-

Two more lenders, AmeriHome and Caliber, look to join Rocket and United Wholesale Mortgage, by raising capital through public stock offerings.

October 2 -

Mortgage applications decreased 4.8% from one week earlier, as refinance activity was down even as average rates fell to a new record low, according to the Mortgage Bankers Association.

September 30 -

The automated closing disclosures software aims to be "40% faster than the 'old fashioned' method," a company spokesman said.

September 30 -

For the majority of borrowers, interest rate research for mortgage refinancing came with unwanted and annoying sales calls, which could ultimately hinder potential business for lenders.

September 28 -

Called it a better all-around process for United Wholesale Mortgage to become a publicly traded company.

September 25 -

Mortgage applications increased 6.8% from one week earlier as this summer's surprise purchase demand has carried over to the fall, according to the Mortgage Bankers Association.

September 23 -

But the group is more conservative than Fannie Mae when it comes to interest rate movements over the next six quarters.

September 22 -

Low rates, along with increased new and existing home sales activity drives the latest forecast.

September 16 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Mortgage applications decreased 2.5% from one week earlier as refinance activity appears to decelerating, according to the Mortgage Bankers Association.

September 16 -

Only 18% of refinance borrowers returned to the same lender in the second quarter, the second lowest rate since 2005.

September 14 -

Even though second-quarter originations were nearly double the same period in 2019, most were refinancings, which generate less revenue for title companies.

September 11 -

The guidelines are somewhat similar to those the Federal Housing Finance Agency established for the government-sponsored enterprise market in response to the high number of loans impacted by coronavirus-related hardships.

September 11 -

From an increased interest in outdoor space to a need for a dedicated home office, the pandemic has created new drivers for refinancing, moving and other housing decisions, TD Bank found.

September 11 -

That, along with continued high refinance volume over the next three months, keeps originators' profit forecasts elevated, Fannie Mae said.

September 11 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

Nearly half of the second-quarter volume came from its existing customers.

September 3 -

Mr. Cooper plans to hire an additional 2,000 employees by the end of this year as record low interest rates spur home purchases and mortgage refinancings.

September 2 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

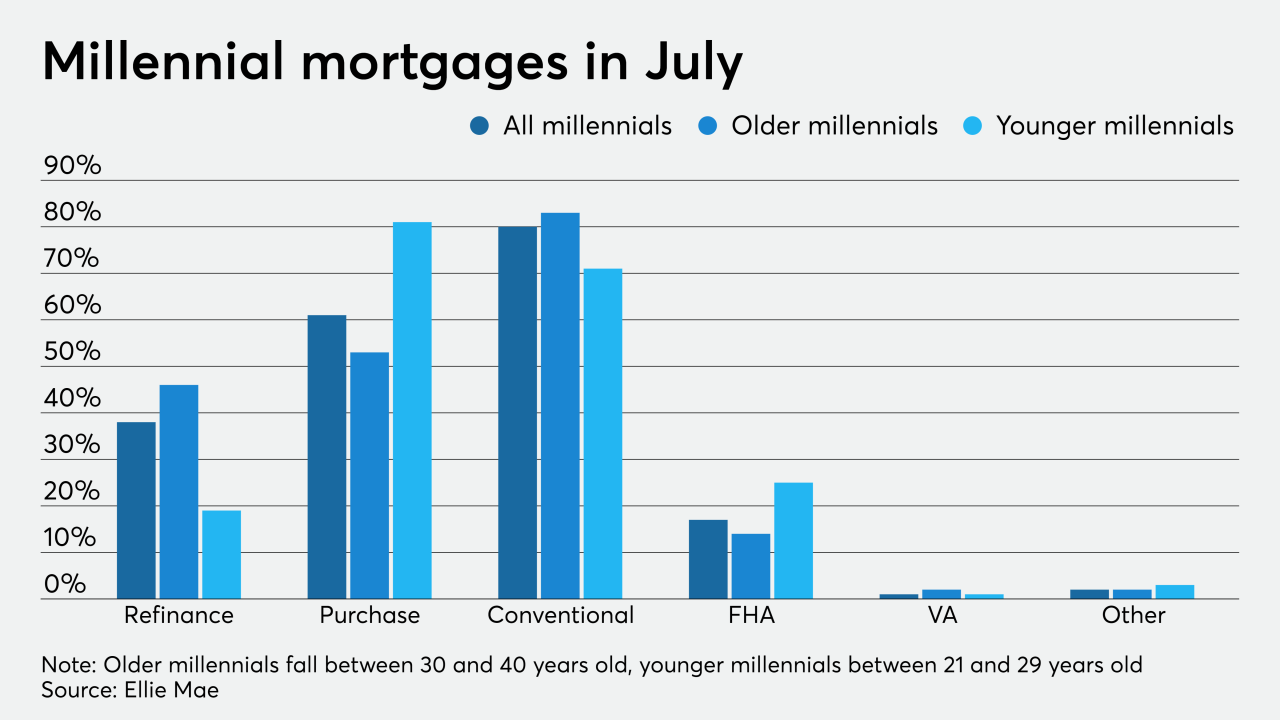

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2