-

Mortgage borrowers 60 days or more late with their payments declined both quarter-to-quarter and year-over-year, as recession-era defaults work their way out of the system.

February 20 -

As digital mortgage technology helps consumers take a more hands-on approach to the mortgage process, lenders are stepping up their adoption of automation and machine learning through artificial intelligence capabilities.

December 26 -

The long-running slide in mortgage payments 60 or more days past due will continue next year, and perhaps even longer as borrowers benefit from favorable economic conditions.

December 13 -

The 60-day-plus mortgage borrower delinquency rate dropped to the lowest point since the recession suggesting that there is still room to broaden credit.

November 15 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

The forecast for total originations of home equity lines of credit over the next five years is almost twice as high as the five-year total through 2017.

October 24 -

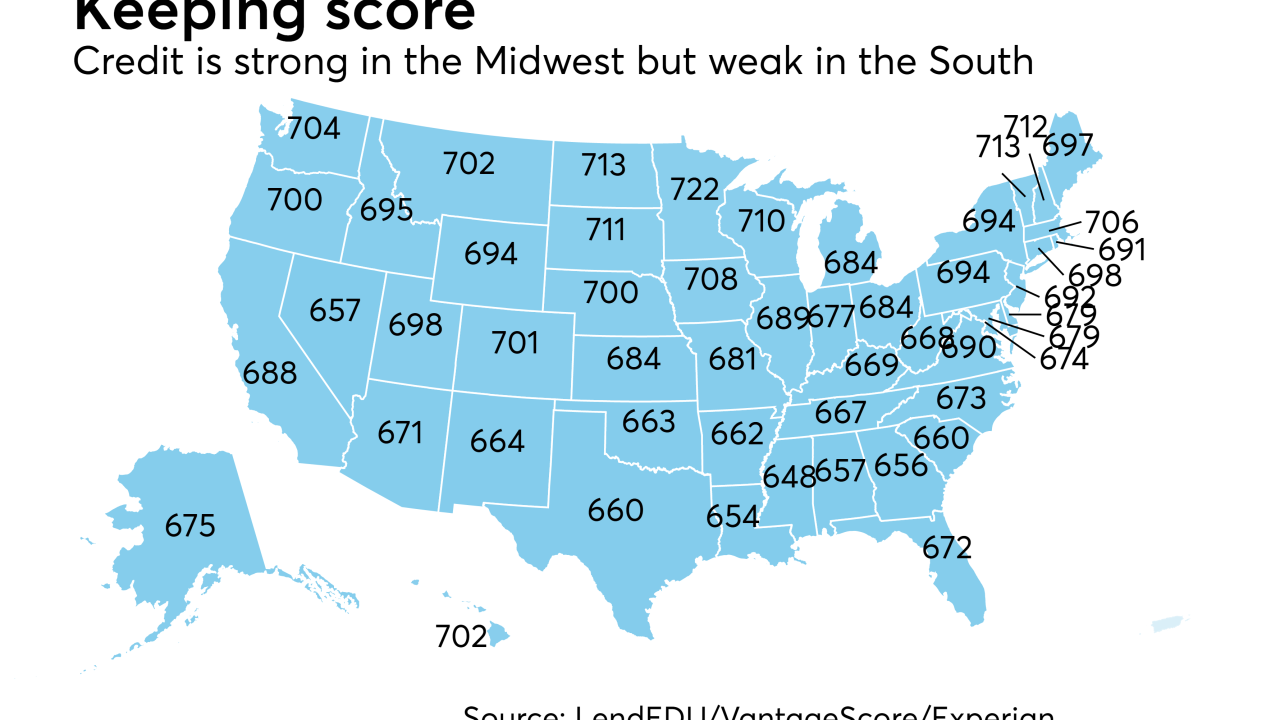

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

The Equifax breach has millions of Americans now thinking about freezing their credit to guard against identity theft. But those who act could be cutting themselves off from the nation's vast credit economy.

September 19 -

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

Millennial credit scores are lower than when Generation X consumers were coming of age, reflecting changes in credit consumption and other consumer behaviors.

August 30 -

Despite rising home prices and a market where many older homeowners are loath to sell, home equity line of credit lending remains muted in all but one corner of the industry: credit unions.

August 14 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

As financial institutions look closer at the increasingly detailed consumer credit data available, they are learning consumers are more apt to pay off personal loans before mortgages, auto loans and credit cards.

May 17