-

Though the pandemic recession has driven up the delinquency rate on Federal Housing Administration loans, the president's appointees are widely expected to reduce mortgage insurance premiums by at least 25 basis points to make home loans less expensive.

January 28 -

Marcia Fudge told senators that her first priority as secretary would be to assist renters and homeowners struggling financially due to the COVID-19 pandemic.

January 28 -

The president’s executive action looks to assess the impact of the previous administration's alterations to the Affirmatively Furthering Fair Housing and Disparate Impact rules, while reinforcing Biden’s vow to eliminate discriminatory lending practices.

January 27 -

Appointee Jenn Jones spent the last four years as the chief of policy and membership at the National Community Reinvestment Coalition, an organization fighting housing and lending discrimination.

January 21 -

Fudge, who has served in the House since 2008, represents most of the majority-Black areas of Cleveland as well as part of Akron.

December 8 -

The teams include people who previously worked for the Treasury and the Federal Housing Finance Agency as well as HUD.

November 13 -

The Assistant Secretary for Housing and Federal Housing Commissioner at the Department of Housing and Urban Development says HUD is removing regulatory barriers to the proliferation of manufactured housing.

October 29 Department of Housing and Urban Development

Department of Housing and Urban Development -

If the underwriters' option is exercised, proceeds will bring in $112 million instead of a possible $176 million.

October 22 -

HUD Deputy Secretary Brian Montgomery questioned "whether we could ever totally accept desktop-only appraisals" at the Mortgage Bankers Association conference this week.

October 21 -

The bar to prove discriminatory patterns is so high that plaintiffs would have slim odds of winning lawsuits against housing providers.

October 2 George Washington University

George Washington University -

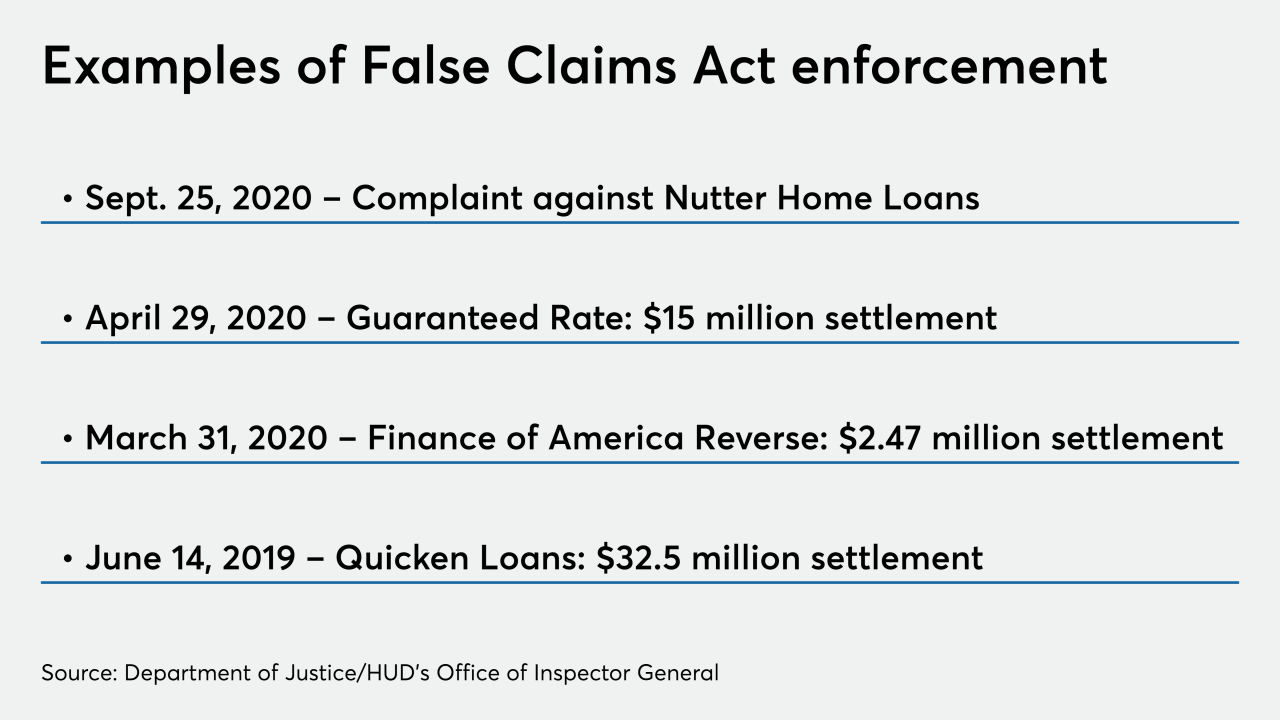

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

Twelve people were charged in a scheme regarding the creation of 100 fraudulent mortgages in Georgia, according to the HUD inspector general.

September 24 -

The final version of the amended rule, like the original proposal, makes fair lending claims tougher to prove; but it does soften language that otherwise might have allowed mortgage companies to use algorithms to prove nondiscrimination.

September 9 -

Individuals who received a coronavirus stimulus check earlier this year also qualify for the protection, as do couples who jointly file their taxes and expect to earn less than $198,000.

September 1 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 17 -

The proprietors of the Lorraine Hotel in downtown Toledo have received multi-year prison sentences from a federal judge for orchestrating a $3.9 million fraudulent real-estate investment scheme, while a third person received probation.

August 12 -

While Black homeownership just rose to its highest level in 16 years, it's still the lowest of any racial demographic and 29 percentage points behind white people.

August 6 -

Black homeownership grew for the fourth quarter in a row, hitting its largest percentage since 2004 despite disproportionate impacts of the coronavirus.

July 29 -

The housing agency's prior permanent chief, Brian Montgomery, left the position after he was tapped to become deputy HUD secretary.

July 28 -

The Trump administration's executive order to terminate and replace federal enforcement of anti-discrimination policies at the local level, citing the burden it put on municipalities, enraged advocates of equitable housing practices.

July 23

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/7956e80/2147483647/strip/true/crop/3462x1947+0+223/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)