-

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but they've been slow to borrow against this newfound wealth, according to Black Knight.

April 2 -

There is now less fraud risk associated with adjustable-rate mortgage applications and this will offset some of the higher hazard associated with a purchase market.

April 2 -

Despite growth in senior-held mortgage debt, home equity for homeowners 62 and older grew to $6.6 trillion in the fourth quarter, according to the National Reverse Mortgage Lenders Association and RiskSpan.

March 28 -

Mortgage applications increased 4.8% from one week earlier and rose for the fourth time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

March 28 -

Independent mortgage banks and mortgage subsidiaries of chartered banks saw production profits tank in the fourth quarter of 2017, according to the Mortgage Bankers Association.

March 23 -

Closing times for refinances have fallen dramatically due to mortgage lenders' increased emphasis on home purchase loans.

March 21 -

The share of mortgage refinance applications dropped to its lowest level in nearly 10 years as interest rates continued to climb.

March 21 -

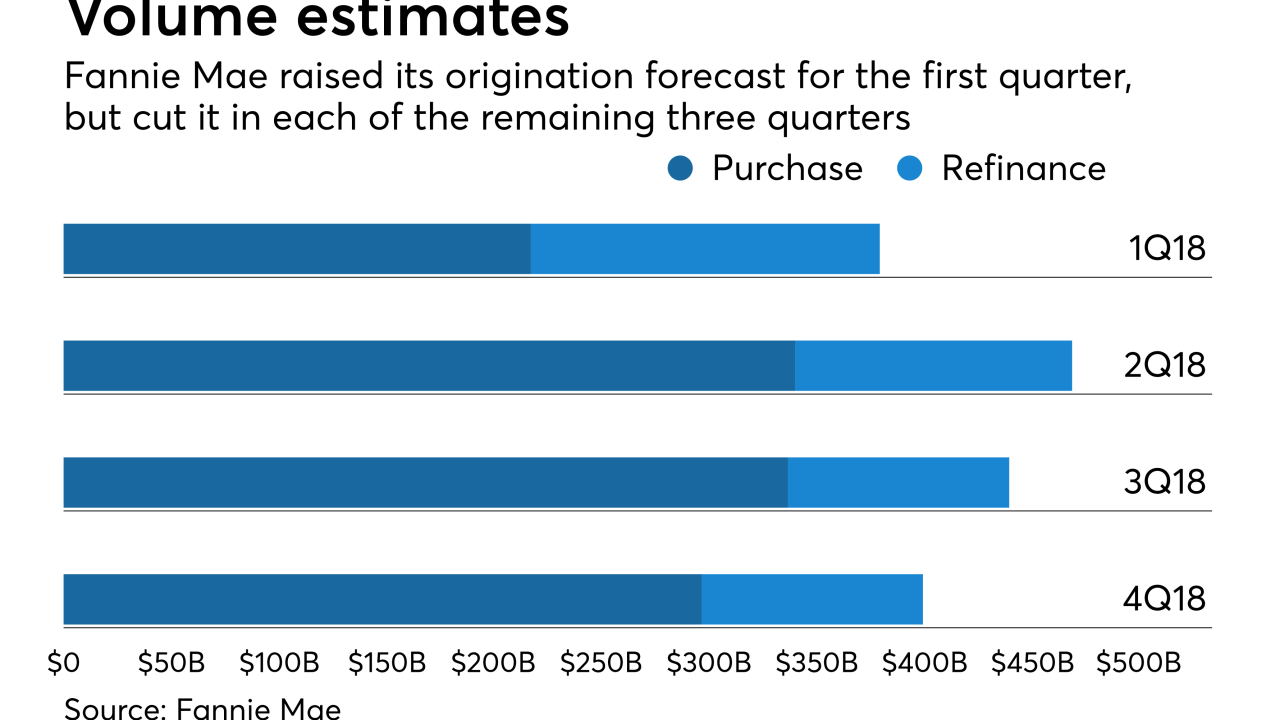

A stronger than expected refinance market led Fannie Mae to increase its origination projections for the first quarter by nearly 4% in its March outlook.

March 19 -

Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

March 19 -

Residential mortgage originations fell 19% year-over-year in the fourth quarter of 2017, due primarily to a large drop in refinance volume, according to Attom Data Solutions.

March 16 -

Mortgage lenders are growing more pessimistic about their profitability, with the highest percentage ever seen in Fannie Mae's first-quarter industry sentiment survey expecting a decline in margins.

March 15 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

Mortgage application activity increased slightly from one week earlier even as the rate for the 30-year conforming loan rose to its highest level in four years.

March 7 -

The number of mortgage borrowers with an interest rate incentive to refinance fell 40% during the first six weeks of the year and now sits at the lowest level in more than nine years.

March 5 -

It is important for lenders to understand in what locations and property types their application fraud risk rests as the market share of purchase loans rises.

March 2 -

Higher levels of purchase activity even with rising interest rates drove the increase in mortgage applications compared with one week earlier.

February 28 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21 -

With 30-year mortgage rates reaching a four-year high, loan application activity was lower this past week, according to the Mortgage Bankers Association.

February 21 -

Mortgage borrowers 60 days or more late with their payments declined both quarter-to-quarter and year-over-year, as recession-era defaults work their way out of the system.

February 20