-

A lack of new and existing homes for sale led to a drop in purchase and overall mortgage application volume although refinances grew.

July 25 -

Rising median home prices and tight housing inventory led purchase and overall mortgage application volume to fall although refinances rose.

July 18 -

The job market gaining steam year-over-year pushed the purchase and overall mortgage application volume upward despite refinance activity dropping to an 18-year low.

July 11 -

The average millennial borrower credit score remained unchanged in May, but values by city painted very different pictures, according to Ellie Mae.

July 11 -

Volatility in the financial markets, uncertainty with foreign trade and the housing supply deficit caused mortgage applications to drop for the second straight week.

July 5 -

Mortgage applications fell by nearly 5% last week as concerns over foreign trade and tariffs outweighed other positive economic news, according to the Mortgage Bankers Association.

June 27 -

Here's a look at the 12 housing markets where mortgage lenders have to compete the most for borrowers' business.

June 21 -

Mortgage application activity increased 5.1%, rising for the second time in the past three weeks, according to the Mortgage Bankers Association.

June 20 -

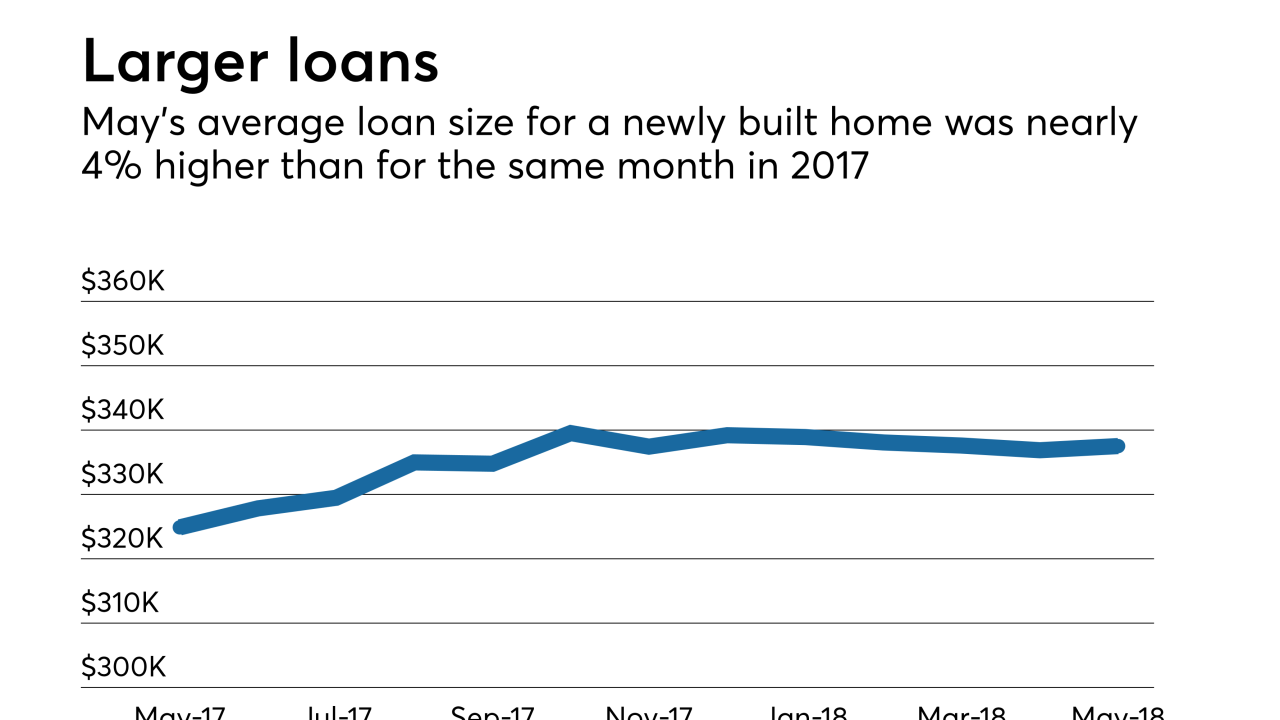

Mortgage applications for newly constructed homes declined in May as sales and supply are not keeping up with demand, the Mortgage Bankers Association said.

June 15 -

Mortgage applications fell 1.5% from the previous week, as rising interest rates ended a brief pickup in activity, the Mortgage Bankers Association reported.

June 13 -

After eight consecutive weeks of decreases, mortgage applications increased by 4.1% last week as key interest rates dropped sharply, according to the Mortgage Bankers Association.

June 6 -

Freedom Mortgage is being punished by a government-owned mortgage guarantor amid concerns that the Mount Laurel, N.J.-based company is helping to enable unnecessary refinances of veterans' loans.

June 4 -

While all cities show signs of healthy mortgage competition nationwide, some areas have higher concentrations of lender activity but also face varying degrees of competitiveness based on loan type, according to LendingTree.

June 1 -

Mortgage applications decreased 2.9%, falling for the eighth consecutive week even as interest rates came down from their recent highs, according to the Mortgage Bankers Association.

May 30 -

Mortgage applications decreased by 2.6%, falling for the seventh straight week as key interest rates jumped to seven-year highs, according to the Mortgage Bankers Association.

May 23 -

The Ginnie Mae 2020 report coming out this summer will reveal the path the agency is taking toward working with digital mortgages, an agency executive said at an industry conference.

May 22 -

Mortgage applications decreased by 2.7% and fell for the sixth straight week as key interest rates fell slightly, according to the Mortgage Bankers Association.

May 16 -

Mortgage applications decreased by 0.4% and were down for the fifth straight week, as key interest rates also fell slightly, according to the Mortgage Bankers Association.

May 9 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at eight key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 8 -

Rising interest rates contributed to a 2.5% decrease in mortgage application activity, which fell for the fourth straight week.

May 2