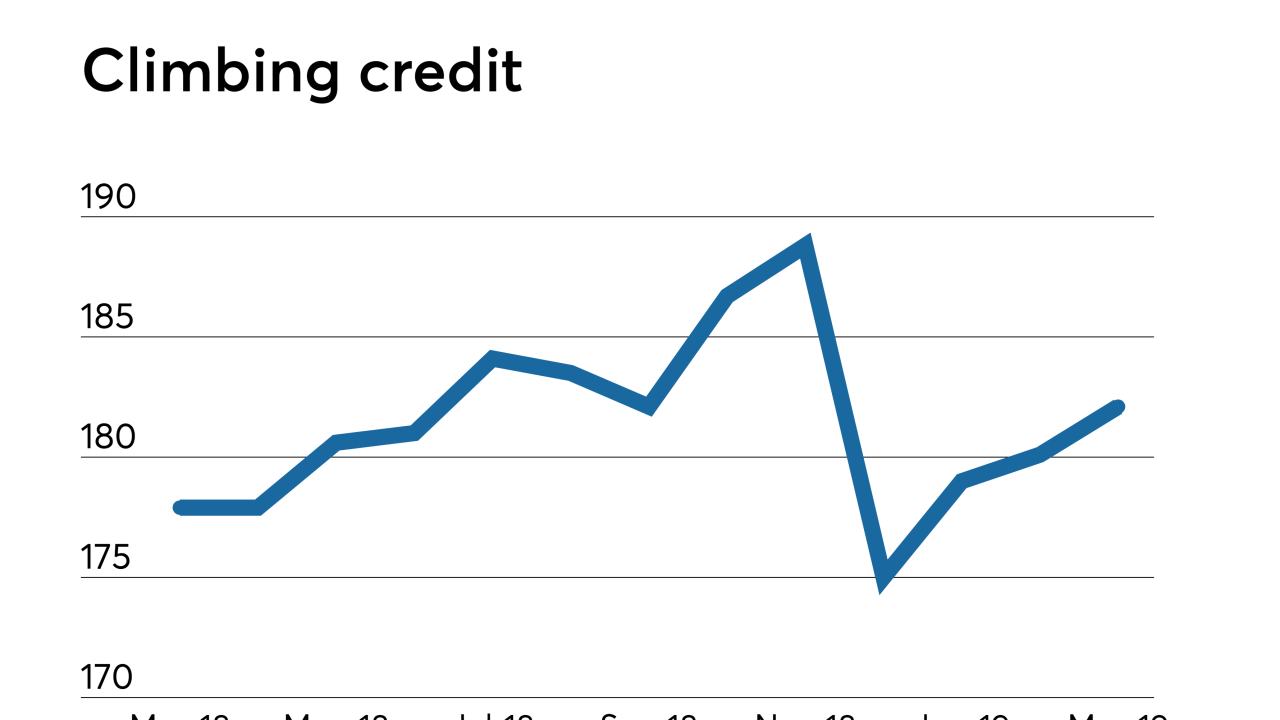

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

With interest rates down, purchase mortgages accounted for the vast majority of millennial homebuyers' loans in February, according to Ellie Mae.

April 3 -

Mortgage refinance applications reached their highest level in three years as interest rates plunged last week in the aftermath of the Federal Open Market Committee's March meeting.

April 3 -

The mortgage industry is stepping up its fight against a bill that would raise the Department of Veterans Affairs' mortgage fees to cover medical costs for Vietnam vets.

April 1 -

There was a huge rise in mortgage refinance application activity due to the large drop in interest rates following last week's Federal Open Market Committee meeting.

March 27 -

Mortgage applications increased last week but unlike the prior period, it was driven by refinance volume as interest rates fell to a one-year low, according to the Mortgage Bankers Association.

March 20 -

New-home mortgage applications are on the rise, incentivizing builders to add housing stock in a market drained of supply and signaling a healthy spring buying season ahead, according to the Mortgage Bankers Association.

March 15 -

Mortgage lenders are optimistic about their business prospects during this spring's home purchase season even with the negative sentiments about demand in the previous three months, Fannie Mae said.

March 13 -

Purchase application volume increased, both week-to-week and year-over-year, as high-end buyers as well as those that need government loans entered the market, according to the Mortgage Bankers Association.

March 13 -

Millennial homebuyers took advantage of a winter lull in interest rates, using the opportunity to refinance their loans, according to Ellie Mae.

March 6 -

Mortgage applications decreased 2.5% from one week earlier, although conventional purchase loan volume and amount is on the rise, according to the Mortgage Bankers Association.

March 6 -

The conventional market recaptured a lot of the first-time homebuyers it lost during the financial crisis, but service members instead have increasingly stuck with loans insured by the Department of Veterans Affairs.

March 1