-

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

Record-low interest rates allowed homebuyers to purchase $32,000 more house for the same monthly payment compared to last July, boosting affordability to the highest level since 2016.

August 3 -

The combined impact of coronavirus forbearance periods ending while low rates persist means large workloads for title insurers, appraisers and others.

July 31 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

The government-sponsored enterprise reported net earnings of $2.55 billion, up from $461 million in the first quarter.

July 30 -

The annual survey and ranking of mortgage servicers found that while trust is increasing, borrowers were frustrated with some digital interactions and long wait times with call centers.

July 30 -

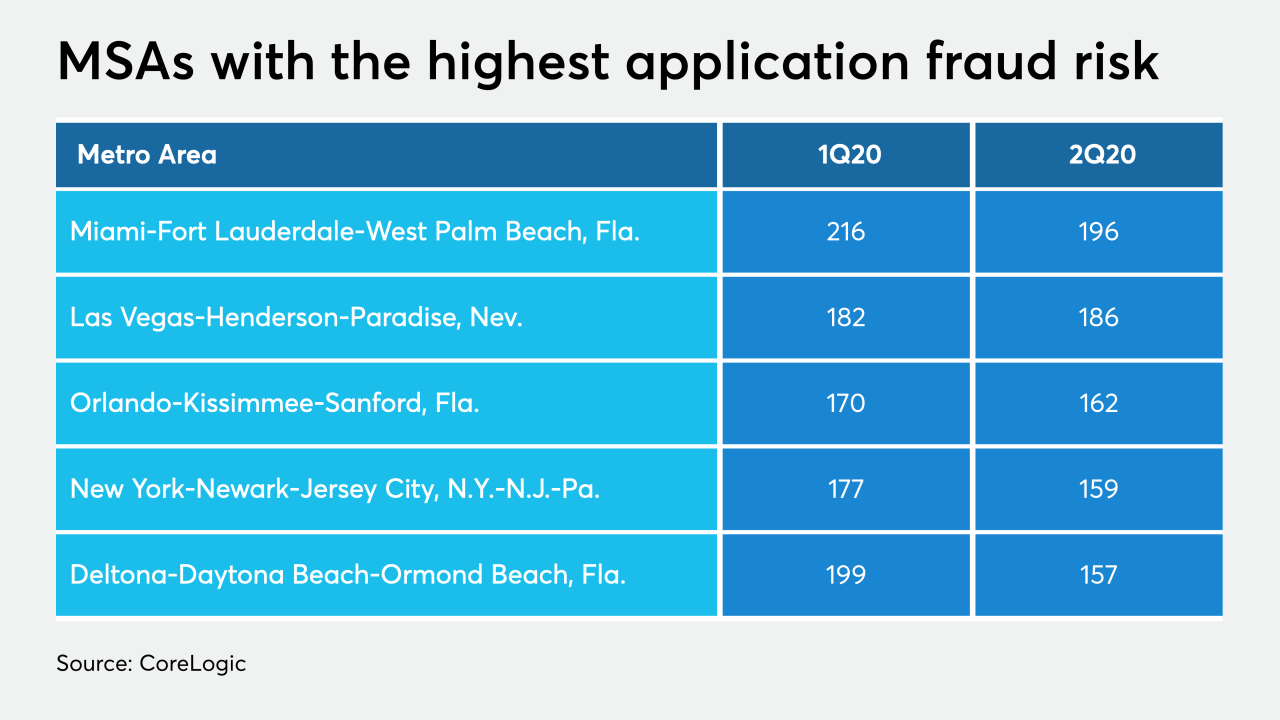

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

Mortgage applications decreased 0.8% from one week earlier as the latest spread of COVID-19 weighed on the minds of consumers looking to buy or refinance, according to the Mortgage Bankers Association.

July 29 -

CoreLogic said more refinancings and fewer investor purchase mortgages drove its index down to a level last reached in the third quarter of 2010.

July 24 -

Almost six in 10 completely agreed that company-provided technology met or exceeded their expectations.

July 23 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

Mortgage applications increased 4.1% from one week earlier as consumers continued to pursue both purchases and refinancings even as conforming rates rose from their record lows, according to the Mortgage Bankers Association.

July 22 -

Planet Home Lending took advantage of coronavirus volatility and low mortgage rates to increase its funding volume.

July 21 -

The Federal Housing Finance Agency will extend the same GSE benchmarks of the past three years into 2021.

July 20 -

Strong growth in refinance volume following several weeks of so-so activity drove a 5.1% week-to-week increase in mortgage applications, according to the Mortgage Bankers Association.

July 15 -

However, those who aren't current bank customers need to have $1 million in a qualifying account.

July 10 -

The current refinancing boom might seem like the worst time to buy leads, but for some, it may be the best.

July 9 -

Booming refinancing is expected to more than offset the tighter underwriting in second-quarter mortgage results.

July 8 -

For the first time in three weeks, mortgage application volume increased, this time by 2.2%, as purchase activity was up in a holiday-shortened week, according to the Mortgage Bankers Association.

July 8