-

The number of mortgage borrowers for whom it made sense to refinance declined by nearly half since the end of last year and is at its lowest since November 2008.

May 7 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

Rising interest rates contributed to a 2.5% decrease in mortgage application activity, which fell for the fourth straight week.

May 2 -

While mortgage application defect risk declined overall in March, at the local level it varied considerably, according to First American Financial Corp.'s Loan Application Defect Index.

April 27 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

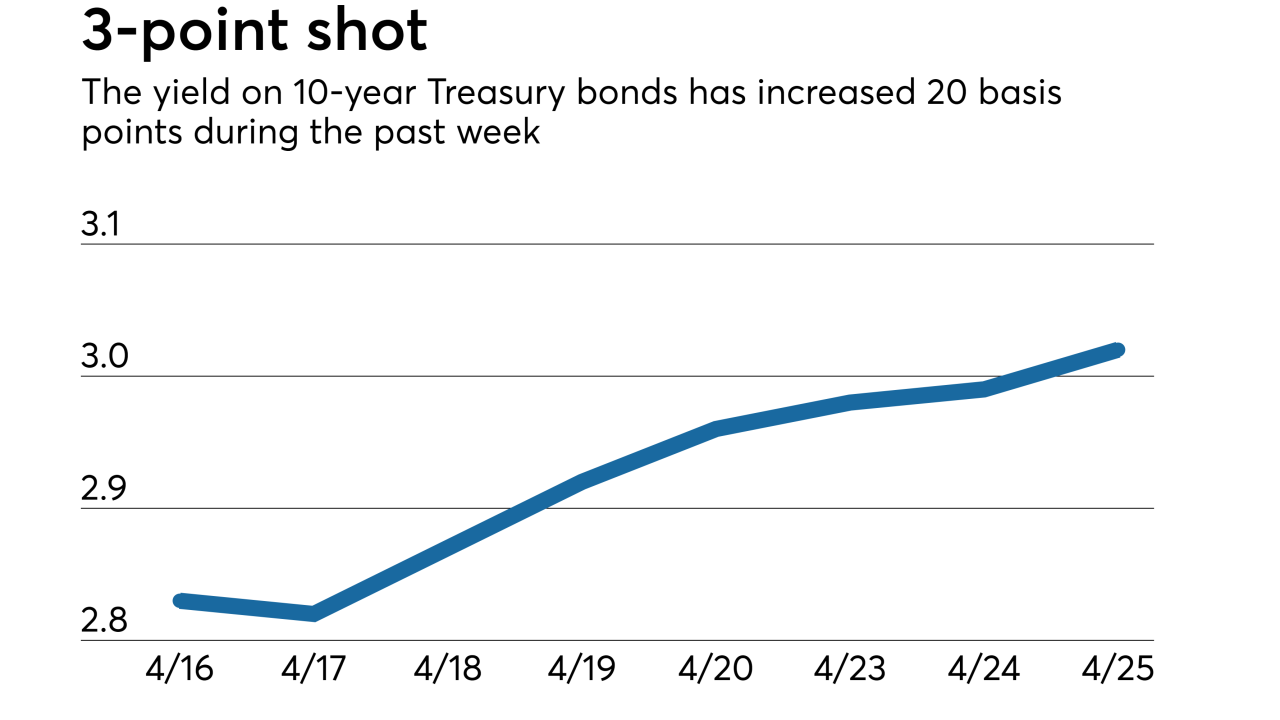

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

Better weather allowed consumers to go shopping for homes and drive the increase in mortgage application volume compared with one week earlier, according to the Mortgage Bankers Association.

April 18 -

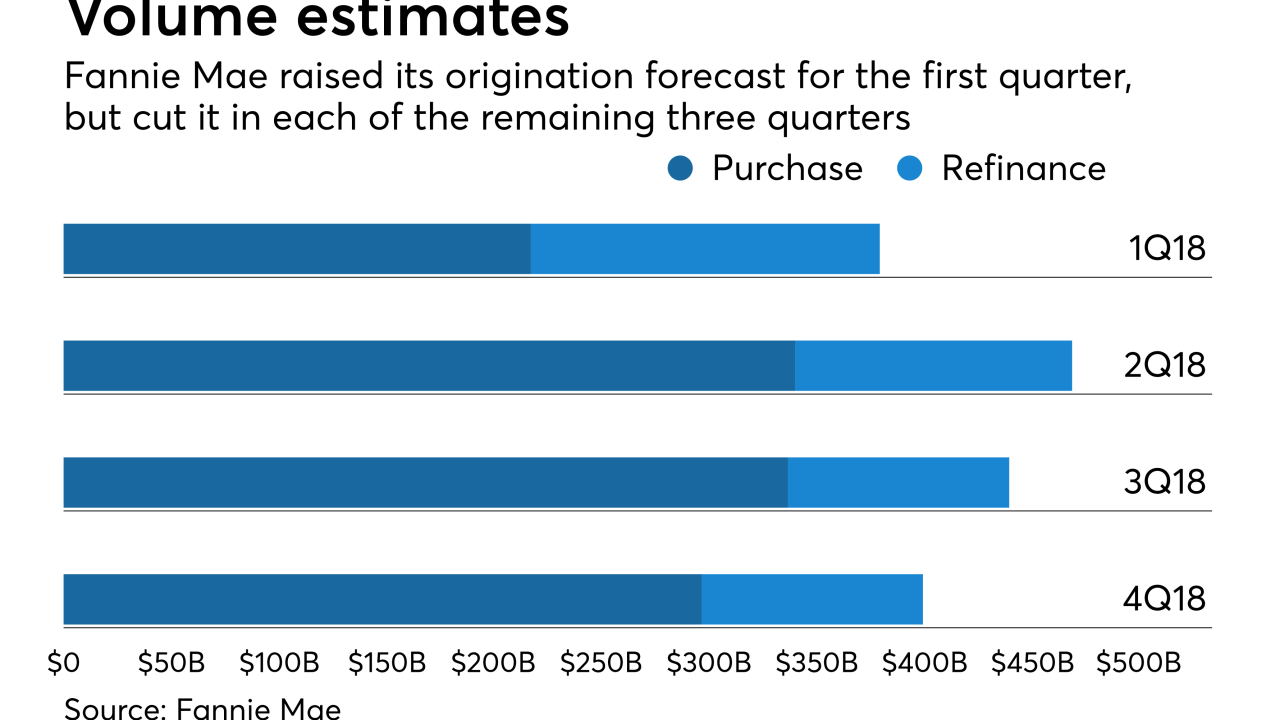

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

April 16 -

Mortgage applications decreased 1.9% from one week earlier as purchase activity was down again, according to the Mortgage Bankers Association.

April 11 -

Mortgage application activity decreased 3.3% from one week earlier as purchase and refinance volume fell prior to the start of the home buying season, according to the Mortgage Bankers Association.

April 4 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

There is now less fraud risk associated with adjustable-rate mortgage applications and this will offset some of the higher hazard associated with a purchase market.

April 2 -

Despite growth in senior-held mortgage debt, home equity for homeowners 62 and older grew to $6.6 trillion in the fourth quarter, according to the National Reverse Mortgage Lenders Association and RiskSpan.

March 28 -

Mortgage applications increased 4.8% from one week earlier and rose for the fourth time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

March 28 -

Independent mortgage banks and mortgage subsidiaries of chartered banks saw production profits tank in the fourth quarter of 2017, according to the Mortgage Bankers Association.

March 23 -

Closing times for refinances have fallen dramatically due to mortgage lenders' increased emphasis on home purchase loans.

March 21 -

The share of mortgage refinance applications dropped to its lowest level in nearly 10 years as interest rates continued to climb.

March 21 -

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

March 19 -

Residential mortgage originations fell 19% year-over-year in the fourth quarter of 2017, due primarily to a large drop in refinance volume, according to Attom Data Solutions.

March 16