-

The Supreme Court may be closer to examining a key restraint on a president's ability to change CFPB leadership.

September 12 -

Paul Manafort, the disgraced former campaign chairman for President Trump, is seeking dismissal of a mortgage fraud case against him in New York because he was already tried on similar charges in federal court.

September 5 -

From consumers straying from certain cities to regulations dictating how homes are built, here’s a look at how climate change is shaping the housing market.

August 29 -

The Mortgage Industry Standards Maintenance Organization is working with stakeholders to come up with a common means of handling new tax transcript authorization requirements in the Taxpayers First Act.

August 19 -

Yields on the 10-year Treasury note fell 11 basis points on the morning of Aug. 5 as the trade dispute between the U.S. and China escalated.

August 5 -

The Federal Reserve reduced short-term rates for the first time in years, and accelerated its plan to stop shrinking the Fed’s balance sheet by rolling maturing mortgage-backed securities into Treasuries.

July 31 -

President Trump has signed the Protecting Affordable Mortgages for Veterans Act, which aims to address concerns that rules around certain VA refinances were impeding those loans' inclusion in secondary market pools.

July 26 -

The president signed an executive order Tuesday establishing a White House council dedicated to examining regulatory barriers to affordable housing.

June 25 -

At a time when costs continue to soar and regulators weigh reforms for Fannie Mae and Freddie Mac, more than half of the Democratic presidential candidates have talked about housing on the campaign trail.

May 22 -

His administration is looking at different alternatives to reform the housing finance system.

May 17 -

As lawmakers discuss reform legislation, the president’s memo calls on agencies to draft both administrative and legislative reform options and deliver their reports “as soon as practicable.”

March 27 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

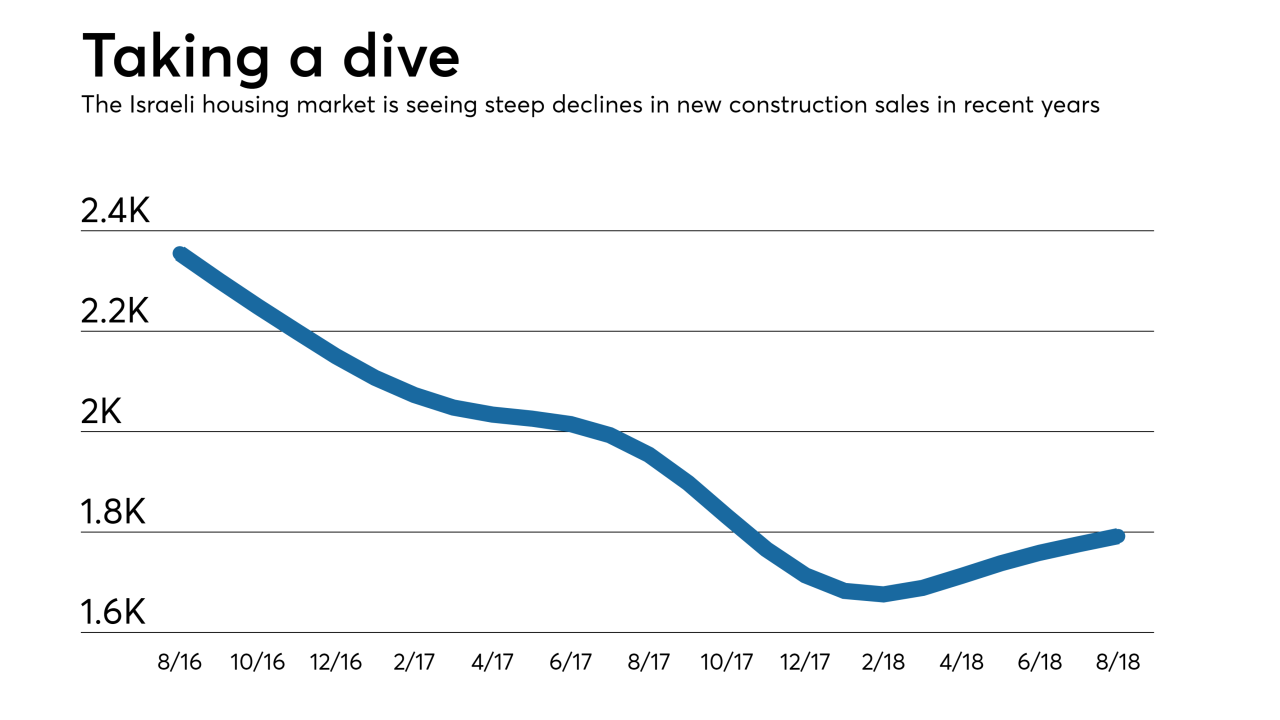

The Department of Housing and Urban Development and the Israeli Ministry of Finance are joining forces through a memorandum of cooperation to explore and share approaches on housing and mortgage finance issues plaguing their nations.

October 22 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

Leandra English, who sued President Trump and Mick Mulvaney last year claiming to be the rightful director of the CFPB, said Friday that she plans to resign and drop the litigation.

July 6 -

It is still a long shot that a rival of Mick Mulvaney's will be able to reclaim the agency's top job, but judges have raised questions over whether Mulvaney can keep the position.

June 26 -

Two South Korean financial firms have bought $100 million of debt on a New Jersey residential building that's part-owned by the family of Jared Kushner.

June 1 -

The industry’s biggest legislative victory in a decade made it to the finish line Thursday.

May 24 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1