-

A majority of recent sellers said they offered to cover closing costs, with many also buying down mortgage rates, according to a new report from Zillow.

December 31 -

Developing class action cases could corral hundreds of thousands of plaintiffs in fights against lenders who allegedly defrauded customers and employees.

December 31 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

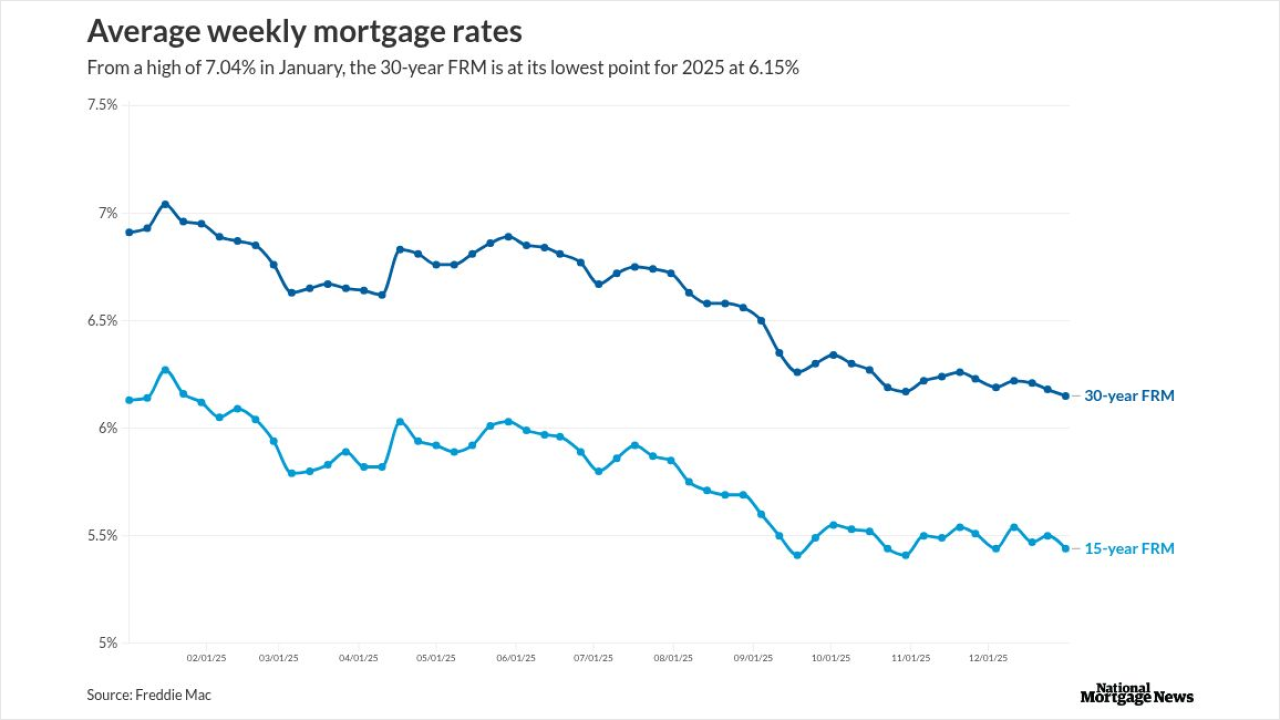

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

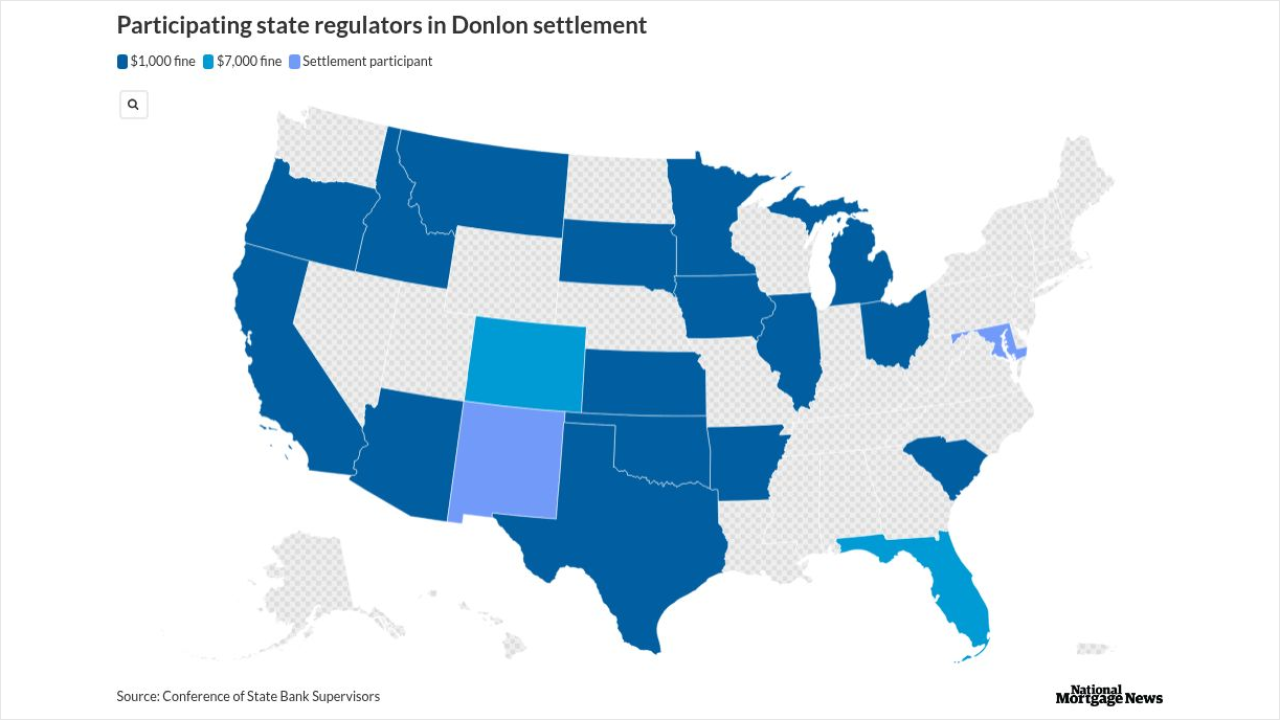

Following the resignation of CEO Patrick Donlon as the result of a settlement, Yield Solutions Group has taken operational control of Trusted American Mortgage.

December 31 -

AI's capabilities far exceed how the technology is being used in mortgage, but an all-in strategy will quickly put companies ahead of the pack, leaders say.

December 31 -

National home prices grew monthly and annually in October, but considerably less than last year, according to S&P Dow Jones Indices.

December 30 -

The professionals can't originate loans in their local cities for various stretches, following a federal judge's ruling granting most of the lender's wishes.

December 30 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

The new regulation, which passed overwhelmingly in the state legislature, would allow insurers to remove wildfire protections from standard homeowners policies.

December 30 -

Three U.S. senators opened an inquiry into insurance ratings firm Demotech and whether its assessments may be exposing taxpayers to growing risks tied to climate-driven insurer failures.

December 30 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

As CFPB oversight recedes, servicers are turning to FHA, VA and state rules for guidance, with distressed loan compliance, redefaults and local registration risks rising in 2026.

December 30 -

The additional research Secretary Scott Turner acknowledged would be required should include a cost-benefit analysis, mortgage professionals suggested.

December 29 -

The latest announcement comes two months after an initial round of staff reductions following approval of Rocket's acquisition of the company.

December 29 -

Here are the most-read stories from National Mortgage News over the past year.

December 29 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

A significant portion of the loans in the pool by balance, 44.5%, are designated at non-QM, according to DBRS, adding that about 50% of the loans in the pool were made to investors for business purposes.

December 29