-

Mortgage rates slipped this week as the coronavirus keeps affecting the overall U.S. economy, according to Freddie Mac.

April 16 -

In the Philadelphia metropolitan area, new listings are down almost 43% from March 1 to April 5, when the number of new listings typically grows by roughly 52%, according to Zillow.

April 15 -

Mortgage rates remained flat from last week, but are expected to fall further as they continue to lag changes in 10-year Treasury yields, according to Freddie Mac.

April 9 -

Mortgage rates dropped for the second consecutive week, falling 17 basis points, but that is not attracting homebuyers back into an uncertain market, according to Freddie Mac.

April 2 -

The actions taken by the Federal Reserve to calm the financial markets was key to the drop in mortgage rates this week, according to Freddie Mac.

March 26 -

With ambiguity surrounding the length of the COVID-19 outbreak and damage it will cause, consumers are becoming diffident in taking out a mortgage for a major purchase, according to Zillow.

March 25 -

For Central Texas' long-sizzling housing market, 2020 is the year the unexpected catastrophic global event — the typical caveat in the region's otherwise ongoing rosy market forecasts — has actually come calling.

March 20 -

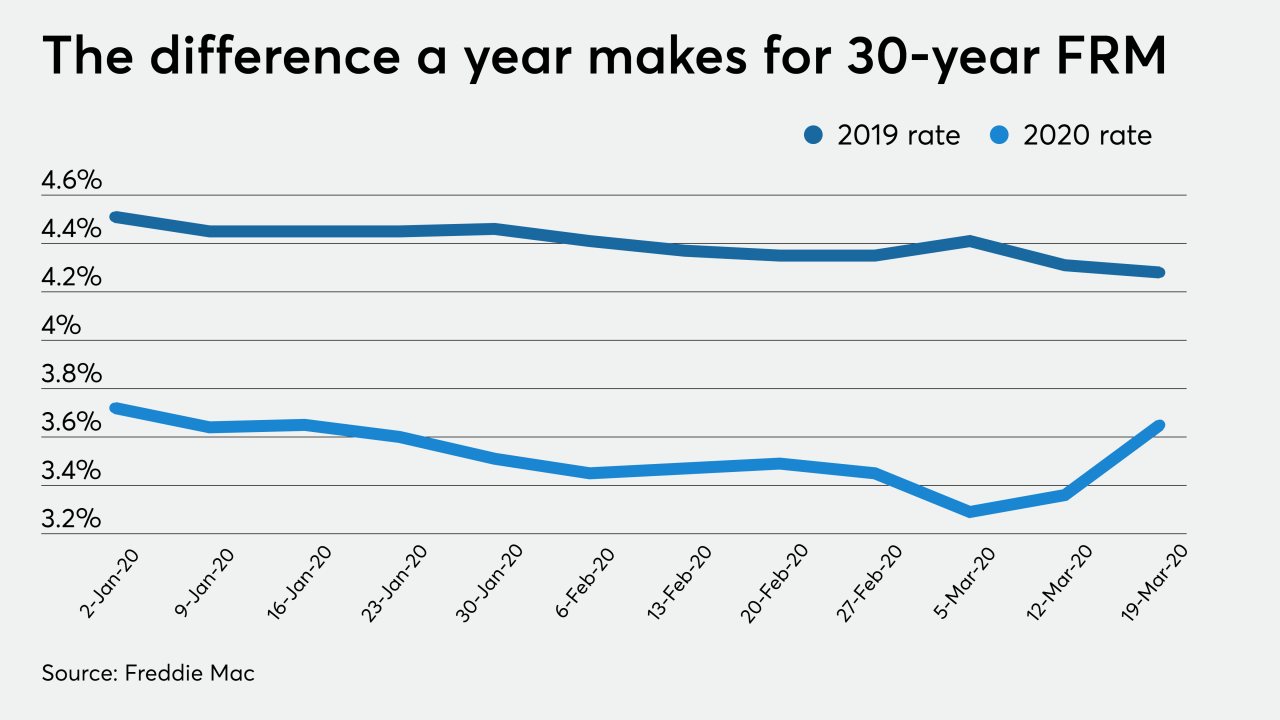

Mortgage rates rose sharply this week as originators looked to manage the overwhelming demand from consumers, according to Freddie Mac.

March 19 -

Paradoxically, mortgage rates actually increased this past week, even as the 10-year Treasury yield plumbed new depths, likely because lenders are too busy to handle the influx of applications.

March 12 -

To help the housing crunch, a growing consensus of economists believe adding homes on lots where one already exists would benefit affordability and incrementally boost supply, according to Zillow.

March 9 -

Mortgage rates hit their lowest point since Freddie Mac began tracking this data in 1971, as the 10-year Treasury yield fell below 1% after the Federal Open Market Committee's surprise short-term rate cut.

March 5 -

Mortgage rates slipped this week, as the stock market sell-off resulted in investors moving into bonds which drove the 10-year Treasury yield down, according to Freddie Mac.

February 27 -

Southern California home prices shot up in January from a year earlier, as buyers fought over a meager supply of homes for sale across the six-county region.

February 25 -

With inventory tight, roughly 80% of housing markets had purchase bidding competition in January and value appreciation is expected to increase in the coming months.

February 24 -

You could easily drive through this leafy Silicon Valley suburb without realizing you were in America's richest neighborhood. From the road, it's all high brick walls and opaque gates.

February 20 -

Even with the small increase in mortgage rates this past week, the home purchase market stayed active and should remain so for the peak buying season.

February 20 -

Mortgage rates ticked up slightly, marking the first increase in four weeks, but they remain at levels which encourage borrowers to refinance, according to Freddie Mac.

February 13 -

Mortgage rates continued their slide this week, which along with positive economic news should continue to pump up purchase demand, according to Freddie Mac.

February 6 -

Home prices were up 3.9% annually in the San Diego metropolitan area in November, outpacing all other West Coast markets, the S&P CoreLogic Case-Shiller Indices reported.

February 3 -

After a months-long slump in Bay Area home prices, the market appears poised to drive higher as buyers act on low interest rates and fight for scarce inventory.

January 31