-

Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

September 2 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

Mortgage application volume decreased 6.5%, falling for the second consecutive week with refinance activity at its lowest since early July, according to the Mortgage Bankers Association.

August 26 -

The mortgage giants were criticized earlier this month for a plan to charge an "adverse market fee" to protect against losses resulting from the pandemic.

August 25 -

Lenders initially won't be able to pass on the cost of the Federal Housing Finance Agency's "adverse market fee" to borrowers whose rates on GSE-backed mortgages and refinances are already locked in.

August 20 -

The higher charge on mortgages refinanced through Fannie Mae and Freddie Mac is supposed to cushion against a crisis but could contribute to one as the fees are passed on to struggling consumers.

August 20

-

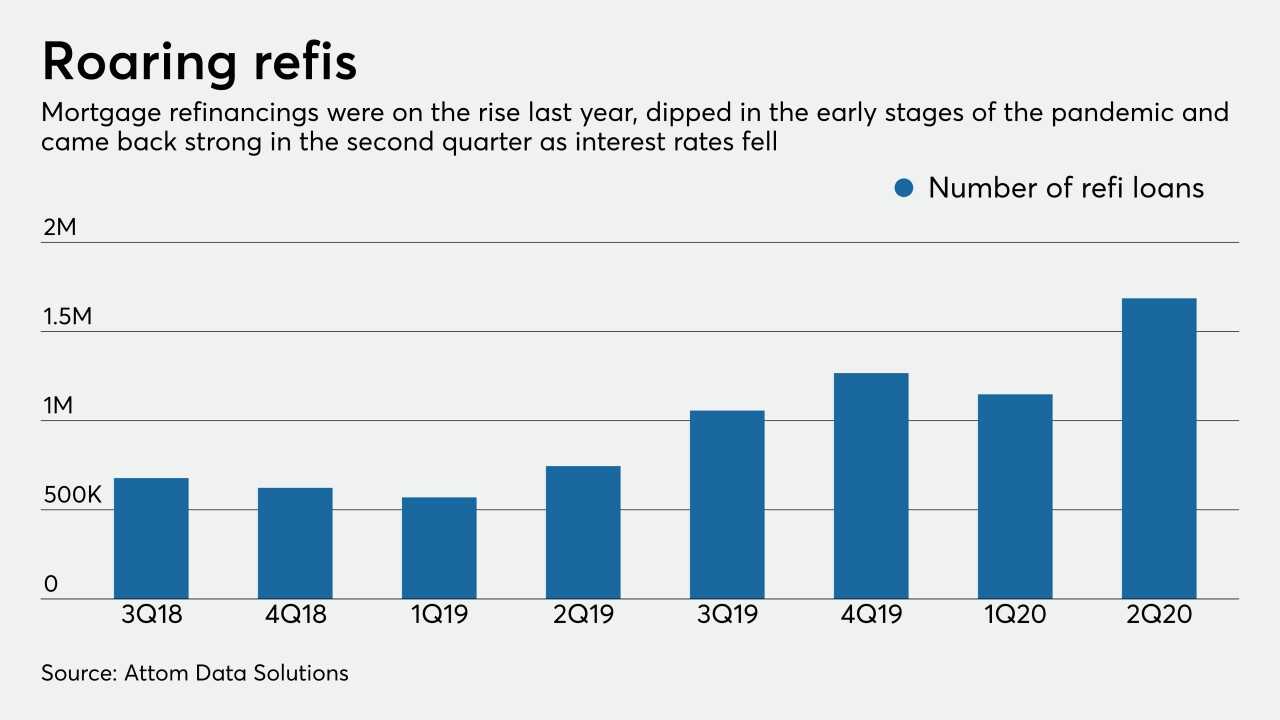

With mortgage rates tumbling near 3% in the second quarter, refinance originations spiked 400% in some housing markets, pushing overall volume to its highest point since 2009, according to Attom Data Solutions.

August 20 -

Mortgage applications decreased 3.3% from one week earlier, but purchase activity momentum persisted with home sales remaining a bright spot in the economic recovery, according to the Mortgage Bankers Association.

August 19 -

Dana Wade, a former OMB official, says a strong capital footing will help the Federal Housing Administration weather an uptick in delinquencies and ensure the mortgage market is viable once the economy recovers.

August 17 -

Both refinancings and purchases will be stronger than what Fannie Mae had previously forecast.

August 17 -

Its stock price, which slid since day two of trading, opened 10% on the earnings news.

August 14 -

The FHFA director’s move this week to impose an “adverse market fee” of 0.5% on most refinanced mortgages will shift billions out of the hands of American consumers and into the hands of Fannie Mae and Freddie Mac — and their private shareholders.

August 14 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

But the 30-year fixed remains below 3%, which should continue to support increased demand.

August 13 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

Refinance volume led the spike in mortgage applications for the week ending Aug. 7 as interest rates continued tumbling.

August 12 -

The company's Dun & Bradstreet investment reduced its results by $31 million.

August 10 -

Gross supply as of the end of June has already reached $1.2 trillion, a torrid pace considering the last decade has averaged $1.3 trillion per annum.

August 7 -

Conditions have improved for the first time since November.

August 6 -

Insurance claims and claims expenses were 503% above 1Q and 1,075% over 2Q19.

August 6

![“We will step up and do whatever we can to make sure that we ensure market stability,” said FHA Commissioner Dana Wade. “But we know [the pandemic will] ... pass and we're going to have a strong, vibrant economy when it does."](https://arizent.brightspotcdn.com/dims4/default/7956e80/2147483647/strip/true/crop/3462x1947+0+223/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F86%2Fa5%2F2a944fc3439c83e983c974aa82ca%2Fwade-dana-bl-081720.jpg)