-

First-time homebuyers earn $30,000 more than their peers who didn't buy a house, and nearly $12,000 more than the country's overall median household income, highlighting affordability issues in current housing conditions, according to Zillow.

January 9 -

Millennials comprise the largest cohort of homebuyers as most have entered their prime purchasing years, and they just might shake up migration patterns in 2019, according to First American Financial Corp.

January 7 -

Home price appreciation gained $1.9 trillion in 2018, as the national housing market continued recovering from the Great Recession, according to Zillow.

January 4 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

The mortgage industry heads into 2019 with little relief from the market strains of the past three years. To succeed — or at least survive — lenders must confront major questions about demand, affordability and market consolidation.

December 26 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

As home prices continue their ascent, affordability fell for four straight quarters, according to Attom Data Solutions.

December 20 -

Fannie Mae made a slight increase to its origination forecast, expecting housing affordability to improve in 2019 as mortgage rates remain flat and home price appreciation moderates.

December 14 -

While home values rose over 5% in November, air is getting let out of the home price balloon, as the growth rate remains low compared to the past few years, according to Quicken Loans.

December 11 -

The lack of housing affordability, caused by rising home prices and mortgage rates, remains a roadblock to homeownership.

December 4 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

Volatility in the stock market caused the growth in the top 5% of average home sale prices to slow more than the rest of the market, according to Redfin.

November 29 -

Affordability will take a hit and rent prices are expected to go higher next year behind rising mortgage rates, but they'll bring positive developments, according to Zillow.

November 28 -

The Federal Housing Administration's risk-sharing program with the Federal Financing Bank began as a temporary fix, but the agency is exploring how to make it more permanent.

November 27 -

While a downturn is expected to come for the housing market, it could be more of a side-step than falling off a cliff, according to the latest Barclays Global Economics Weekly report.

November 26 -

While the housing market perennially decelerates in the winter, it can be a wonderland for potential homebuyers, according to Attom Data Solutions.

November 21 -

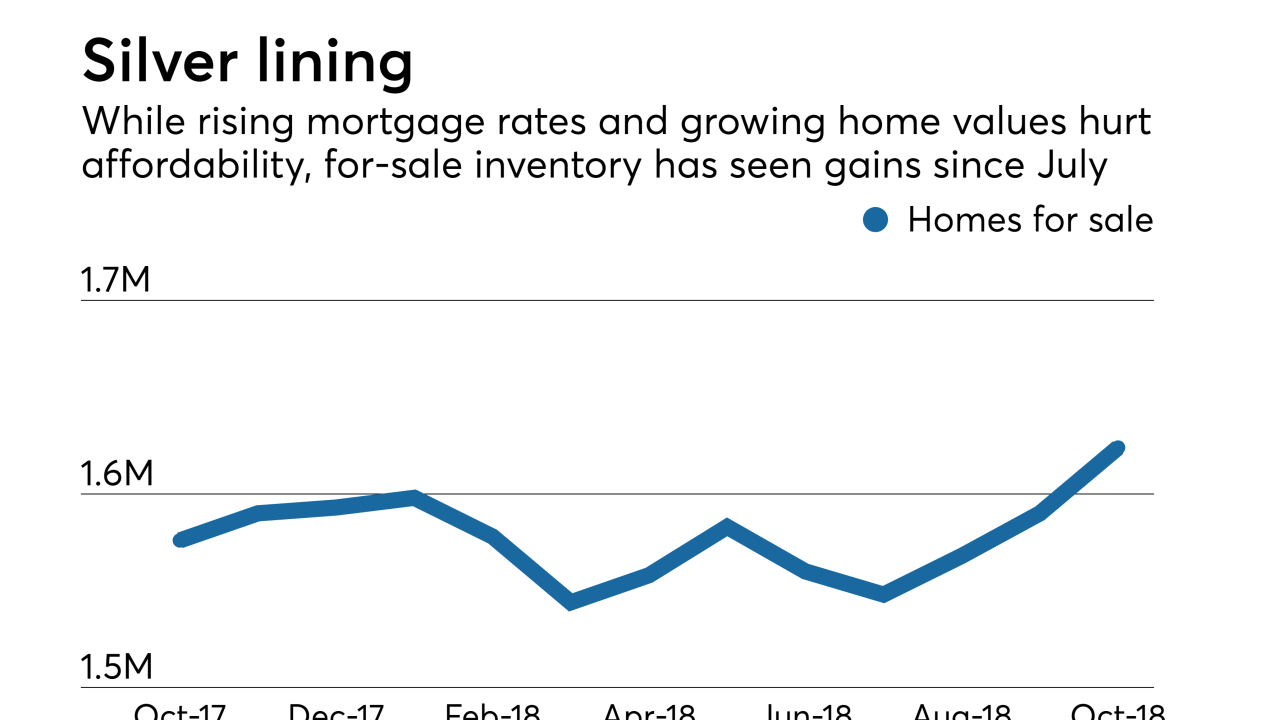

As inflating home prices hampered sales in recent years, housing inventory finally shows signs of bouncing back, according to Zillow.

November 21 -

While it's normally a time the market slows down for mortgage lenders relative to the rest of the year, this winter shouldn't be used to hibernate, according to Attom Data Solutions.

November 20 -

The decelerating pace of home price growth in October is helping offset the rise in mortgage rates, according to Quicken Loans.

November 14 -

Rising home prices and climbing mortgage rates pulled down affordability to the lowest point since before the housing market crash.

November 9