-

Mortgage lenders are growing more pessimistic about their profitability, with the highest percentage ever seen in Fannie Mae's first-quarter industry sentiment survey expecting a decline in margins.

March 15 -

Continued increases in mortgage rates caused the refinance loan application share to fall to its lowest level since September 2008, according to the Mortgage Bankers Association.

March 14 -

Think you know your IRRRL from your LPMI? See if you can ace this quiz of 10 quirky abbreviations from the origination sector of the mortgage industry.

March 13 -

Mortgage application activity increased slightly from one week earlier even as the rate for the 30-year conforming loan rose to its highest level in four years.

March 7 -

The number of mortgage borrowers with an interest rate incentive to refinance fell 40% during the first six weeks of the year and now sits at the lowest level in more than nine years.

March 5 -

It is important for lenders to understand in what locations and property types their application fraud risk rests as the market share of purchase loans rises.

March 2 -

Higher levels of purchase activity even with rising interest rates drove the increase in mortgage applications compared with one week earlier.

February 28 -

Refinance mortgages accounted for 45% of mortgage volume, the highest share in a year, according to Ellie Mae.

February 21 -

With 30-year mortgage rates reaching a four-year high, loan application activity was lower this past week, according to the Mortgage Bankers Association.

February 21 -

Mortgage borrowers 60 days or more late with their payments declined both quarter-to-quarter and year-over-year, as recession-era defaults work their way out of the system.

February 20 -

Rising rates, largely tied to the stock market turmoil, took their toll on mortgage application volume during the past week.

February 14 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Even as rates hit their highest levels in nearly four years, mortgage application volume increased compared with one week earlier, according to the Mortgage Bankers Association.

February 7 -

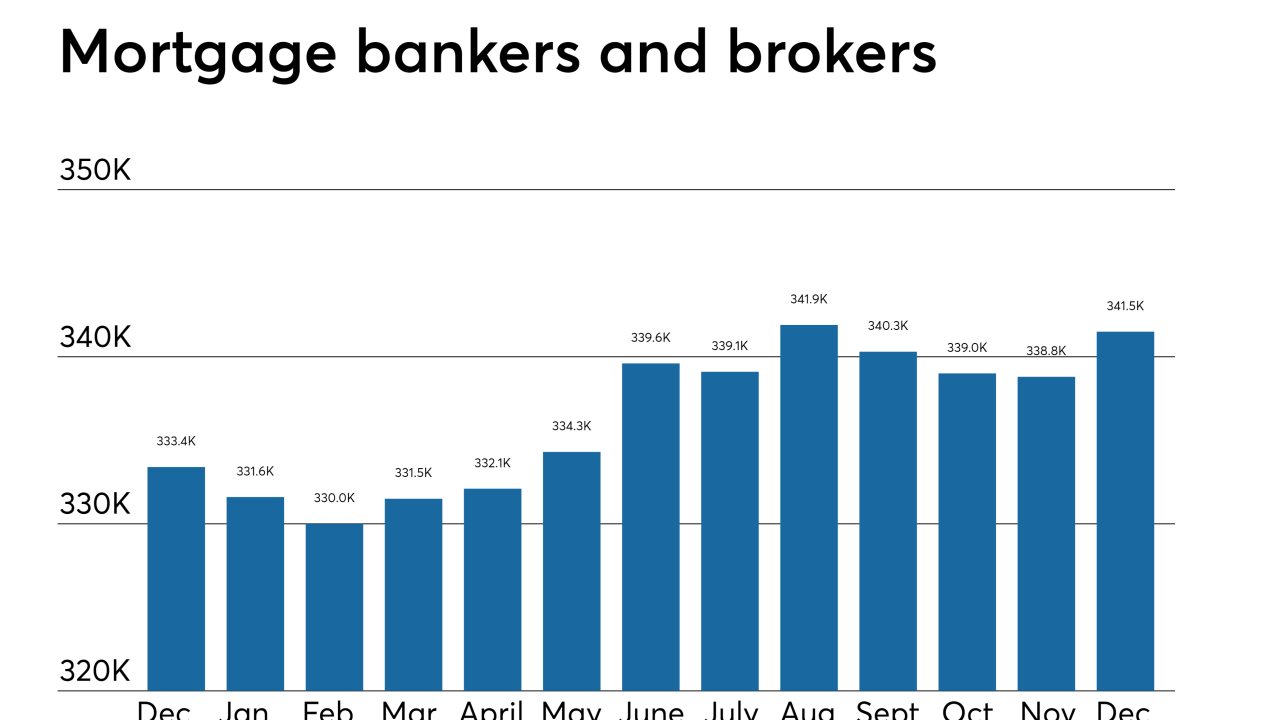

A December hiring spike at nondepository mortgage originators ended a three-month skid and solidified the fourth straight year of job gains in the sector. But with loan volume projected to decline again in 2018, it remains to be seen whether nonbanks will add more workers or start making cuts.

February 2 -

Rising rates suppressed total mortgage application activity, which decreased 2.6% from one week earlier, according to the Mortgage Bankers Association.

January 31 -

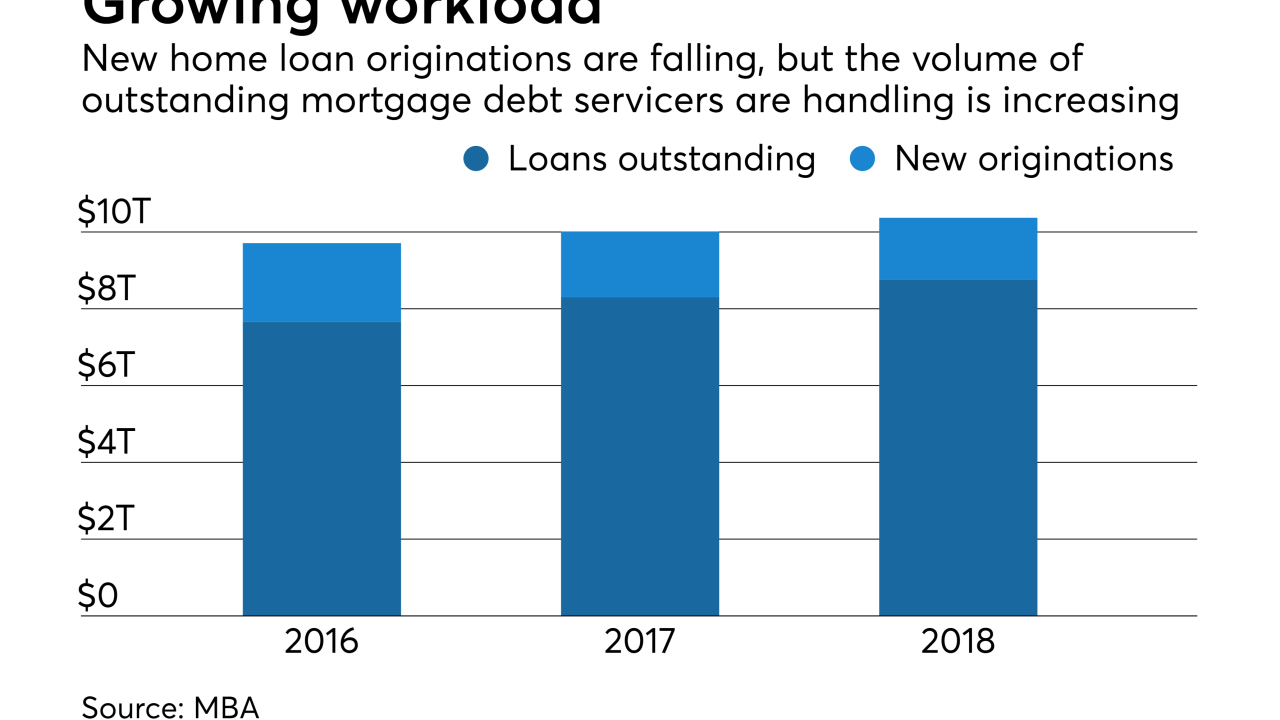

Rising mortgage rates have taken a toll on refinance lending and extended the lifecycle of existing loans. With new purchase originations also making portfolios larger, servicers must take steps to avoid capacity constraints.

January 31 -

The mortgage industry should expect significant volatility that could result in a wave of lender consolidation in 2018, warns an analyst at risk management technology vendor LoanLogics.

January 31 -

Purchase loan applications were at their highest level in nearly eight years because of rising interest rates, according to the Mortgage Bankers Association.

January 24 -

The Blackstone affiliate is cashing out over $200 million of home price appreciation in the process, resulting in a loan-to-value ratio that is unchanged from the original Colony American Homes transactions.

January 23 -

The changes created by tax reform will be a mixed influence on housing as consumers will have more to spend to buy a property, but lose other benefits of homeownership.

January 22