-

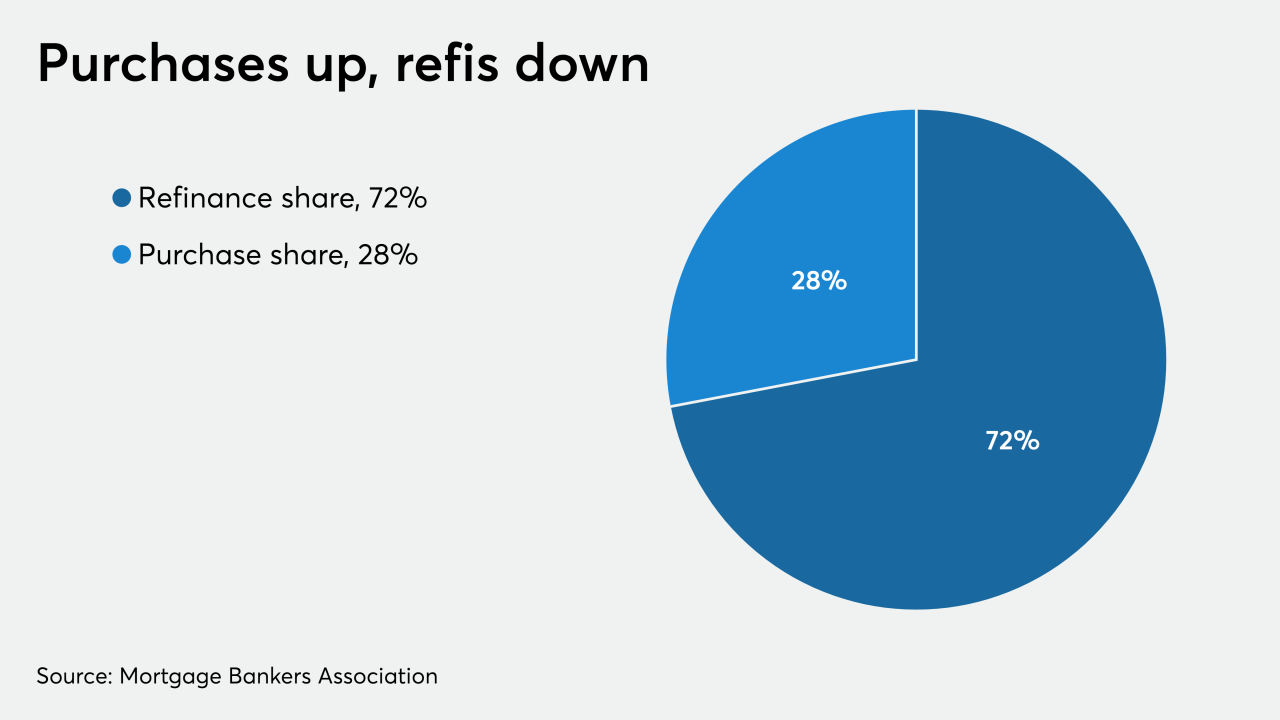

Purchase mortgage activity rose for the third consecutive week, although the total volume was flat compared with the previous seven-day period, according to the Mortgage Bankers Association.

May 6 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Less competition in the marketplace meant customers were less apt to fudge the truth on a loan application.

May 4 -

Even though mortgage application volume decreased from one week earlier, lenders had their best week for purchase business since the coronavirus shutdown began, according to the Mortgage Bankers Association.

April 29 -

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

Low mortgage rates increased new orders, but fallout from the pandemic hurt investment income.

April 23 -

Mortgage fraud risk plummeted in the first quarter of 2020 amid historically low mortgage rates and a boom of refinances, but the coronavirus could create a new set of risks, according to CoreLogic.

April 22 -

Mortgage applications decreased 0.3% from one week earlier, although purchase activity was higher for the first time in six weeks, according to the Mortgage Bankers Association.

April 22 -

The coronavirus outbreak, along with the shift to a lower paying refinance business, will likely limit commission earnings for the rest of 2020.

April 20