-

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

The shift ended a long run of higher rates that have depressed loan application activity, and it temporarily creates a new refinancing incentive for some borrowers.

April 8 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

After two straight months on an upward trajectory, rising interest rates pushed homebuyer demand down to a third of where it stood at the start of 2021, according to Freddie Mac.

April 1 -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

But the 10-year Treasury yield began backing down after the weekend as investors reacted to turmoil in Europe.

March 25 -

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

As more borrowers between 21 and 40 leveraged the historically low mortgage rates in January, the average age rose to a report high, according to ICE Mortgage Technology.

March 10 -

Finance of America Reverse's product combines features of a forward mortgage, like 10 years of payments, with parts of a non-recourse reverse loan.

March 10 -

Mortgage rates surged 40 basis points since the start of the year as the economy improved.

March 10 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

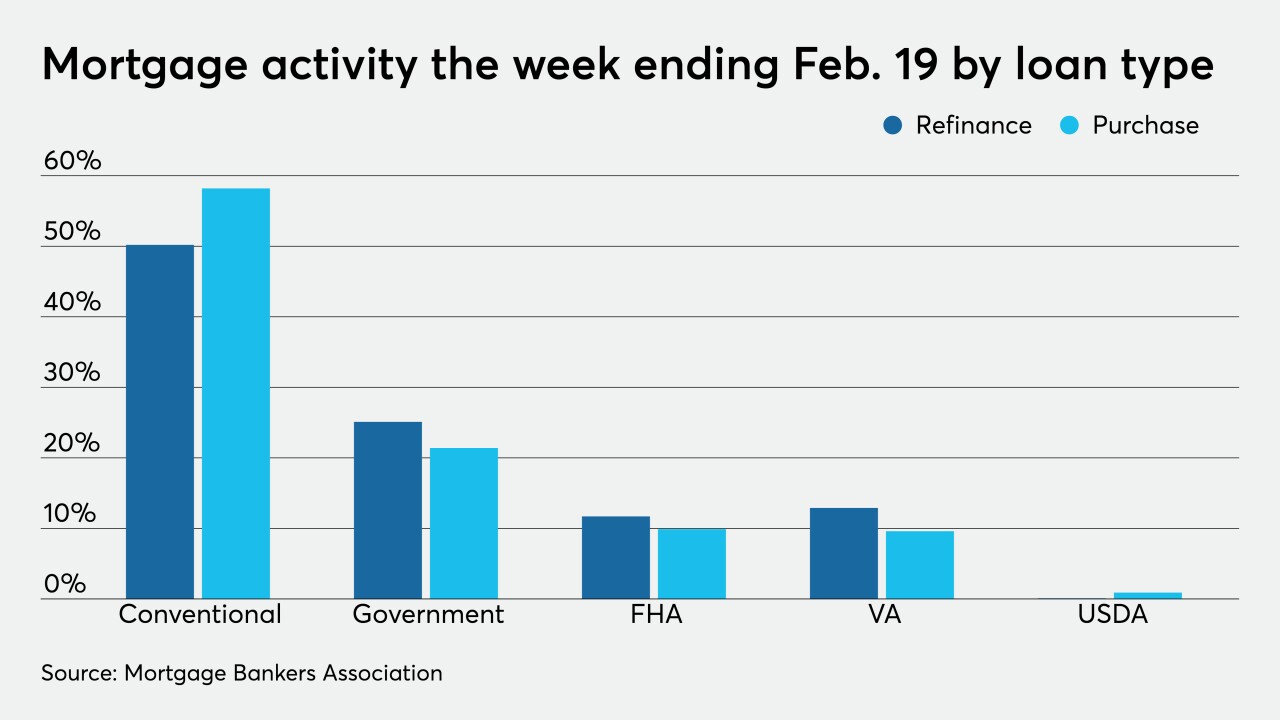

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

Origination volume hit a record high in 2020 as more borrowers tapped the equity in their homes and investors and second-home purchasers flocked to the market at levels unseen since before the Great Recession.

February 17 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12