-

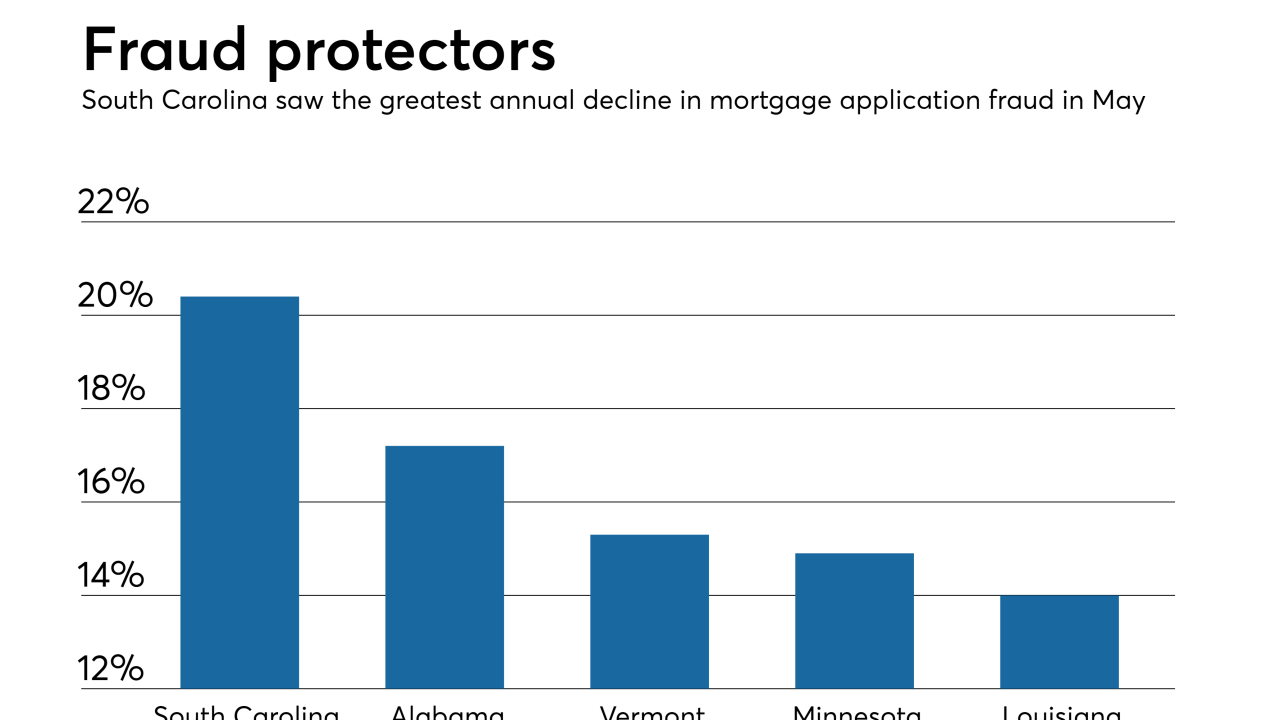

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Mortgage applications fell by nearly 5% last week as concerns over foreign trade and tariffs outweighed other positive economic news, according to the Mortgage Bankers Association.

June 27 -

Mortgage application activity increased 5.1%, rising for the second time in the past three weeks, according to the Mortgage Bankers Association.

June 20 -

Though mortgage originations were down overall in the first quarter, home equity lines of credit spiked on higher home prices, according to Attom Data Solutions.

June 14 -

Mortgage applications fell 1.5% from the previous week, as rising interest rates ended a brief pickup in activity, the Mortgage Bankers Association reported.

June 13 -

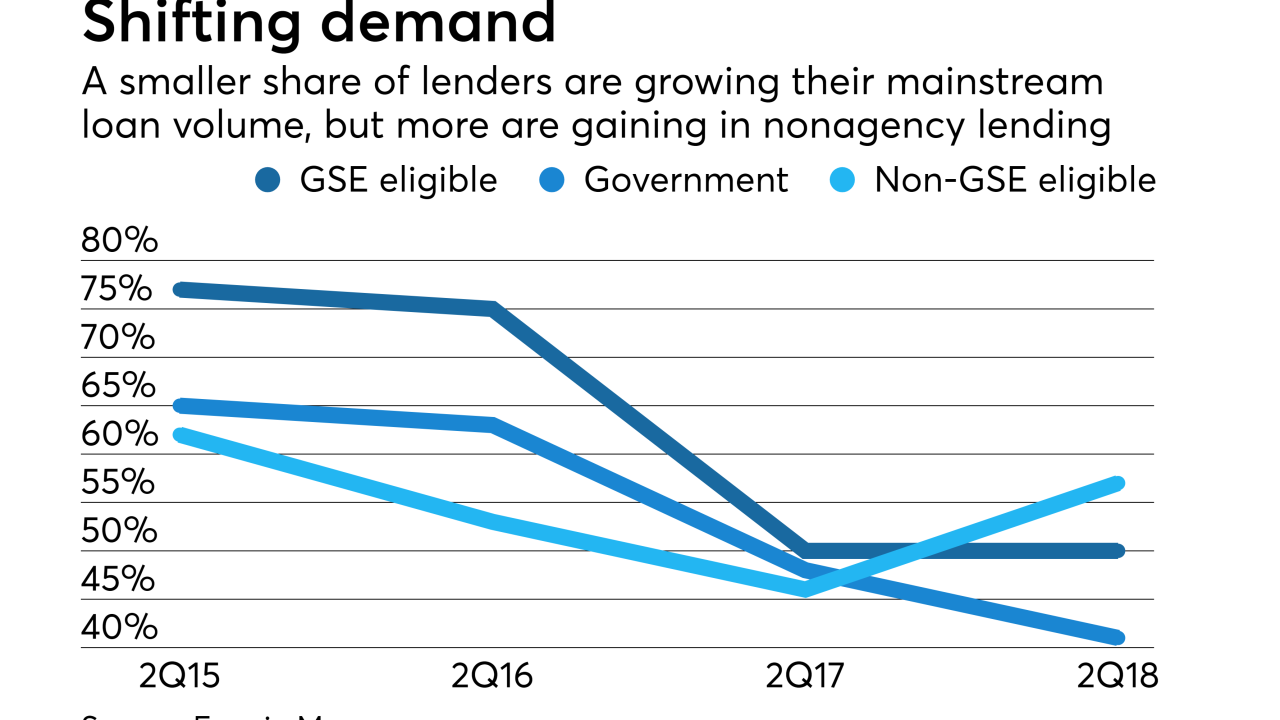

The net share of government and agency mortgage lenders who found spring homebuyer demand to be strong enough to drive purchase loan growth is considerably lower than three years ago.

June 12 -

Private mortgage insurance was used on approximately 4% fewer loans in 2017 when compared with 2016, according to the U.S. Mortgage Insurers.

June 8 -

All five – Plaza West Covina Mall (Calif.), Franklin Park Mall (Ohio), Parkway Plaza (Calif.), Capital Mall (Wash.), and Great Northern Mall (Ohio) – were built in the 1970s and have JCPenney or Sears as a major tenant.

June 7 -

After eight consecutive weeks of decreases, mortgage applications increased by 4.1% last week as key interest rates dropped sharply, according to the Mortgage Bankers Association.

June 6 -

Mortgage applications decreased 2.9%, falling for the eighth consecutive week even as interest rates came down from their recent highs, according to the Mortgage Bankers Association.

May 30 -

The ability-to-repay standard is responsible for the reduction in loan application defects over the past four-plus years, according to First American Financial.

May 30 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

The cash-out mortgage refinance share was at its highest in nearly 10 years in the first quarter, due to rising interest rates and homes not being used as piggybanks.

May 24 -

Mortgage applications decreased by 2.6%, falling for the seventh straight week as key interest rates jumped to seven-year highs, according to the Mortgage Bankers Association.

May 23 -

Originations and margins are thinning, and there will be mortgage banking firms that don't make it through this year, but after that, the numbers may look better.

May 22 -

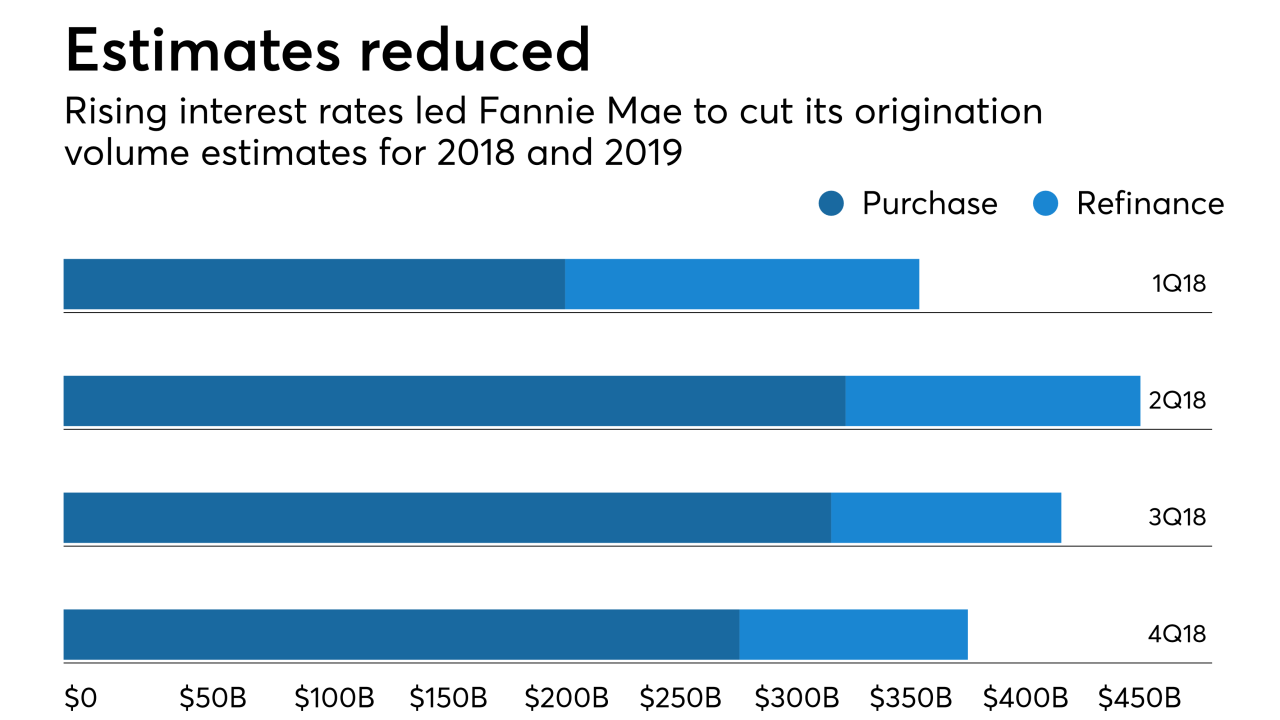

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

As mortgage rates continued rising, the percentage of closed home purchase loans grew to its highest level in about four years, according to Ellie Mae.

May 16 -

Mortgage applications decreased by 2.7% and fell for the sixth straight week as key interest rates fell slightly, according to the Mortgage Bankers Association.

May 16 -

Mortgage applications decreased by 0.4% and were down for the fifth straight week, as key interest rates also fell slightly, according to the Mortgage Bankers Association.

May 9 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at eight key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 8