-

An activist investor is seeking more information on how, and when, the largest bank deal of 2025 came together.

November 18 -

Federal Reserve Gov. Christopher Waller said in a speech Monday that private and public-sector data suggests that the labor market is continuing to weaken, making a 25 basis point rate cut in December a prudent choice.

November 17 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

Representatives of the insurance industry called the proposal too speculative and prescriptive, while consumer and environmental advocates say it doesn't go far enough.

November 17 -

New-home mortgage applications dropped, but the annual sales pace was the strongest in over a year, the Mortgage Bankers Association said.

November 17 -

Federal Reserve Governor Lisa Cook's legal team argued in a new letter to Attorney General Pam Bondi that the claims "fail on even the most cursory look at the facts."

November 17 -

The bank is adding trusted contacts, specialized teams and new tech against scams, but consumer advocates say reimbursement is the key missing piece.

November 17 -

AIME's CEO takes an additional AI leadership role, ALTA elects new president and Revolution, Tidalwave, Visio welcome chief operating officers.

November 17 -

Policy reviews of GSEs and Basel rules could reshape the MSR market, opening opportunities for banks and altering Fannie, Freddie MBS dynamics.

November 17 -

Delinquencies are at their second highest level in three years, led by deterioration in the performance of FHA loans, the Mortgage Bankers Association said.

November 14 -

Bayview Asset Management and three affiliates reached an agreement in a data breach lawsuit for an incident that impacted 5.8 million customers.

November 14 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

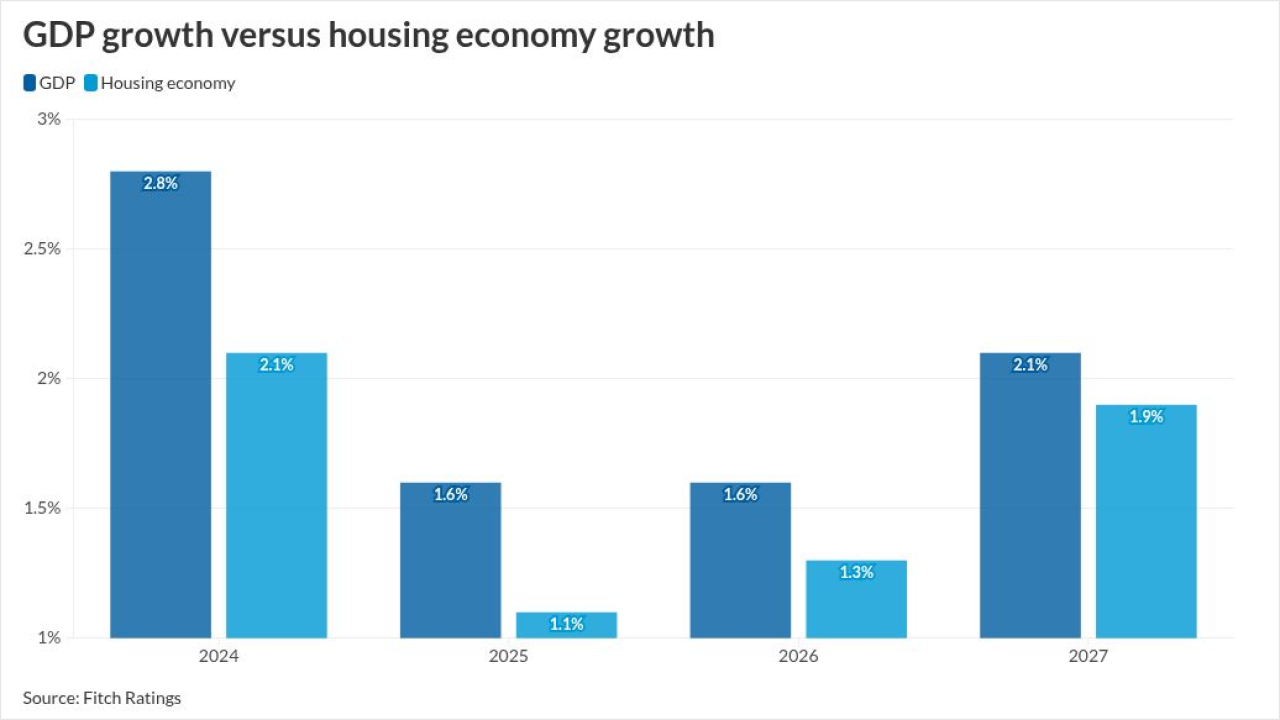

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

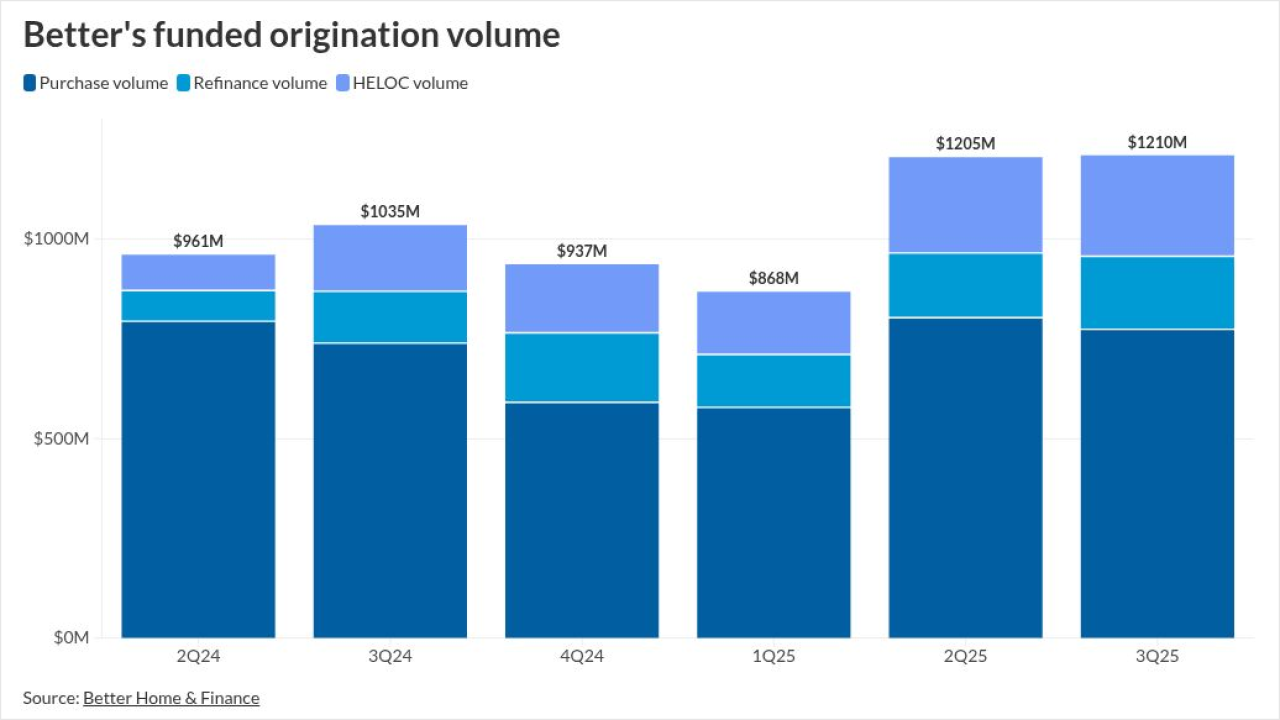

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

Origination has picked up but has limits, retention rates are improving and stakeholders are seeking a recapture standard, experts at an industry meeting said.

November 13 -

The hidden costs of homeownership total nearly $16,000, rising 4.7% in the past year.

November 13 -

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

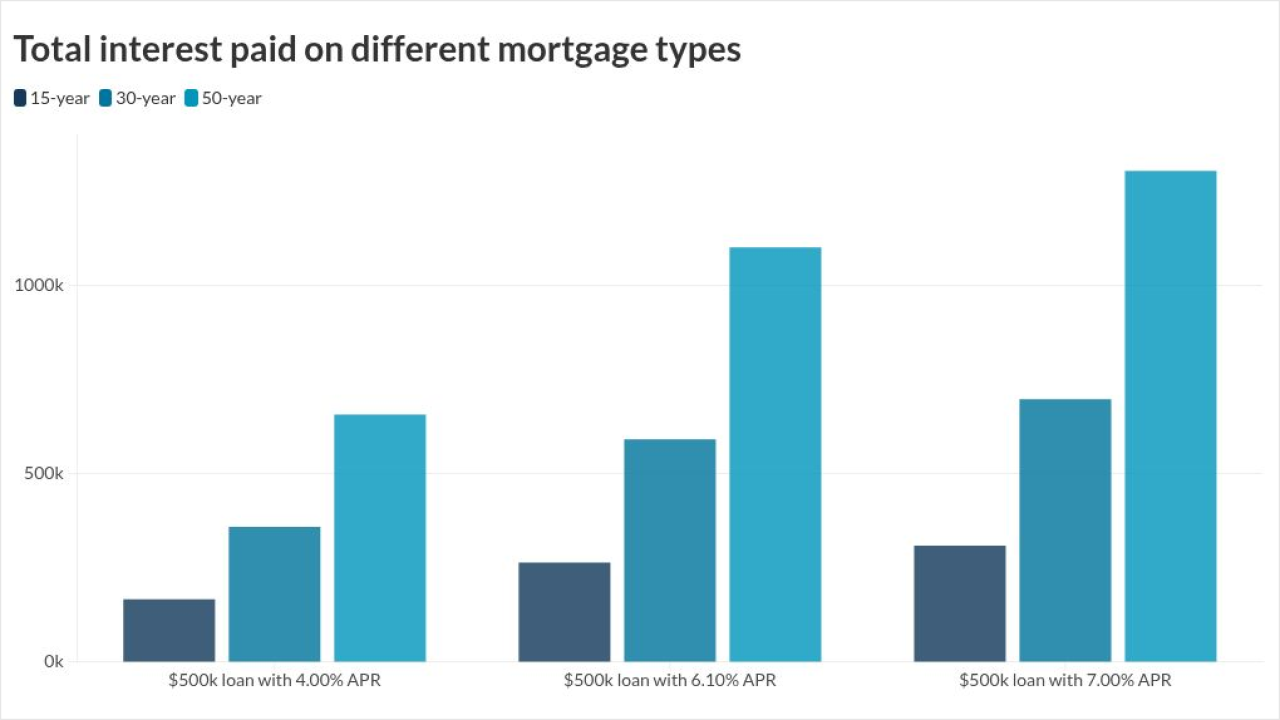

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13