-

As lawmakers discuss reform legislation, the president’s memo calls on agencies to draft both administrative and legislative reform options and deliver their reports “as soon as practicable.”

March 27 -

Many federal agencies have been closed for more than three weeks, making it the longest shutdown in U.S. history. With no end in sight, here's how it's affecting banks, credit unions and mortgage lenders.

January 13 -

Acting Ginnie Mae President Michael Bright will leave his post on Jan. 16 and will no longer seek confirmation to be the permanent head of the mortgage secondary market agency.

January 9 -

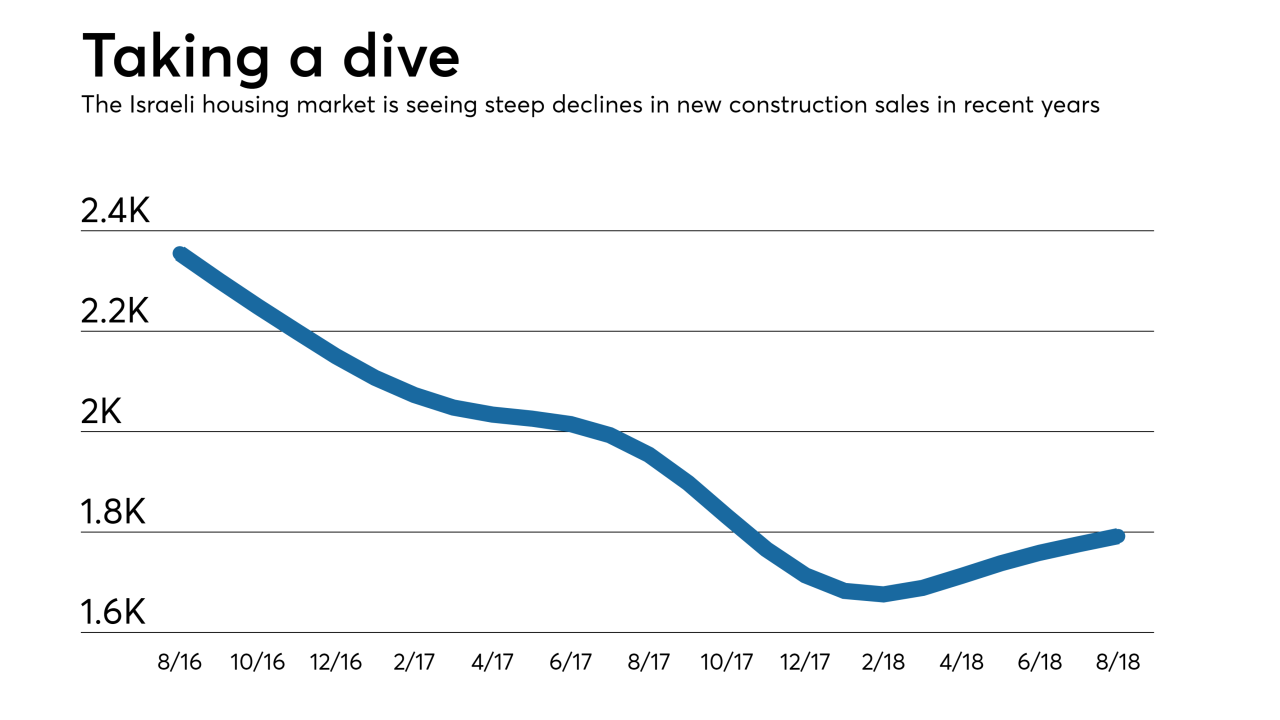

The Department of Housing and Urban Development and the Israeli Ministry of Finance are joining forces through a memorandum of cooperation to explore and share approaches on housing and mortgage finance issues plaguing their nations.

October 22 -

A new court filing suggests that Stephen Calk was named to a 13-member economic advisory team in 2016 in exchange for approving a $9.5 million loan to former campaign manager Paul Manafort.

July 6 -

Leandra English, who sued President Trump and Mick Mulvaney last year claiming to be the rightful director of the CFPB, said Friday that she plans to resign and drop the litigation.

July 6 -

It is still a long shot that a rival of Mick Mulvaney's will be able to reclaim the agency's top job, but judges have raised questions over whether Mulvaney can keep the position.

June 26 -

Two South Korean financial firms have bought $100 million of debt on a New Jersey residential building that's part-owned by the family of Jared Kushner.

June 1 -

The industry’s biggest legislative victory in a decade made it to the finish line Thursday.

May 24 -

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

A panel of judges remained skeptical of claims by Leandra English, deputy director of the Consumer Financial Protection Bureau, that she is the rightful head of the agency. But they didn’t sound convinced that current acting Director Mick Mulvaney is, either.

April 12 -

According to the Reuters report, which cited unnamed sources, acting CFPB Director Mick Mulvaney is seeking a settlement with Wells over claims related to force-placed auto insurance and improper mortgage fees.

April 9 -

As lawmakers consider reforms to the Dodd-Frank Act, fresh data shows a dramatic reduction in new items issued by the regulatory agencies.

April 6 -

Acting CFPB Director Mick Mulvaney dismissed concerns by Sen. Elizabeth Warren, D-Mass., about his leadership of the consumer agency while supporting a lighter regulatory touch for credit unions.

February 27 -

Credit union executives talked up a pending regulatory relief effort while endorsing a radical shift in direction by the Consumer Financial Protection Bureau during a meeting with President Trump and other top White House officials on Monday.

February 26 -

The Chicago bank is denying a report that its CEO, Steve Calk, made $16 million in mortgage loans to former Trump campaign chairman Paul Manafort in exchange for a job in the White House.

February 21 -

The busy legislative agenda laid out by President Trump in the State of the Union speech Tuesday night casts doubt on how quickly Congress can move on financial services legislation, particularly a housing finance reform package.

January 31 -

Lower East Side People's Federal Credit Union's case against the appointment of Mick Mulvaney as head of the CFPB turns on whether it has standing to sue.

January 15 -

Sen. Sherrod Brown called on the Trump administration to support the Consumer Financial Protection Bureau's enforcement action against PHH Corp., which agreed to a

$45 million settlement this week related to foreclosure abuses.January 4 -

If acting CFPB Director Mick Mulvaney ultimately prevails in the lawsuit challenging his position, he is expected to continue implementing the most significant changes to the agency in its six-year history.

January 2