-

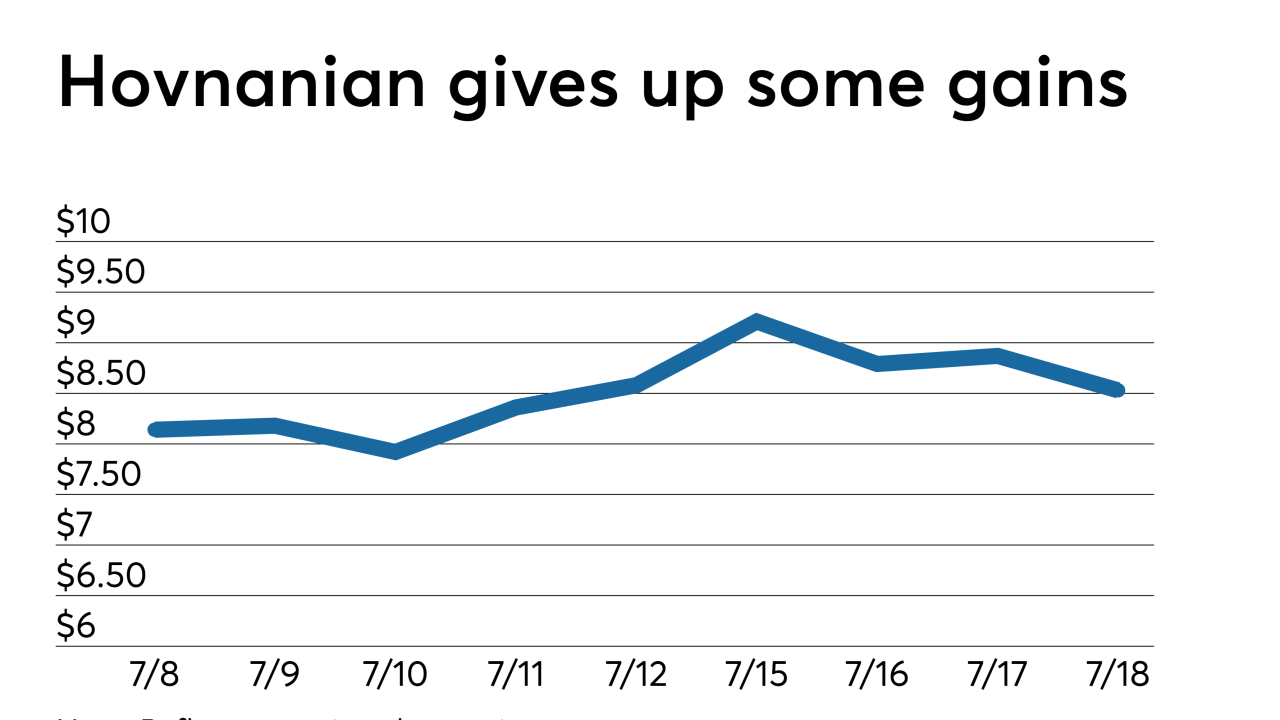

Hovnanian Enterprises, the corporate parent of homebuilder K Hovnanian Homes, received a new notice from the New York Stock Exchange indicating its low market capitalization could jeopardize its listing status.

July 18 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

Ginnie Mae is examining whether the shift in business to nonbank issuers has implications beyond the risks it has historically looked at, and identifying advantages that should be nurtured as well.

June 10 -

The Federal Housing Finance Agency has far more authority to upend the status quo than most realize, according to a new report.

June 7 -

Private mortgage insurers can help to ease banks' compliance burden when it comes to the Current Expected Credit Loss accounting standard, an industry executive said.

May 22 -

Prepayments tied to repeated VA loan refinancing activity have had an adverse effect on Ginnie’s mortgage securities that persists despite countermeasures. The government bond issuer is making new plans to address the impact.

May 21 -

Having poor credit doesn't necessarily keep someone looking to become a mortgage broker from obtaining a surety bond, but it can complicate matters.

May 1 JW Surety Bonds

JW Surety Bonds -

Learning to understand the risk rather than adding steps to the mortgage application process is the way to mitigate fraud.

April 10 CoreLogic

CoreLogic -

An emerging gap between the government-sponsored enterprises on a Federal Housing Finance Agency scorecard item is prompting Fannie Mae to diversify its multifamily credit risk transfer efforts.

March 29 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

Costs, process, privacy: Here's a look at some key digital mortgage drivers and obstacles identified by experts at this year's MBA Technology Solutions Conference.

March 27 -

The bank was fined $25 million for what the Office of the Comptroller of the Currency said was an inability to provide the discounts to all who were eligible.

March 19 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

Mortgage brokers need to consider bringing their business into new locations to overcome limitations like competition and a finite number of possible customers.

March 15 JW Surety Bonds

JW Surety Bonds -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

Mr. Cooper Group took a net loss of $136 million in the fourth quarter after lower rates hurt the mark-to-market value of its larger mortgage servicing rights portfolio harder than its peers.

March 7 -

Policymakers could improve independent mortgage banks' financial stability by giving these companies improved access to liquidity, according to the Mortgage Bankers Association.

February 25 -

The Federal Reserve Bank of New York is streamlining its Ginnie Mae holdings by combining mortgage-backed securities with similar characteristics into larger pass-through instruments.

February 25 -

Ginnie Mae should not overreact in supervising smaller, more diversified mortgage bankers, but rather scale its approach in line with the concentration of risk that different-sized servicers pose.

February 13 Community Home Lenders of America

Community Home Lenders of America -

MGIC Investment Corp. responded to the broad-based roll out of "black box" pricing engines from the other mortgage insurers by bringing its version to market.

January 17