-

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

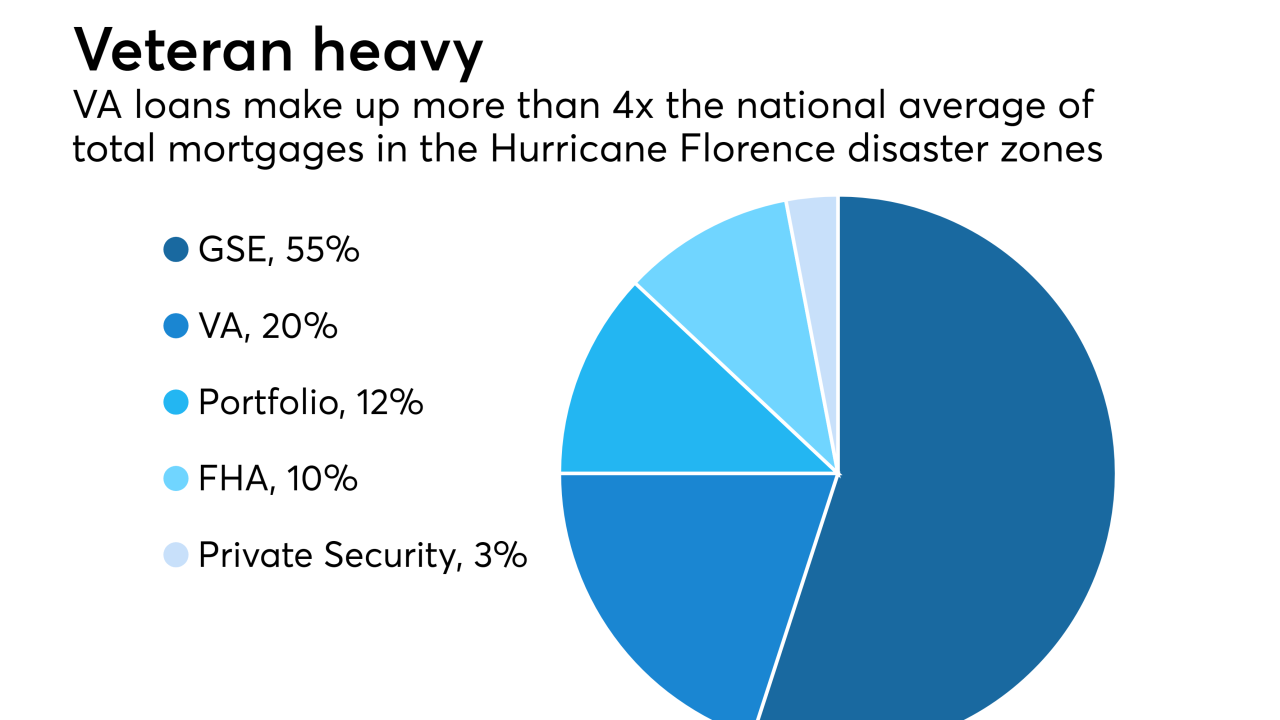

Delinquencies will be on the rise and Veterans Affairs loans have greater density within FEMA-declared disaster zones from Hurricane Florence, according to Black Knight.

October 8 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

August's share of conventional mortgages closed by millennials reached a three-year high as lenders added products to meet their lifestyle, Ellie Mae said.

October 3 -

With customers in Afghanistan and a headquarters in San Antonio, USAA uses digital mortgage tools to craft a consistent experience and reach borrowers around the globe, according to Executive Director of the Mortgage Digital Experience Mark Burrage.

October 2 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

Mortgage applications increased 4.2% from one week earlier, rising for the first time in over a month, according to the Mortgage Bankers Association.

August 22 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15 -

July's new-home sales were at their highest pace since April, leading to a 3.5% year-over-year increase in mortgage applications to purchase recently constructed homes, the Mortgage Bankers Association said.

August 10 -

Mortgage applications declined for the fourth consecutive week as interest rates remained at high levels.

August 8 -

Mortgage applications dropped for the third consecutive week around rising interest rates and languid housing starts.

August 1 -

As regulators move forward with policy changes designed to curb so-called refinance churning of Department of Veterans Affairs-insured mortgages, concerns have surfaced about the fate of loans originated during the transition period.

July 25