-

While millennials took advantage of mortgage rates falling to two-year lows, increasing their refinance share, teaching them about low down payment loan products would help grow homeownership for this group, according to Ellie Mae.

September 4 -

Mortgage applications fell 3.1% from one week earlier even with another decrease in rates, according to the Mortgage Bankers Association.

September 4 -

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

A growing share of refinances born by lower rates is pushing down risk levels for fraud on a mortgage application, according to First American.

August 30 -

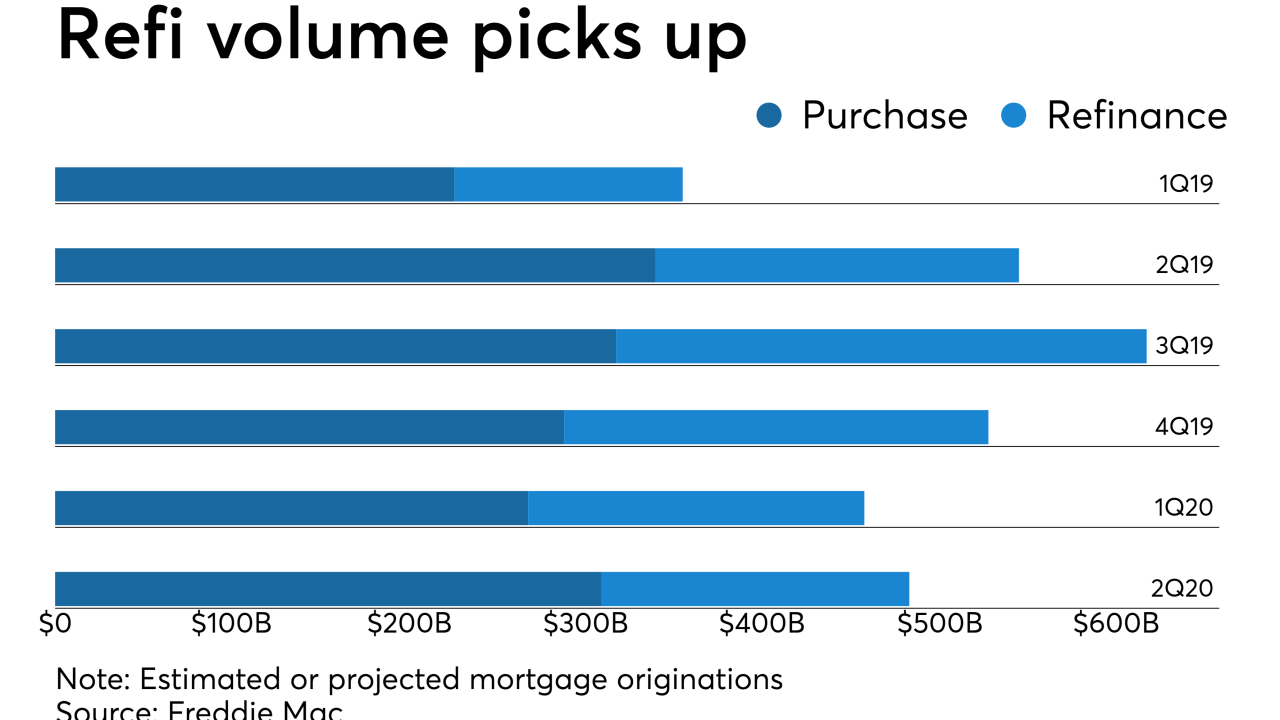

Freddie Mac now forecasts that refinance volume will make up nearly half of third and fourth quarter production, and has increased its origination estimate for the year to over $2 trillion.

August 30 -

Mortgage rates remained near three-year lows last week, but their movement did not mirror the period's big shifts in the 10-year Treasury yield.

August 29 -

Mortgage rates rose for the first time since the middle of July, but that, along with continued consumer worries about the economy, helped to reduce application activity from the prior week.

August 28 -

Lower interest rates that have the power to reduce house payments are triggering a surge in mortgage refinancing activity and giving real estate agents hope that more affordable rates can lift area home sales that are barely lagging behind 2018.

August 26 -

Refinances jumped in July in response to a considerable mortgage rate decline from the month prior as homeowners set to lock in lower costs, according to Ellie Mae.

August 22 -

Mortgage rates continued to drop this week and hit their lowest levels since November 2016, while stimulating the real estate market and the economy, according to Freddie Mac.

August 22 -

Mortgage application volume fell last week as the small drop in interest rates slowed refinancing activity, while economic worries likely kept purchasers out of the market, according to the Mortgage Bankers Association.

August 21 -

Wide short-term swings in interest rates — and loan prepayments — that we've all witnessed have serious secondary effects on consumers, lenders, investors and also policymakers.

August 19 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The world's headlong dash to zero or negative interest rates just passed another milestone: Homebuyers in Denmark effectively are being paid to take out 10-year mortgages.

August 19 -

With long-term interest rates at historic lows, mortgage refinancing is coming on strong. But that additional revenue may not be enough to offset net interest margin pressures and lost servicing income.

August 15 -

Lower rates will likely sustain higher levels of origination through at least the third quarter, but supply constraints and economic weakness could limit the purchase market's response in the long term.

August 15 -

Mortgage rates remained unchanged this past week even with all of the upheaval in the bond markets that pushed long-term Treasury yields down, according to Freddie Mac.

August 15 -

Mortgage activity fell at the start of the year, but lower mortgage rates are boosting refinance volume, and Generation Z is starting to creep into the housing market, according to TransUnion.

August 14 -

While last week's large drop in interest rates sparked a surge in refinance activity, purchase mortgage application volume increased for the first time in over a month, according to the Mortgage Bankers Association.

August 14 -

There's a silver lining to the recent economic turbulence: Mortgage rates have tumbled in recent weeks, triggering a rush to refinance and a race to the closing table for many Twin Citians.

August 14