-

Ask someone looking to rent a reasonably priced apartment in Santa Fe, N.M., to describe their experience and they will likely sum it up this way: Frustrating.

October 8 -

The Federal Housing Administration chief has already been serving as the acting deputy secretary of the Department of Housing and Urban Development.

October 8 -

Miami-Dade's housing affordability crisis is so dire, it now poses as much of a threat to the region as sea level rise, according to Florida International University's Jorge M. Perez Metropolitan Center.

October 7 -

The creation of new houses in Rochester, Minn., is on the decline.

October 2 -

Guild Mortgage, which originated loans on some of the first manufactured homes eligible for new lower-rate Fannie Mae financing, anticipates demand for this housing type will continue to grow this year.

October 1 -

As the affordable housing crisis comes to a head, the Mortgage Bankers Association put up opposition to the "not in my backyard" mindset by getting behind the Yes, In My Backyard bill introduced in the House of Representatives.

September 30 -

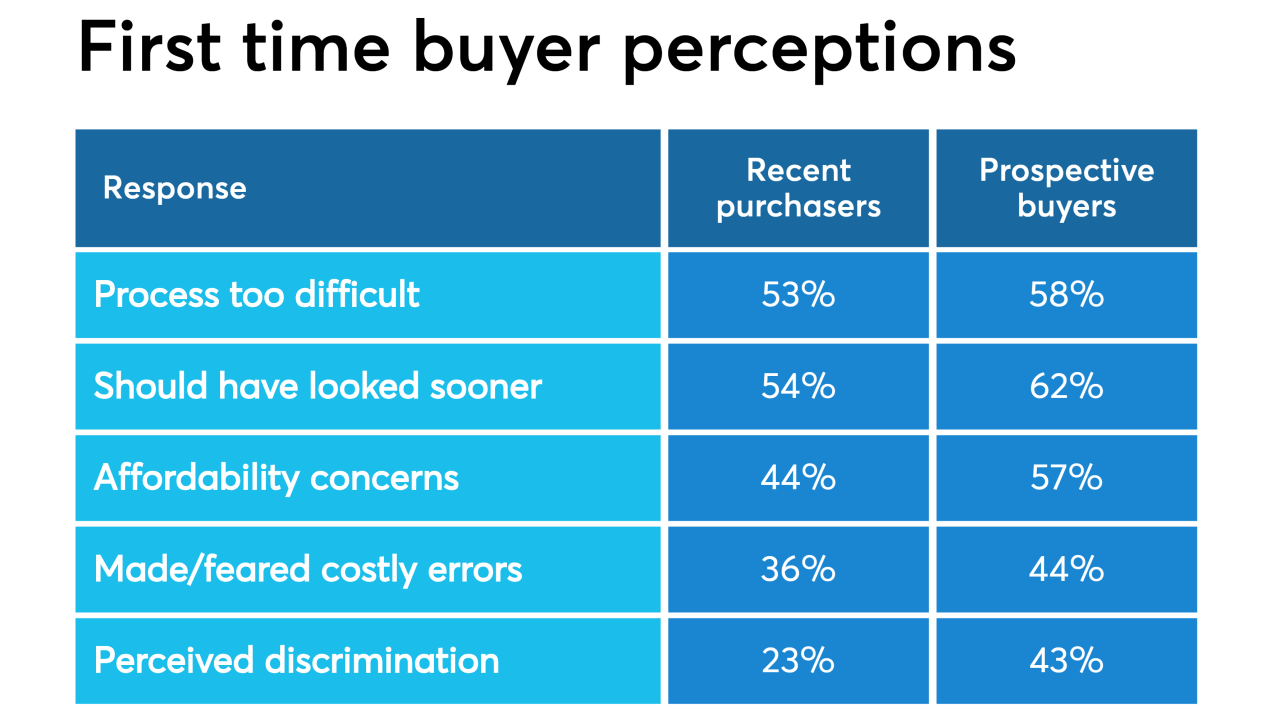

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

The proposed reforms of Fannie Mae and Freddie Mac have gotten all the attention, but the administration also wants to scale back the Federal Housing Administration, expand its capital cushion and adopt risk-based pricing. Some of the ideas have former agency officials concerned.

September 19 -

With the ongoing issue of the affordable housing crisis, the Mortgage Bankers Association got behind the Build More Housing Near Transit Act, a bipartisan bill introduced in the House of Representatives.

September 16 -

California Attorney General Xavier Becerra filed a brief Thursday in support of Oakland's lawsuit against Wells Fargo, alleging that the bank illegally discriminated against minority borrowers.

September 13 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

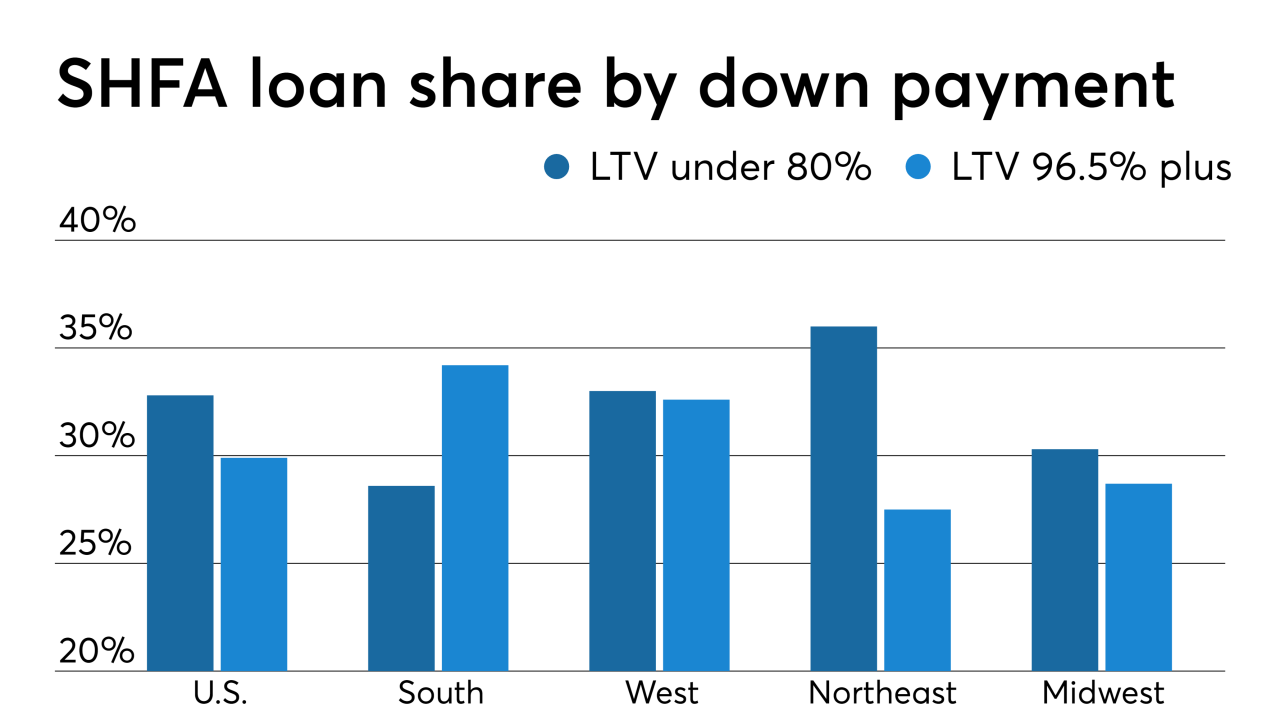

The use of state housing finance agency down payment assistance programs is part of the solution to address the growing affordable housing gap, a Fitch Ratings report said.

September 11 -

The legislation takes aim at third-party bank service vendors, the backlog of FHA appraisals, rural housing assistance and other issues where there is broad agreement.

September 11 -

By 2030, about 20% of the U.S. population will be over age 65, up from 15% in 2016, according to the Census Bureau.

September 10 -

The Trump administration raised the goal posts for ending the conservatorships of Fannie Mae and Freddie Mac, but how officials get there is still highly uncertain.

September 6 -

With its proposal to restrict disparate-impact claims, the Trump administration seems determined to solve a problem that does not exist.

September 6

-

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

The Trump administration is not backing down even after a federal court blocked guidance that would have limited the operations of national housing funds.

September 4 -

With officials putting finishing touches on presidentially directed reports on the future of the housing finance system, the Senate Banking Committee announced a hearing to examine the issue.

September 4 -

There is no legal basis to force Bank of America to make good on its commitment to provide $150 million in mortgages to beneficiaries of the Department of Hawaiian Home Lands, the state's Attorney General said.

September 3