-

The ability-to-repay standard is responsible for the reduction in loan application defects over the past four-plus years, according to First American Financial.

May 30 -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

The cash-out mortgage refinance share was at its highest in nearly 10 years in the first quarter, due to rising interest rates and homes not being used as piggybanks.

May 24 -

Mortgage applications decreased by 2.6%, falling for the seventh straight week as key interest rates jumped to seven-year highs, according to the Mortgage Bankers Association.

May 23 -

Originations and margins are thinning, and there will be mortgage banking firms that don't make it through this year, but after that, the numbers may look better.

May 22 -

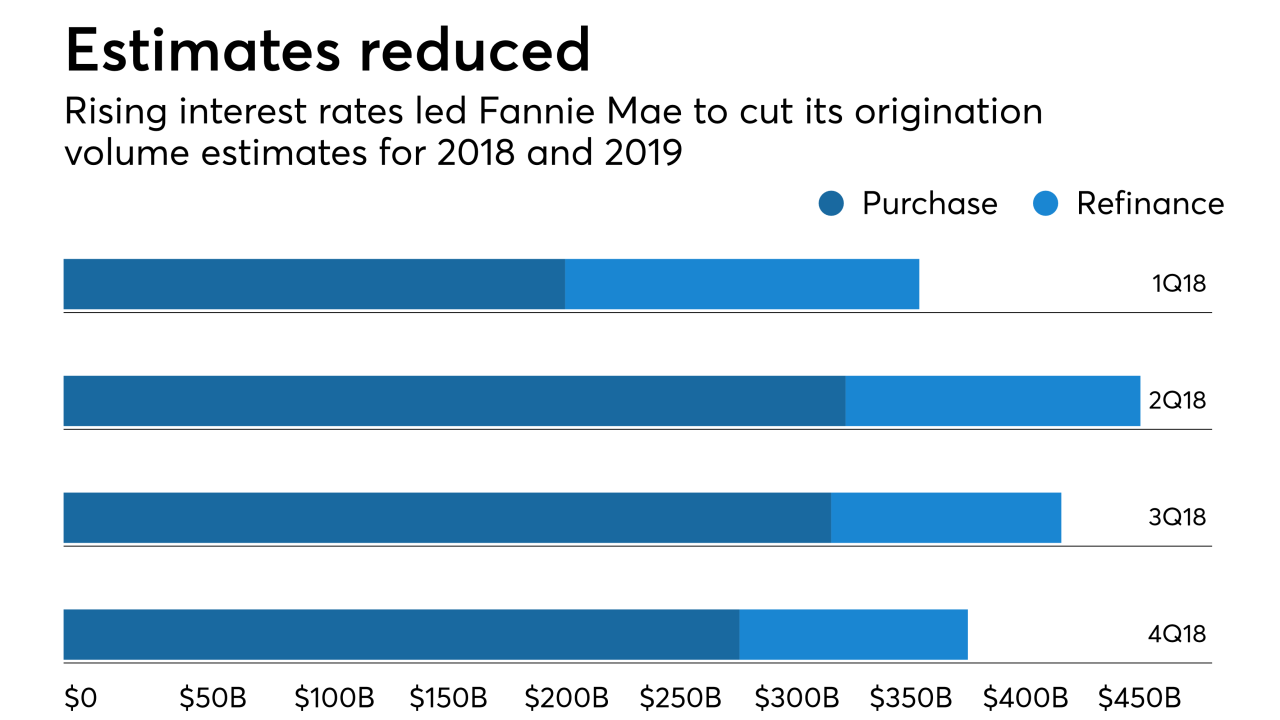

Fannie Mae reduced its mortgage origination volume forecast for 2018 and 2019 as rising interest rates are affecting refinancings now, and will curtail purchase activity going forward.

May 17 -

As mortgage rates continued rising, the percentage of closed home purchase loans grew to its highest level in about four years, according to Ellie Mae.

May 16 -

Mortgage applications decreased by 2.7% and fell for the sixth straight week as key interest rates fell slightly, according to the Mortgage Bankers Association.

May 16 -

Mortgage applications decreased by 0.4% and were down for the fifth straight week, as key interest rates also fell slightly, according to the Mortgage Bankers Association.

May 9 -

From falling originations to market share shifts for nonbanks and government loans, here's a look at eight key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 8 -

The number of mortgage borrowers for whom it made sense to refinance declined by nearly half since the end of last year and is at its lowest since November 2008.

May 7 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

Rising interest rates contributed to a 2.5% decrease in mortgage application activity, which fell for the fourth straight week.

May 2 -

While mortgage application defect risk declined overall in March, at the local level it varied considerably, according to First American Financial Corp.'s Loan Application Defect Index.

April 27 -

The Federal Housing Finance Agency's plan to combine Fannie Mae and Freddie Mac mortgages into a single security starting in June 2019 promises to bring both benefits and challenges to the mortgage sector.

April 27 -

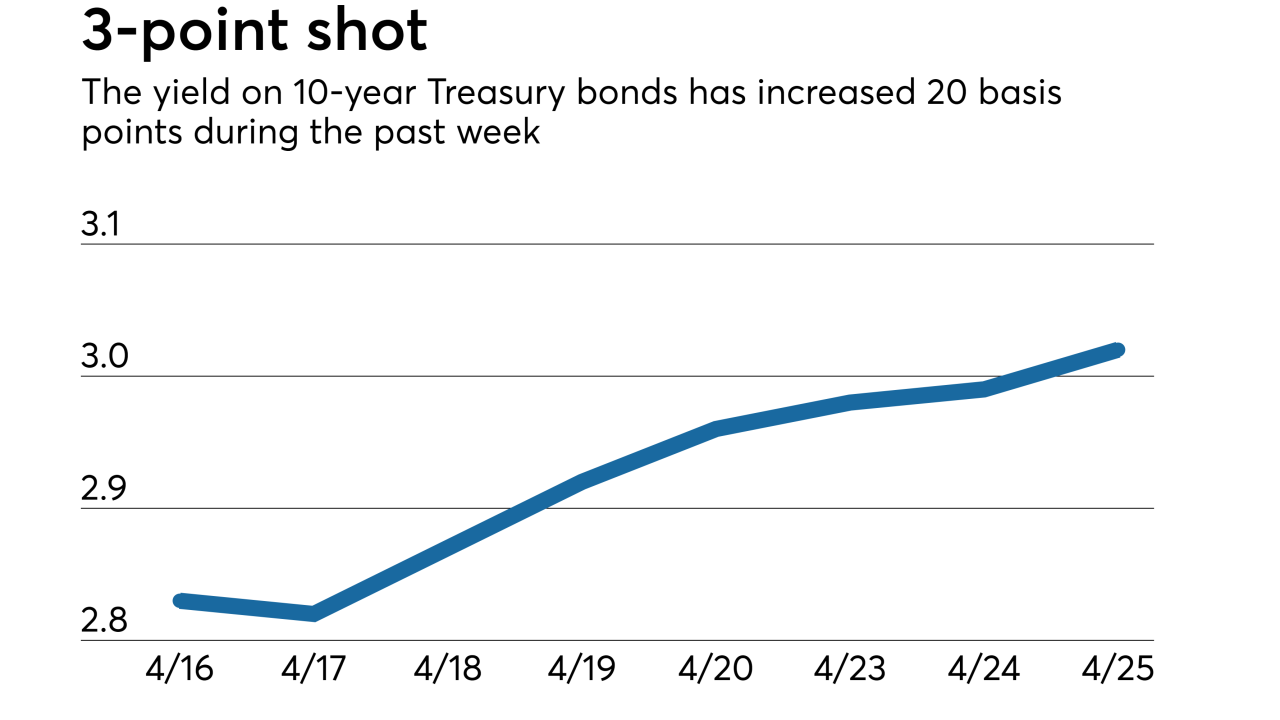

If 10-year Treasury yields remain at or above 3%, the average 30-year fixed-rate mortgage could hit 5% sooner than previously expected.

April 25 -

Better weather allowed consumers to go shopping for homes and drive the increase in mortgage application volume compared with one week earlier, according to the Mortgage Bankers Association.

April 18 -

Fannie Mae increased its second-quarter mortgage origination projection by $7 billion as refinance volume is remaining stronger than previously expected.

April 16 -

Mortgage applications decreased 1.9% from one week earlier as purchase activity was down again, according to the Mortgage Bankers Association.

April 11 -

Mortgage application activity decreased 3.3% from one week earlier as purchase and refinance volume fell prior to the start of the home buying season, according to the Mortgage Bankers Association.

April 4