-

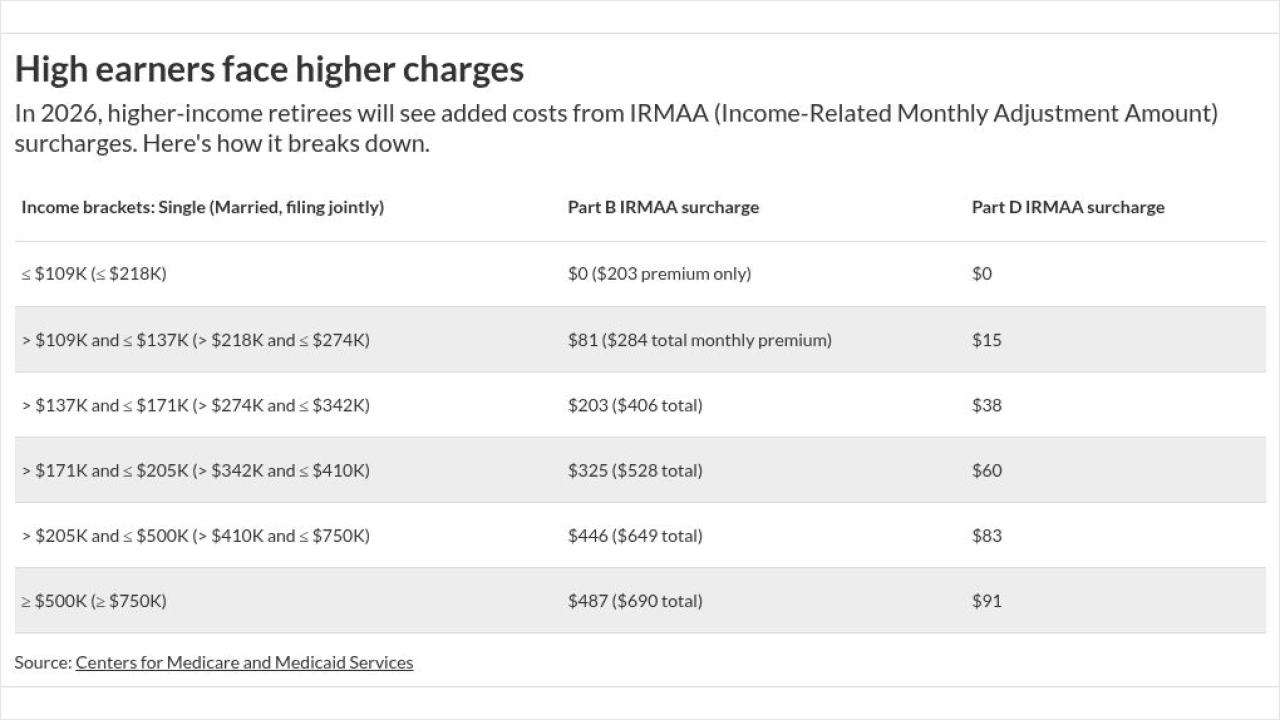

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

Financial security is a concern for 31% respondents who said they feel less well-off than their parents or grandparents, a Nationwide survey found.

July 9 -

There is little doubt that growing and protecting wealth is a critical pillar in everyone's financial plan. But what about maintaining and improving your health?

-

The wealth management business is undergoing considerable transformation. The pandemic has created a new breed of investors, with distinct expectations and tastes formed by new technology and having lived through the financial crisis.

-

Financial advisors have a variety of objectives in working with their investment-planning clients. But when all is said and done, clients are usually mainly interested in a successful road map to growing and protecting their wealth to and through retirement.

-

Many put aside their own financial planning during the boom year of 2020 and some, as independent contractors, have no retirement savings at all. Here’s why they shouldn’t rely on selling their own companies or client lists to support themselves after they exit the workforce.

June 3 -

Women in the United States have a lot in common when it comes to managing their money. They prioritize financial stability and nearly half equate negative emotions with financial planning - far more than men.

-

A range of startups are experimenting with more ethical retirement savings products than traditional reverse mortgages and annuities, says venture capitalist Ben Cukier. However, according to Cukier, they're too focused on millennials and ignoring a group with more urgent needs and greater wealth — baby boomers.

August 19 -

Being a homeowner may not be the most cost efficient move in some areas.

January 15 -

Earlier versions of the bill would have caused bigger changes in how Americans finance home purchases, higher education and retirement. Still, the final legislation will have important effects on borrowing and saving decisions.

December 21