-

That, along with continued high refinance volume over the next three months, keeps originators' profit forecasts elevated, Fannie Mae said.

September 11 -

Mortgage applications increased 2.9% from one week earlier, rising for the first time in nearly a month with home-buying demand remaining unusually strong as summer ends, according to the Mortgage Bankers Association.

September 9 -

Nearly half of the second-quarter volume came from its existing customers.

September 3 -

Mr. Cooper plans to hire an additional 2,000 employees by the end of this year as record low interest rates spur home purchases and mortgage refinancings.

September 2 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

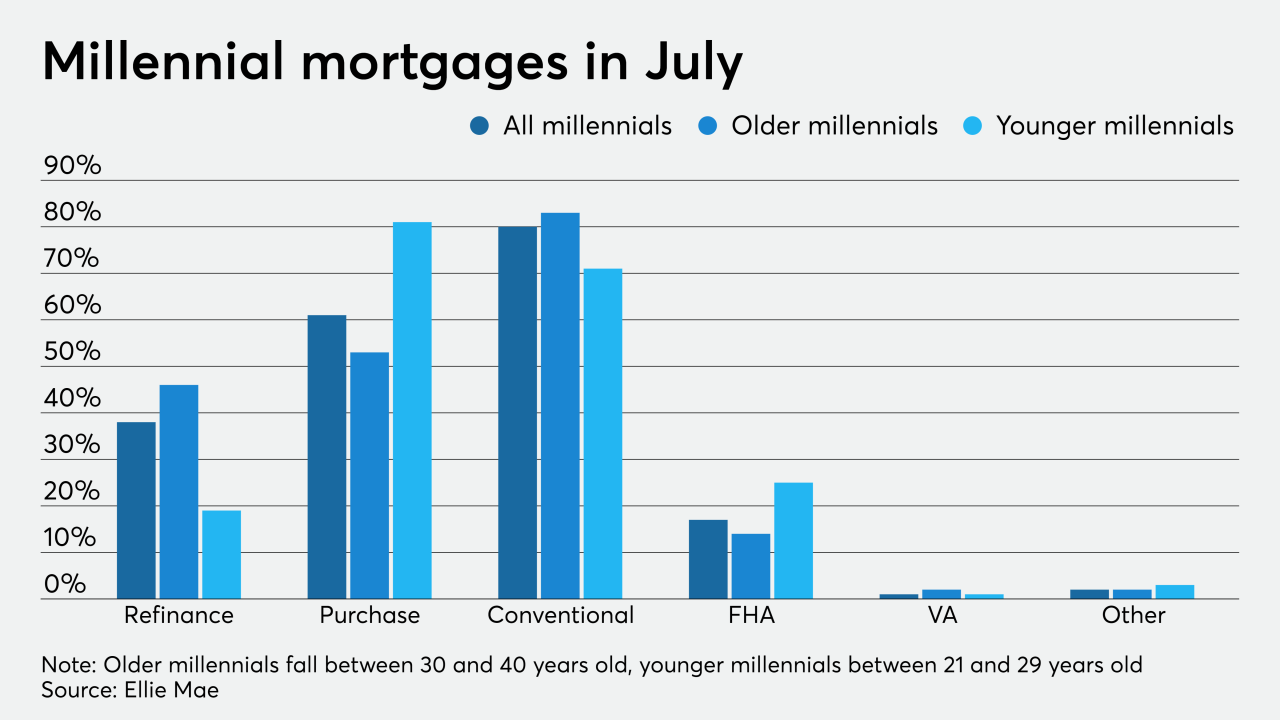

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26