-

Acting Consumer Financial Protection Bureau Director Mick Mulvaney proposed dramatic curbs to his agency's power in a report Monday, including a recommendation that all CFPB rules must be approved by Congress.

April 2 -

The new request for information is the 10th in the series that is part of acting Director Mick Mulvaney’s “call for evidence” to assess the CFPB’s overall effectiveness.

March 28 -

After several years of preparation, Fannie Mae and Freddie Mac will start issuing a new, common mortgage-backed security starting June 3, 2019, the Federal Housing Finance Agency said Wednesday.

March 28 -

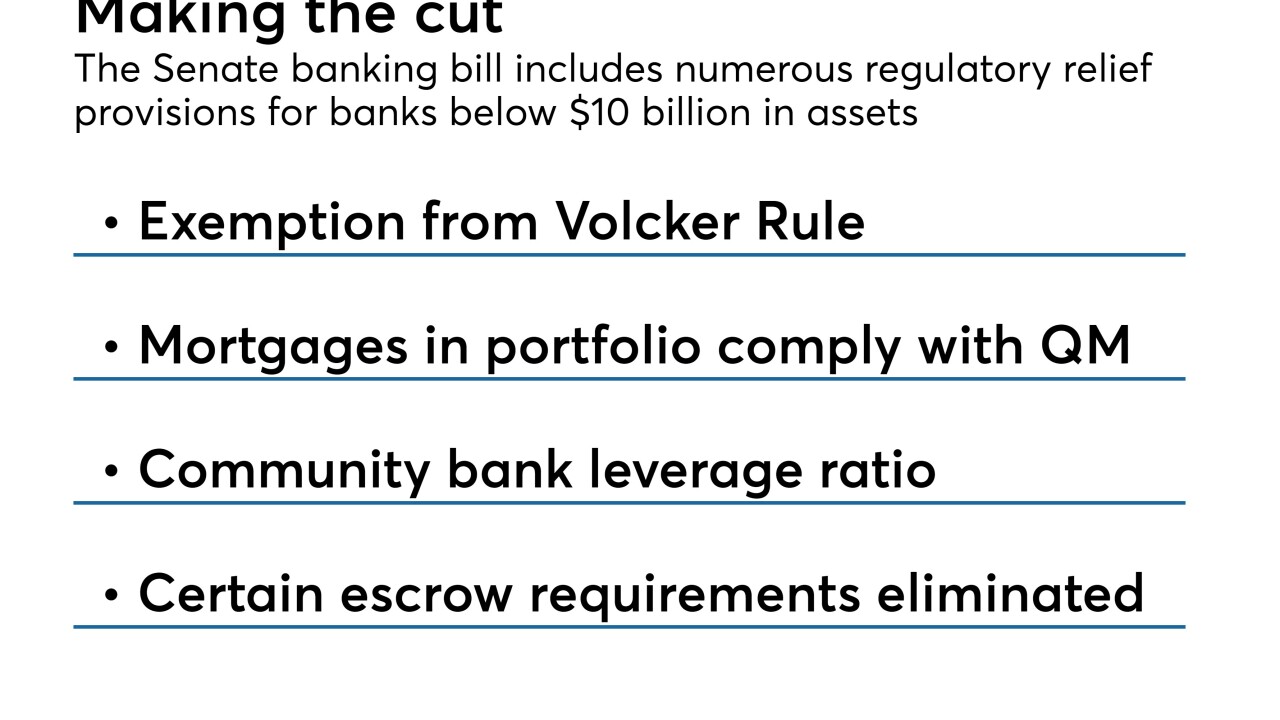

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

March 26 -

Senate Democrats accused Housing and Urban Development Secretary Ben Carson and his agency of failing to enforce fair housing laws.

March 22 -

The information collection effort is consistent with acting CFPB Director Mick Mulvaney's efforts to set the agency on a more pro-industry, anti-enforcement course.

March 22 -

While regulatory relief legislation would raise the asset threshold for “systemically important” banks, Federal Reserve Chairman Jerome Powell said the central bank could still apply prudential scrutiny to banks below that new cutoff.

March 21 -

In the joint report with the Federal Trade Commission on debt collection practices, the CFPB said it had initiated four enforcement actions last year, had resolved one case and has five others pending.

March 21 -

HUD Secretary Ben Carson told lawmakers that overly rigid False Claims Act enforcement had forced lenders to suffer financially for what were just minor errors, but that lenders' fears of being sued were dissipating.

March 20 -

Housing and Urban Development Secretary Ben Carson said he wasn't trying to mislead the public when an agency spokesman initially denied that he and his family were involved in a controversial decision to buy a $31,000 dining room set for his office.

March 20 -

Critics of the Consumer Financial Protection Bureau have long sought to convert its leadership structure from a single director to a five-member commission. Here’s why the idea is dead on arrival.

March 20 -

The House Financial Services Committee chairman's effort to make changes to a Dodd-Frank revision bill could either give him a defining victory or extend his losing streak.

March 19 -

A day after the Senate passed regulatory relief, top House Republicans vowed to have a big say in the final version before the bill heads to the White House. That raised fresh questions about how quickly the Dodd-Frank reforms will become law.

March 15 -

With the Senate finishing its work on a regulatory relief package, a showdown in the House still looms while critics of Dodd-Frank weigh whether this is their last shot at unwinding it.

March 14 -

Sen. Elizabeth Warren, D-Mass., introduced a bill to create a permanent law enforcement unit to investigate criminal activity at large banks, just as the Senate was close to passing a regulatory relief package.

March 14 -

As Congress moves quickly toward passing regulatory relief legislation, another financial services policy goal — long-term reform of the National Flood Insurance Program — remains stalled.

March 14 -

There's too much momentum and too little debt for rising interest rates to derail the U.S. economic expansion or drive up the cost of home ownership.

March 14 -

Lawmakers on Tuesday continued debating a thicket of proposed additions to a crucial regulatory relief bill on their way to a final vote likely to occur as early as midweek.

March 13 -

The eventual pick will likely encounter heavy scrutiny from senators and, if confirmed, would take the helm of an agency still defined by turmoil nearly seven years after its creation.

March 12 -

Regulators are working intently on a proposal to reform how they apply the Community Reinvestment Act after previous attempts to modernize CRA policy drew mixed reviews.

March 9