-

Mortgage rates continued sliding this week as investors put money into safer assets like bonds, contributing to the 30-year fixed-rate mortgage dropping 9 basis points, according to Freddie Mac.

January 30 -

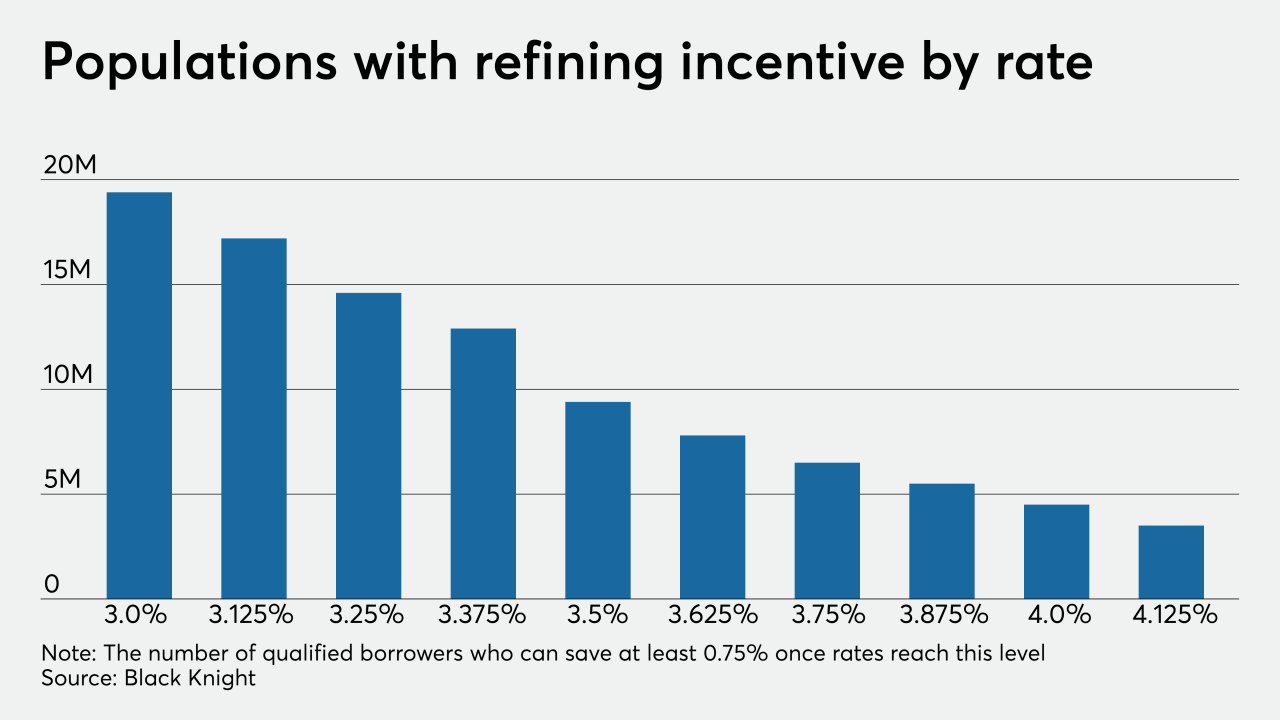

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

Mortgage applications increased 7.2% from one week earlier as consumers reacted to falling interest rates related to news regarding the coronavirus, according to the Mortgage Bankers Association.

January 29 -

Conundrum for lenders: How to overcome top producers' tendency to stay put?

January 29 -

Flasgstar Bancorp's mixed results in its fourth-quarter earnings report are a sign strategic shifts it made to make its earnings less volatile are working.

January 28 -

Lower rates spurred a lot of unexpected mortgage business in 2019 but credit unions need to prepare themselves for what happens once the boom ends.

January 28 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 22 -

Mortgage application activity slowed down this past week from its fast start to 2020, with a decrease of 1.2% from one week earlier, according to the Mortgage Bankers Association.

January 22 -

With interest rates expected to stay low while wages and the overall economy grow in conjunction, Fannie Mae again boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

January 22 -

Mortgage loan officer compensation remained level year-over-year as an unexpected surge in originations surprised employers expecting it to be a down year, an LBA Ware report said.

January 17