-

Rising rates, largely tied to the stock market turmoil, took their toll on mortgage application volume during the past week.

February 14 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Even as rates hit their highest levels in nearly four years, mortgage application volume increased compared with one week earlier, according to the Mortgage Bankers Association.

February 7 -

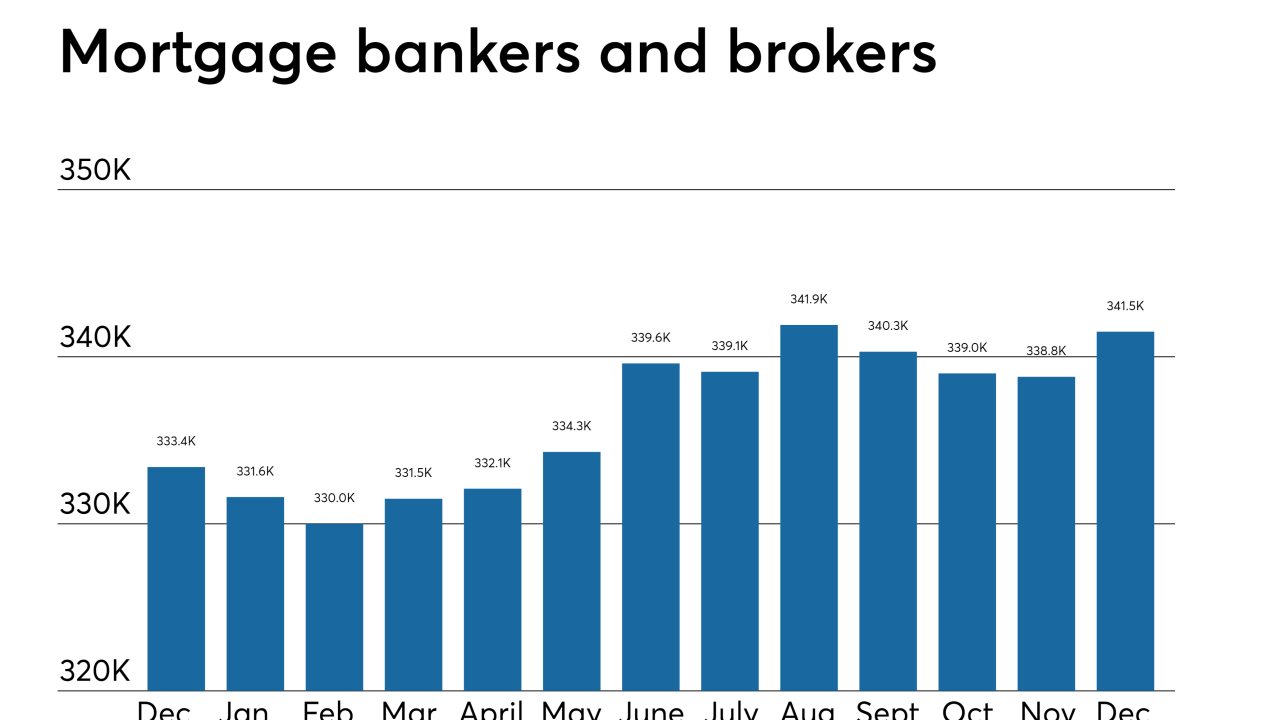

A December hiring spike at nondepository mortgage originators ended a three-month skid and solidified the fourth straight year of job gains in the sector. But with loan volume projected to decline again in 2018, it remains to be seen whether nonbanks will add more workers or start making cuts.

February 2 -

Rising rates suppressed total mortgage application activity, which decreased 2.6% from one week earlier, according to the Mortgage Bankers Association.

January 31 -

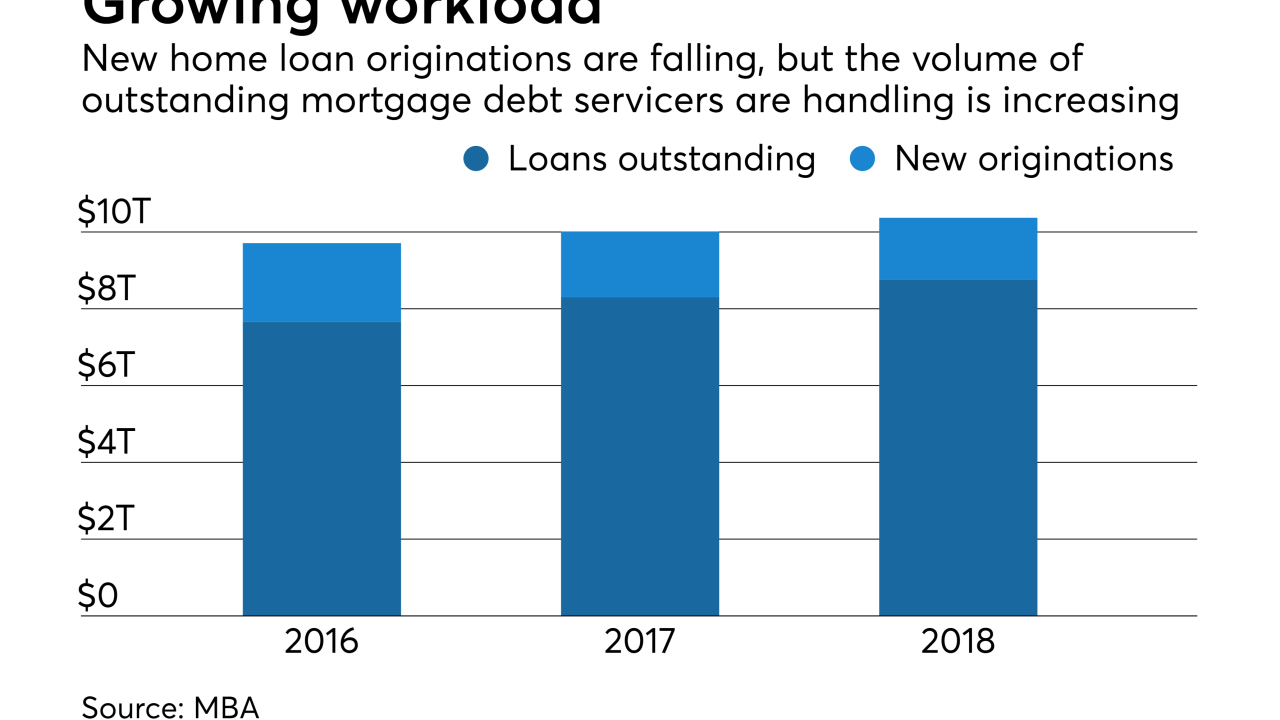

Rising mortgage rates have taken a toll on refinance lending and extended the lifecycle of existing loans. With new purchase originations also making portfolios larger, servicers must take steps to avoid capacity constraints.

January 31 -

The mortgage industry should expect significant volatility that could result in a wave of lender consolidation in 2018, warns an analyst at risk management technology vendor LoanLogics.

January 31 -

Purchase loan applications were at their highest level in nearly eight years because of rising interest rates, according to the Mortgage Bankers Association.

January 24 -

The Blackstone affiliate is cashing out over $200 million of home price appreciation in the process, resulting in a loan-to-value ratio that is unchanged from the original Colony American Homes transactions.

January 23 -

The changes created by tax reform will be a mixed influence on housing as consumers will have more to spend to buy a property, but lose other benefits of homeownership.

January 22 -

The percentage of refinances grew to 40% of all closed loans in December, according to Ellie Mae.

January 17 -

Even as mortgage rates rose to their highest level since March, application activity increased from one week earlier, according to the Mortgage Bankers Association.

January 17 -

Mortgage application volume started the year on the upswing because of higher refinance activity, even with a slight increase in rates.

January 10 -

There were fewer mortgage programs available to borrowers at the lower end of the credit spectrum in December, resulting in an overall decrease in credit availability.

January 9 -

Homeowners can tap into more home equity than ever before, but deciding between a home equity line of credit and cash out refinance mortgage has gotten more complicated following recently passed tax reforms.

January 8 -

Refinance volume fueled recent market gains by nonbank mortgage originators. But lower volume amid the shift to purchase lending has nonbanks trimming headcounts and may position banks to recapture market share.

January 5 -

Mortgage application volume decreased 2.8% during the last two weeks of 2017, according to the Mortgage Bankers Association.

January 3 -

The average credit score of loans made to members of the millennial generation were a little lower than they were a year ago, according to Ellie Mae.

January 3 -

After surging earlier in the year, the number of mortgage loan application defects remained flat in November, a positive sign when it comes to fraud incidents going forward.

December 29 -

From consolidation to tech innovation, here's a look at some of the top challenges and trends that mortgage executives from lenders, servicers and vendors are focused on for 2018.

December 28