-

Comptroller of the Currency Joseph Otting said in a press conference Wednesday morning that there is a place in the banking world for some kind of fintech charter, though the exact parameters of such a charter are still unclear and have to be worked out.

December 20 -

The Consumer Financial Protection Bureau on Tuesday withdrew a

plan to conduct a web survey for its debt collection proposal while acting Director Mick Mulvaney reviews the rulemaking.December 19 -

The executive tasked with reshaping Wells Fargo's embattled retail banking unit will now also be responsible for mortgage, auto and student lending.

December 18 -

The U.S. Chamber of Commerce said Monday that an attempt to oust Mick Mulvaney as acting director of the Consumer Financial Protection Bureau would raise "grave questions" about the constitutionality of the consumer agency.

December 18 -

When the acting director of the Consumer Financial Protection Bureau announced plans to bring aboard political appointees, many viewed it as antithetical to an independent regulator. But technically there is nothing stopping him.

December 15 -

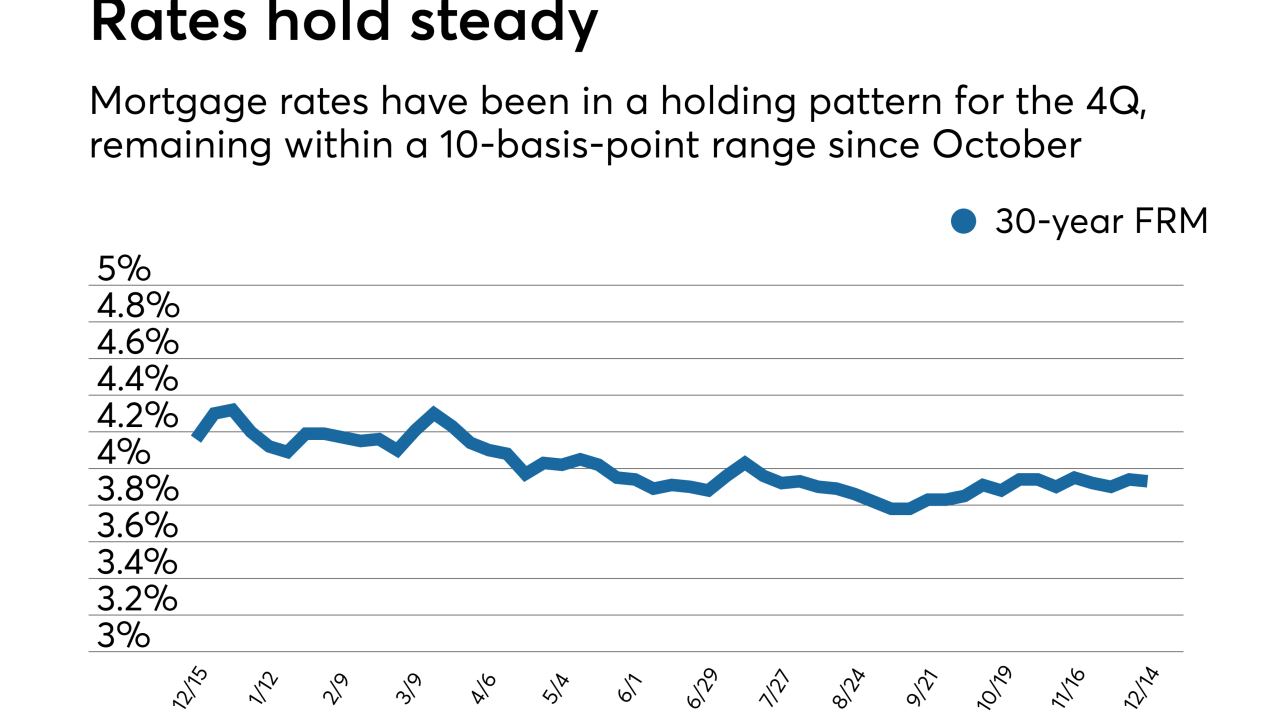

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

The Community Home Lenders Association wants Mick Mulvaney, the acting director of the CFPB, to delay implementation of the Home Mortgage Disclosure Act that goes into effect on Jan. 1.

December 13 -

The Obama administration had tried to ease restrictions on the Federal Housing Administration's condominium program, but the agency under President Trump is seen as moving more aggressively.

December 13 -

The House Financial Services Committee passed 13 bills (and scrapped a vote on one) Wednesday, including one that would stop Fannie Mae and Freddie Mac from being released by the government and another hailed as helping the underbanked in rural areas.

December 12 -

Past statements by Office of Management and Budget Director Mick Mulvaney about the Consumer Financial Protection Bureau should disqualify him from leading the agency, according to New York Attorney General Eric T. Schneiderman and 16 other state AGs.

December 12 -

Over 30 current and former Democratic lawmakers filed a new amicus brief Monday supporting Consumer Financial Protection Bureau Deputy Director Leandra English to be reinstated as acting director of the agency.

December 11 -

Homeowners are still paying very high insurance premiums for the life of their Federal Housing Administration loans to subsidize the operations of the HECM program.

December 8 Potomac Partners

Potomac Partners -

Advocacy groups filed an amicus brief supporting Leandra English’s suit to head the Consumer Financial Protection Bureau, arguing that President Trump's interim pick of Mick Mulvaney was illegal.

December 8 -

Until recently, there was a consensus among policymakers that Fannie Mae and Freddie Mac needed to be eliminated. That just changed. Here's why.

December 8 -

The ban on financing properties encumbered by heating and cooling assessments will go into effect in 20 days, according to the Federal Housing Administration.

December 7 -

House Financial Services Committee Jeb Hensarling shifted tactics on housing finance reform Wednesday, acknowledging that a bill he’s pushed for years to virtually eliminate the government’s role in the mortgage market lacks the support to become law.

December 6 -

The Senate Banking Committee's passage of a regulatory relief bill is fueling optimism about its advancement, but it still must clear a series of legislative hurdles before becoming law.

December 6 -

The agency has suffered a series of setbacks over the past two months, from a rollback of its arbitration rule to a legal battle over its leadership. Here's what happened — and where the agency might lose next.

December 6 -

The Office of the Comptroller of the Currency is eliminating a plan designed to ensure its examiners did not get too close to the big banks they supervise.

December 6 -

Critics argue that the consumer bureau's independence is being undermined, and they worry that a precedent is being established that could hamper the autonomy of other U.S. financial regulators.

December 5