-

Home values posted the largest month-over-month spike in over five years due to continued buyer demand, according to Quicken Loans.

October 10 -

Here's a look at five up-and-coming housing markets for digital mortgage professionals, based on home affordability and the availability of technology careers.

October 10 -

One million dollar tear-downs. Bidding wars. House hunts that last for years. Life in the Bay Area real estate market has long been harsh for buyers.

October 10 -

While home affordability reached a 32-month high in September, it could continue to increase in the fall months, according to Black Knight's Mortgage Monitor.

October 7 -

Miami-Dade's housing affordability crisis is so dire, it now poses as much of a threat to the region as sea level rise, according to Florida International University's Jorge M. Perez Metropolitan Center.

October 7 -

Fannie Mae is cracking down on homebuyer education requirements, particularly for first-time homebuyers and purchasers utilizing high loan-to-value mortgages.

October 4 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

Vancouver home sales rebounded 46% in September in a sign that Canada's most expensive home market may be finding its feet following a policy-driven downturn.

October 3 -

Millennials — now more than ever — dictate the direction the housing market is moving in, and with the deceleration of starter home prices, more should become homeowners soon, according to CoreLogic.

October 1 -

Home prices have more than recovered since the recession, but higher-than-ever medical and student debt is robbing many homeowners from realizing the benefits, while keeping others away from the market, according to Zillow.

October 1 -

Realtors and community leaders are hailing a new milestone for the Rockford, Ill., area housing market.

October 1 -

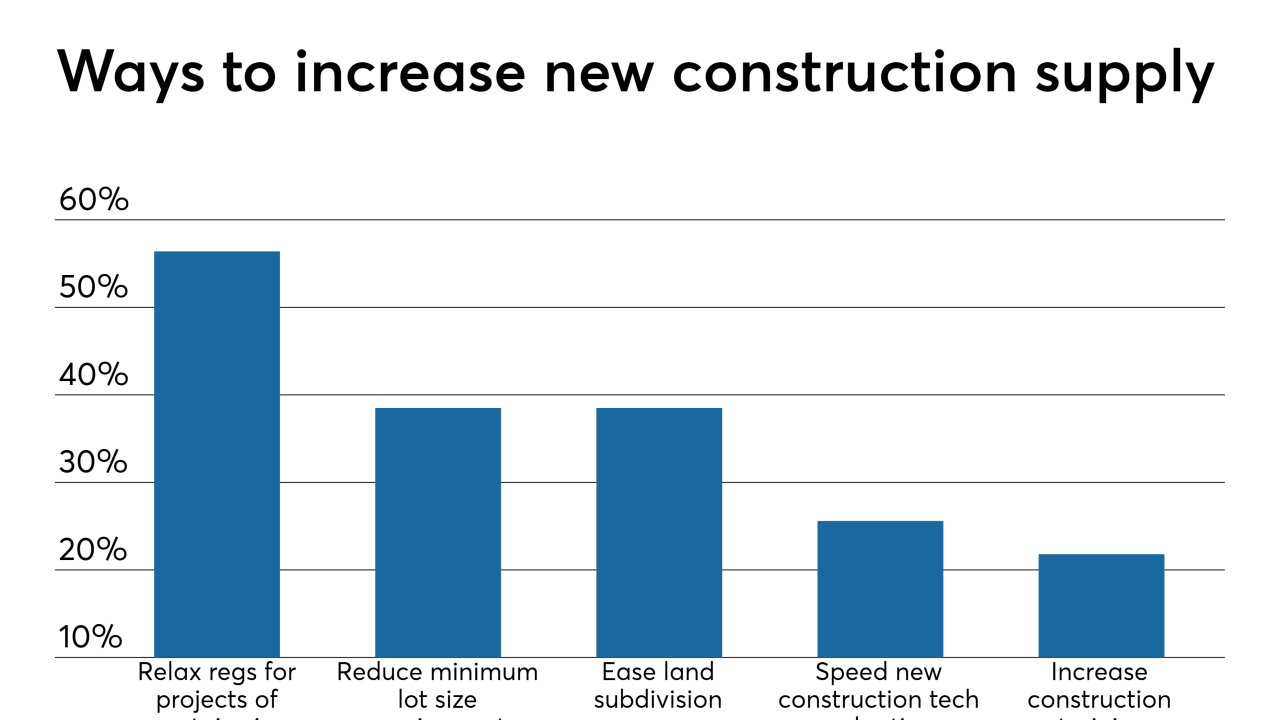

As the affordable housing crisis comes to a head, the Mortgage Bankers Association put up opposition to the "not in my backyard" mindset by getting behind the Yes, In My Backyard bill introduced in the House of Representatives.

September 30 -

The switch to a buyer's home purchase market, as well as fewer natural disasters helped drive the five-month-long decline in mortgage application fraud risk, First American said.

September 27 -

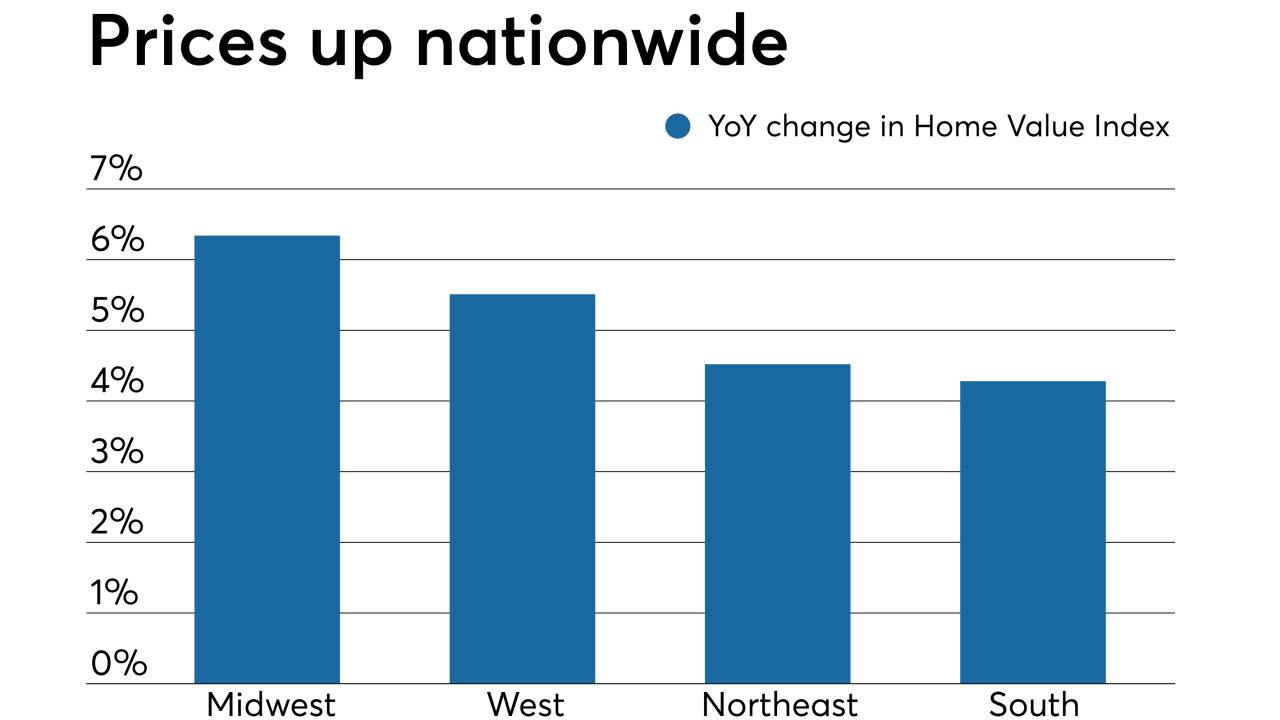

Rising home prices are likely to constrain affordability for some time to come, with only the current low mortgage interest rate environment softening the blow, Attom Data Solutions said.

September 26 -

Home-price gains in 20 U.S. cities decelerated in July for a 16th straight month, as values proved still too elevated for buyers despite low mortgage rates.

September 24 -

From Manhattan to Denver, here's a look at 12 housing markets with the highest monthly rent, making home buying potentially more attractive to consumers.

September 19 -

The FHFA can go beyond a recent Trump administration report to level the playing field between the private sector and Fannie Mae and Freddie Mac.

September 17 American Enterprise Institute Housing Center

American Enterprise Institute Housing Center -

Property values recovered, and in some cases even surpassed housing bubble peaks, but the same can't be said for waning new construction activity, which won't return to historic norms for years, according to Zillow.

September 16 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13