-

Bayview Asset Management and three affiliates reached an agreement in a data breach lawsuit for an incident that impacted 5.8 million customers.

November 14 -

The acquisition agreement is the latest example of merger activity this year focused on the recapture potential held within servicing pipelines.

November 14 -

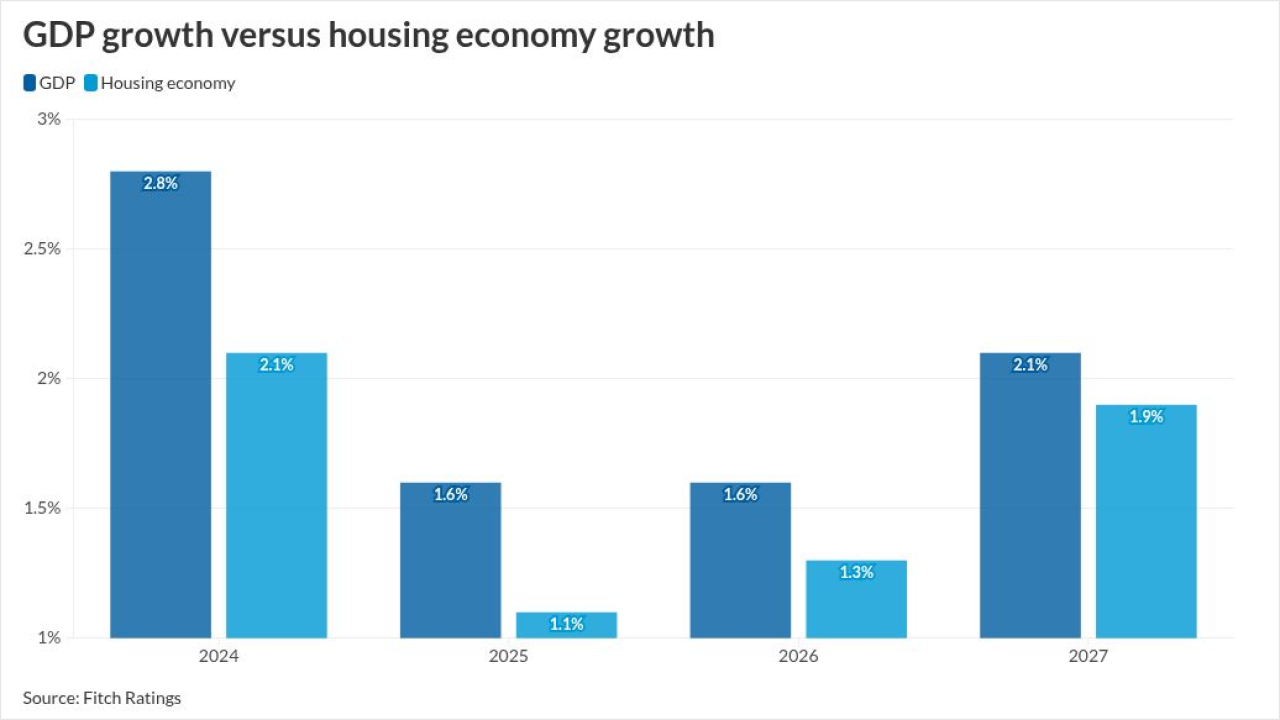

While Fitch and Kroll have differing views on mortgage rates next year, both are looking for mortgage delinquencies to rise in their rated portfolios.

November 14 -

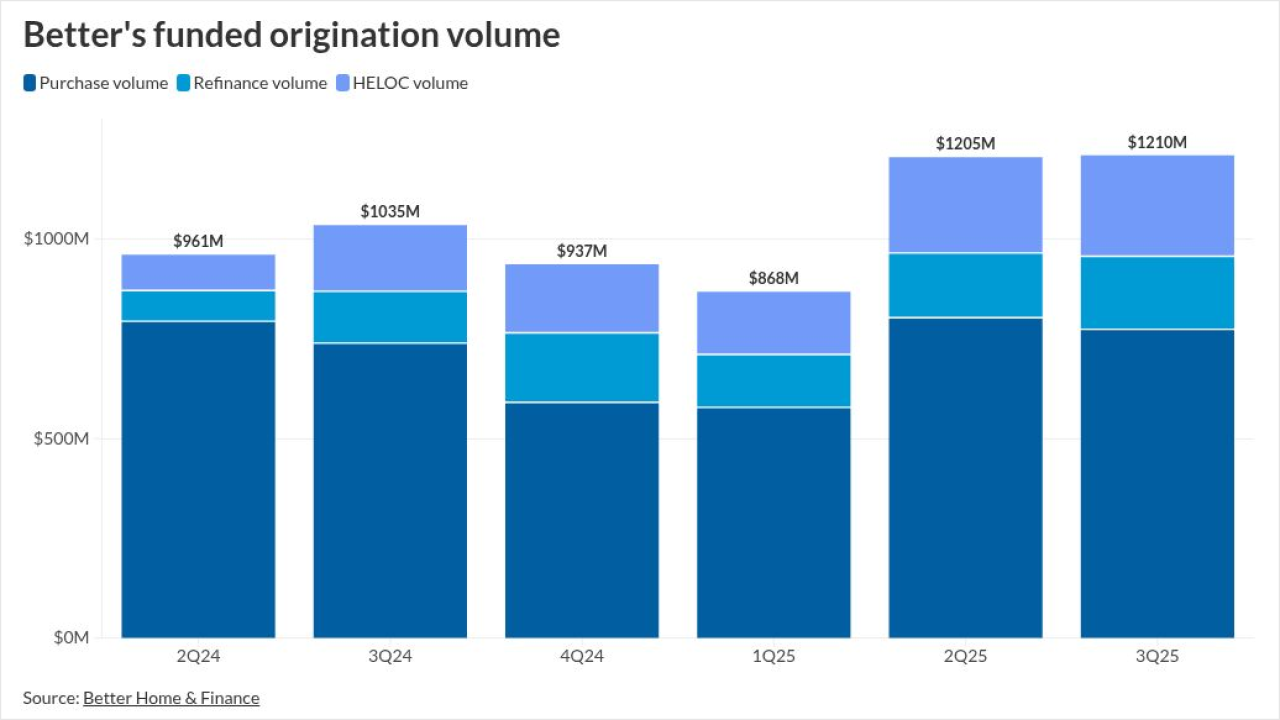

The fintech had over $2 billion in home equity line of credit volume in the third quarter and reported growing production in its crypto and non-QM offerings.

November 14 -

With the increase in investor-owned properties, the risk of undisclosed real estate fraud, including occupancy misrepresentation, rose 9% in the third quarter.

November 14 -

Origination has picked up but has limits, retention rates are improving and stakeholders are seeking a recapture standard, experts at an industry meeting said.

November 13 -

The hidden costs of homeownership total nearly $16,000, rising 4.7% in the past year.

November 13 -

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

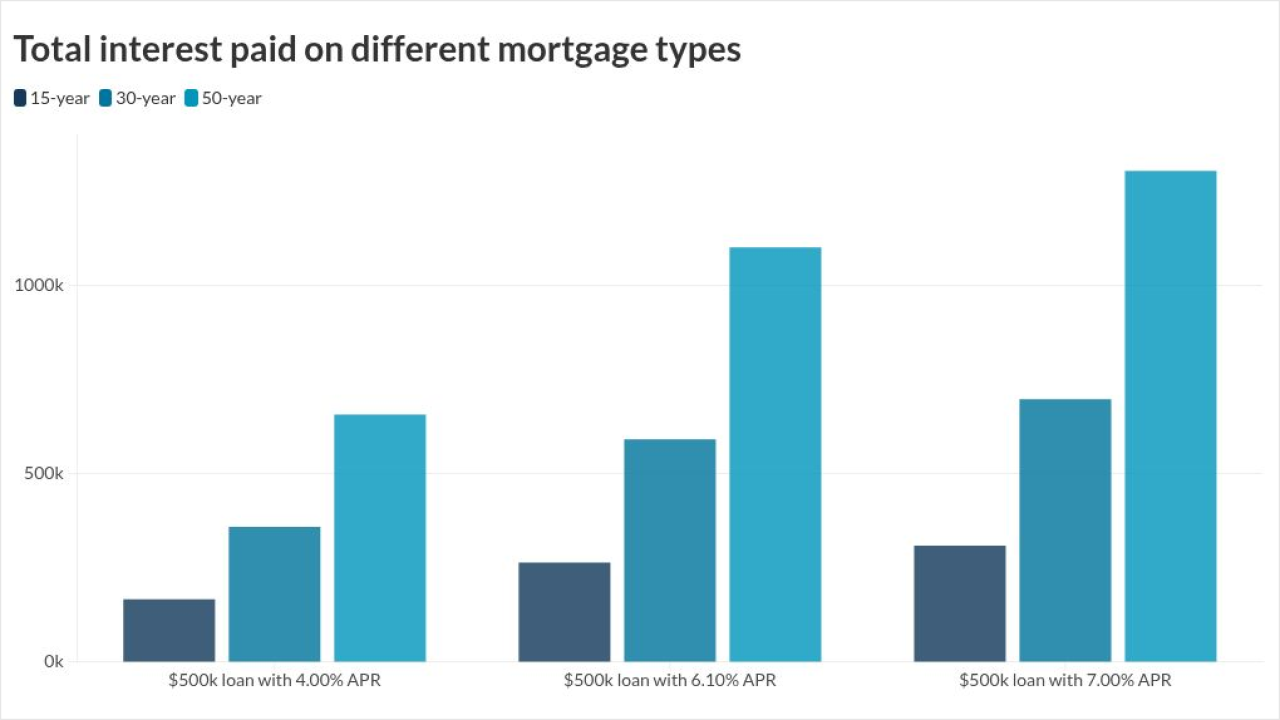

A 50-year mortgage would make borrowers susceptible to higher interest rates, significantly more payable interest and slower equity gains, LendingTree analysis showed.

November 13 -

For the second consecutive week, the 30-year fixed rate mortgage increased as investors were still sorting through the lack of information due to the shutdown.

November 13 -

The mortgage company, even though it is owned by a bank, has been profitable for the last two years, when considering its originations operations, as it does.

November 13 -

Yields were higher by as much as three basis points, led by tenors more sensitive to changes in Fed policy.

November 13 -

These attempts to remove legit items from credit files are made with the aim of at least temporarily boosting the credit score in order to get a loan.

November 13 -

Fed Gov. Stephan Miran has spent his short tenure at the central bank arguing that disinflation in housing and immigration reforms will tamp down inflation in the near term. But other economists say the timing, degree and context of those effects is very much in question.

November 13 -

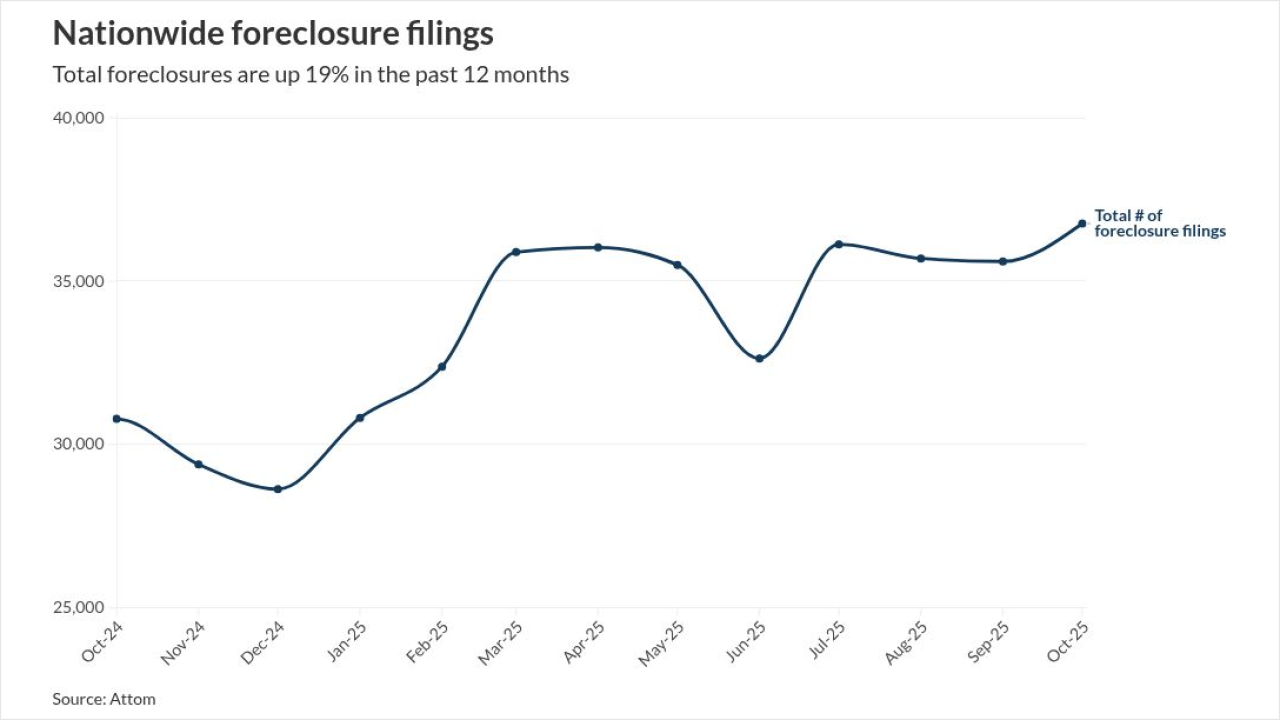

Total foreclosures rose 3% from September and 19% from the same time a year ago in October, marking the eighth straight month of increases.

November 13 -

SEMT 2025-12's collateral profile is slightly weaker compared with the prior transaction, with a slightly lower weighted average FICO score.

November 12 -

A Georgia resident filed the suit after receiving two unsolicited calls from the lender in October even though her number appeared on the Do Not Call registry.

November 12 -

The Consumer Financial Protection Bureau, building on an executive order by President Trump, wants to eliminate the legal framework of "disparate impact" from its implementation of the Equal Credit Opportunity Act.

November 12 -

The government shutdown added an additional dose of pessimism about the U.S. economy to panelists' outlooks, Wolters Kluwer said in its latest survey.

November 12 -

The lawsuit targets Zillow Flex, in which participating agents must meet Zillow Home Loans pre-approval quotas to maintain access to high quality leads.

November 12