-

Finance of America Reverse's product combines features of a forward mortgage, like 10 years of payments, with parts of a non-recourse reverse loan.

March 10 -

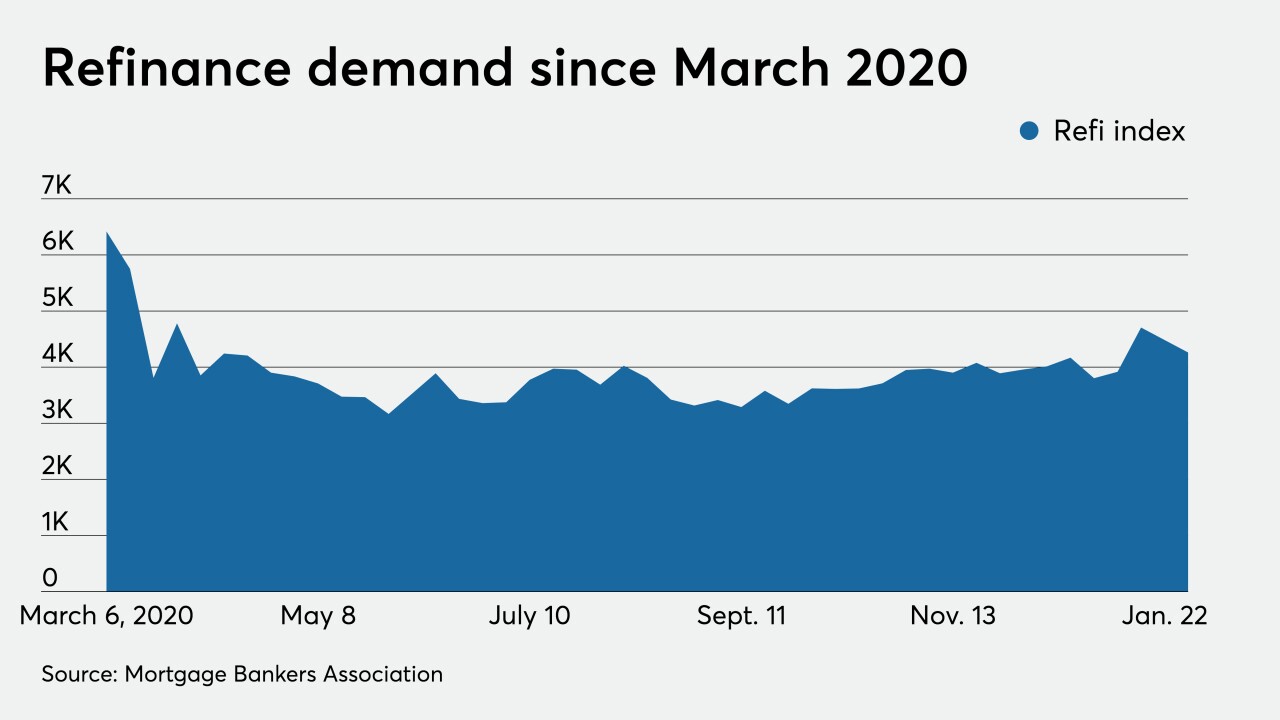

Mortgage rates surged 40 basis points since the start of the year as the economy improved.

March 10 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

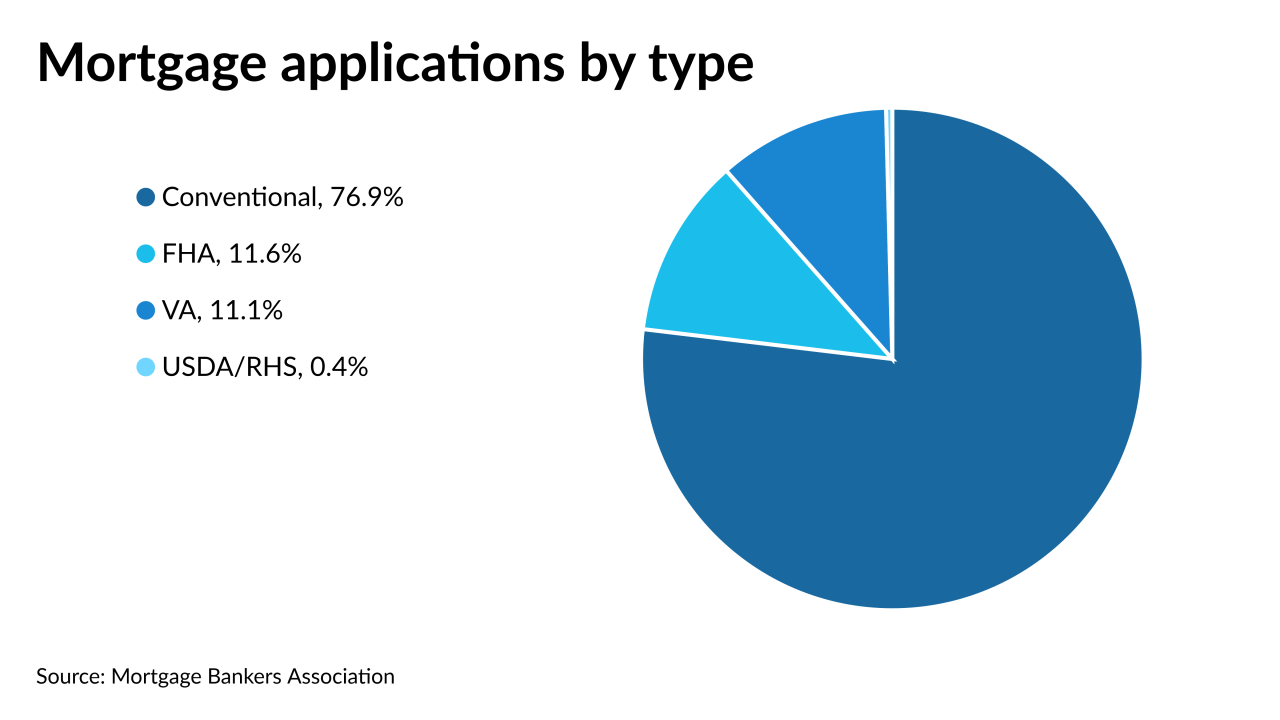

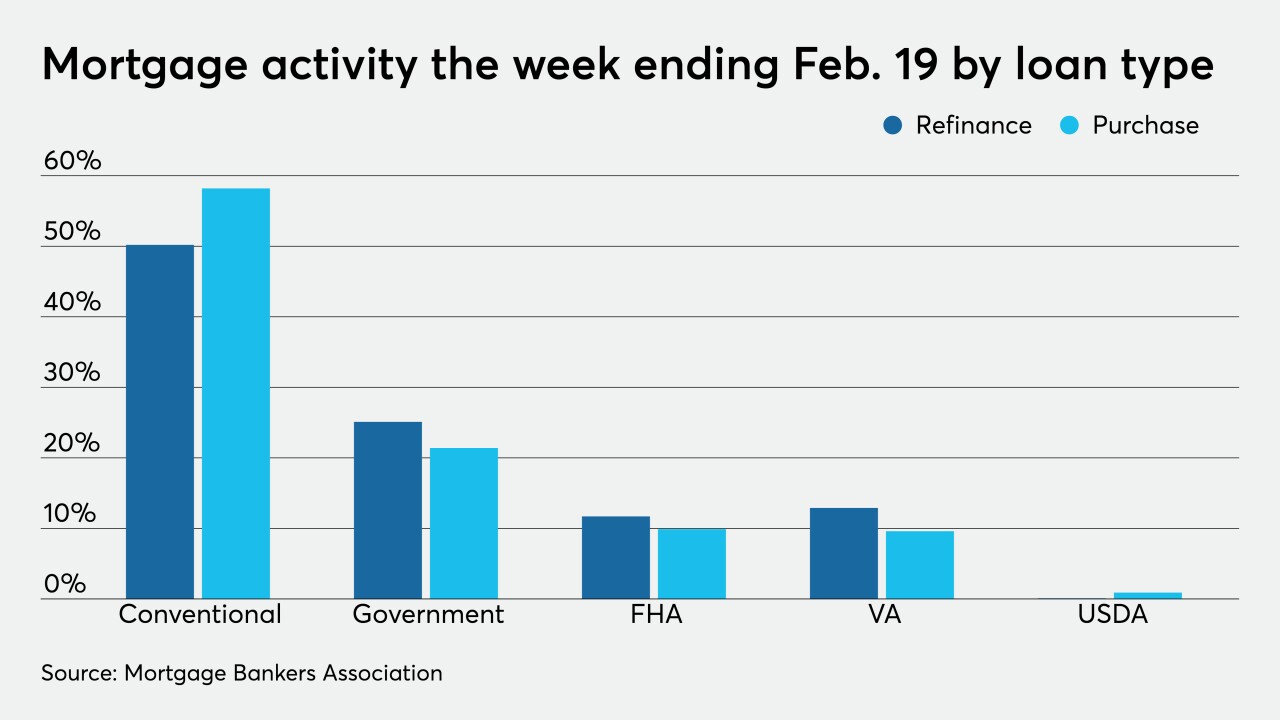

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

Origination volume hit a record high in 2020 as more borrowers tapped the equity in their homes and investors and second-home purchasers flocked to the market at levels unseen since before the Great Recession.

February 17 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

After mortgage rates rose for three weeks, borrowers took advantage of a 3-basis-point dip and sparked a short-term refinancing rally, according to the Mortgage Bankers Association.

February 3 -

With the shift to a low-rate environment dominated by no cash-out refinancing, use of an alternative to traditional valuations has soared.

February 2 -

While financing costs are still low enough to offset sticker-shock from rising home prices, a slight increase in the average 30-year conforming rate weighed on borrowers, according to the Mortgage Bankers Association.

January 27 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

With refinance volumes predicted to fall — but currently continuing apace — lenders explain how they’re readying themselves for eventual contraction and its implications for their expenditures.

January 19 -

Mortgage applications increased 16.7% from one week earlier to their highest level in 10 months, although rates rose in expectation of additional government pandemic relief, according to the Mortgage Bankers Association.

January 13 -

The survey period runs through Feb. 19, so don't dally!

January 8 -

Mortgage applications decreased 4.2% over the final two weeks of 2020, but the strong demand for home buying throughout most of the year should continue, according to the Mortgage Bankers Association.

January 6