-

The $10 million program appears to be the first of its kind in the nation.

March 23 -

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

Despite intensified demand and plummeting inventory, consumer home purchasing power made gains behind falling interest rates in October, according to First American.

December 28 -

October's annual appreciation rate was at its fastest since April 2014, CoreLogic said.

December 1 -

The coronavirus pandemic has made for a rough year for a number of industries in Central Texas, but the home construction sector hasn't been one of them.

November 16 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Low mortgage rates and strained supply drove the housing market price growth to a 26-month high in August, according to CoreLogic.

October 6 -

Consumer home purchasing power gained steam in July thanks to plummeting interest rates and gains in the median income despite steady price growth, according to First American.

September 28 -

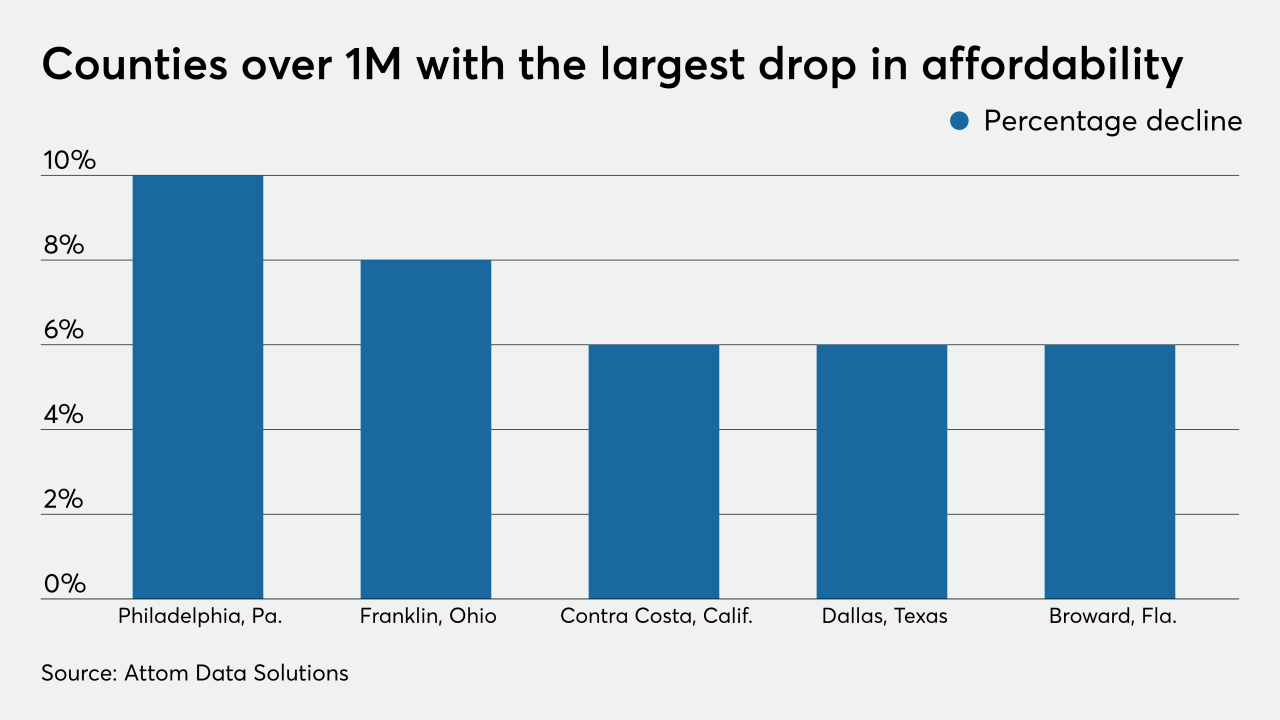

More counties have median home prices above their historic averages for typical wage earners, the company found.

September 24 -

Outside the densely populated coastal hubs, annual home sales grew by leaps and bounds, as buying patterns shifted toward more space with less emphasis on proximity to urban centers, according to Redfin.

September 22 -

Median closing prices hit a new record high during the four-week period ended Sept. 6, Redfin said.

September 14 -

For both homeowners and renters, Philadelphia is a relatively affordable city with low housing costs when compared with other big cities, but Philadelphia's high poverty rate makes the city more expensive for its residents, especially renters.

September 14 -

Albuquerque, N.M., area home prices continued to rise in August, driven in part by a spike in demand for luxury homes.

September 11 -

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

As swelling demand constricts inventory to record-low levels, home price growth cuts into the purchasing power afforded by plunging interest rates, according to First American.

August 24 -

While those migrating from New York and New Jersey found housing they could afford, many Cape Cod residents saw the gap widen between what they could pay for a mortgage or rent given their diminished economic circumstances.

August 24 -

As inventory dropped to an all-time low in July, borrowers hunted for houses further and further from city centers, causing price spikes in rural markets, according to Redfin.

August 17 -

A survey conducted throughout the second quarter found knowledge gaps based on race and income.

August 12 -

About 54% of properties underwent bidding wars in July with some metro areas peaking at 75%, according to Redfin.

August 10